Detect Fraud Efficiently and Effectively

Uncover the top four benefits of preventing fraud with ComplyAdvantage’s AI-powered solution.

Learn moreThe Australian Securities and Investment Commission (ASIC) has announced the imminent introduction of a cross-industry code that will hold banks, telcos, and social media platforms responsible for scam safety and make them liable to reimburse people who lose money through scams. This new code follows several anti-fraud measures outlined in the 2023-24 Federal Budget, including establishing a new National Anti-Scam Centre (NASC) within the Australian Competition and Consumer Commission (ACCC).

According to the ACCC, losses related to scam activity reached a record high of $3.1 billion in 2022. To combat scam activity and online fraud, the 2023-24 budget earmarks $86.5 million over three years.

Research by Scamwatch indicates that Australians lost more than $10.4 million to identity theft and $416,000 to fake charities in 2022, with ASIC estimating 96 percent of victims are not getting their money back. The regulator’s new code will clearly set expectations for banks, telecommunications companies, and social media platforms, detailing their obligations and what consumers can expect from their providers.

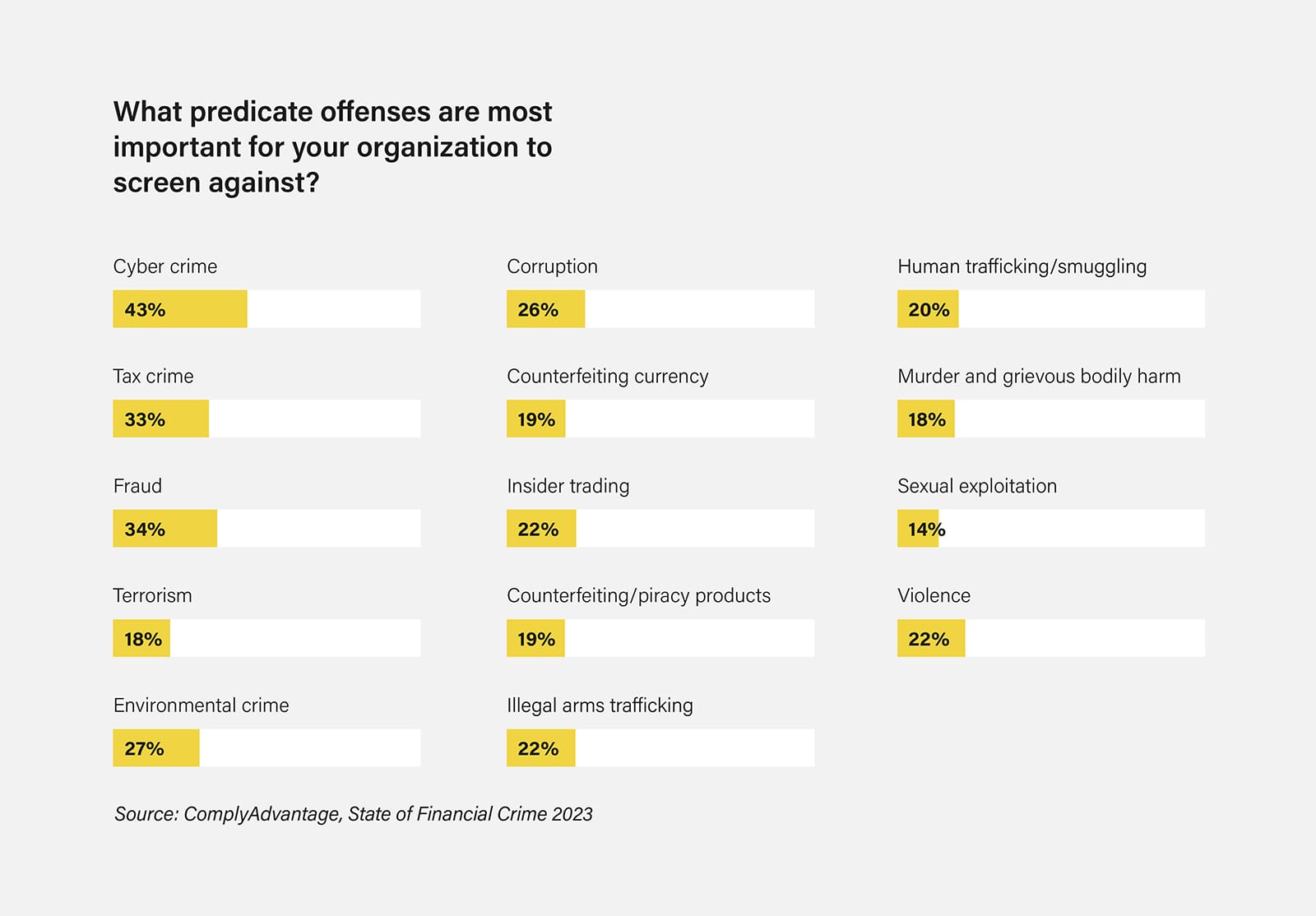

In addition to consumer groups welcoming the new code, results from our 2023 global compliance survey show that financial institutions are hyper-aware of the growing cost of fraud and online scams. When asked which predicate offenses are most important to screen against, cybercrime and fraud were the top two offenses identified by Australian firms – and firms worldwide.

Speaking to the Australian Financial Review, Financial Services Minister Stephen Jones said the first iteration of the new code would be ready by the end of 2023.

As part of the government’s $86.5 million package to combat fraudulent activity, the NASC aims to:

According to the ACCC, the NASC will be operational from July 1, 2023, with additional capabilities – such as data-sharing technology – to be built over the next three years.

Additionally, on May 16, the Australian Banking Association (ABA) announced the launch of a new Fraud Reporting Exchange (FRX) digital platform to help member financial institutions respond more quickly and effectively to scams. The platform facilitates this by streamlining communication between banks, enabling them to decrease the time it takes to block suspicious transactions.

The platform’s launch followed ASIC’s report on the big four banks’ approach to scam activity. In the report, ASIC noted that between 2021 and 2022, over 31,700 customers of the four banks collectively lost over $558 million through scams – representing an increase of 49 percent in customers and 50 percent in financial losses compared to the previous year. During the same period, the banks paid around $21 million in reimbursement and/or compensation to customers who fell victim to a scam – representing a mere 3.8 percent of total losses.

The ABA state that the FRX platform will help boost the likelihood that funds can be frozen and returned to customers by allowing scam payments to be reported in close to real-time. So far, 17 banks have already been onboarded or are in the process of joining the FRX.

In light of Australia’s focus on bolstering technology and operations to mitigate the threat of fraud, compliance teams should also consider their transaction fraud risk across three core areas of compliance:

Uncover the top four benefits of preventing fraud with ComplyAdvantage’s AI-powered solution.

Learn moreOriginally published 18 May 2023, updated 17 October 2023

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).