AML solutions to mitigate financial crime risks

Discover how our dynamic, real time data fights financial crime.

Transaction Monitoring and Screening

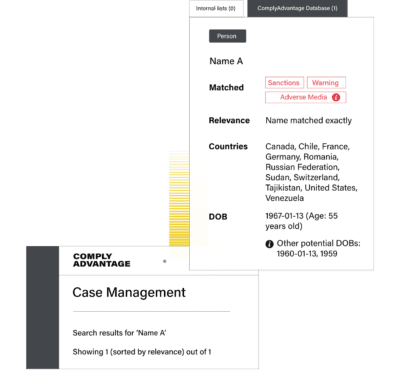

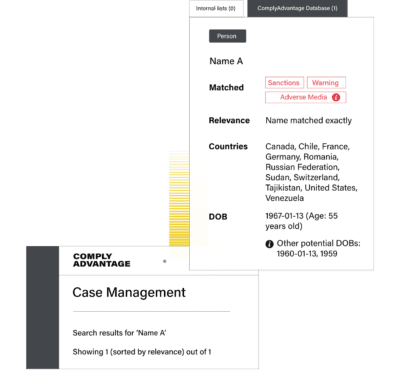

Adverse Media Insights

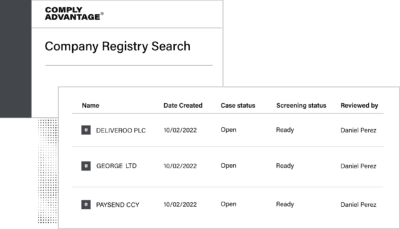

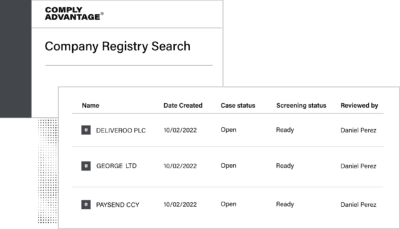

Know Your Business

ComplyTry

Transaction Monitoring and Screening

Adverse Media Insights

Know Your Business

ComplyTry

Customer value

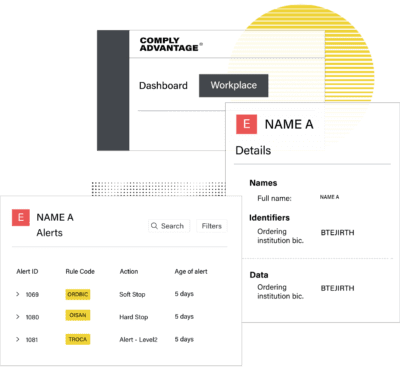

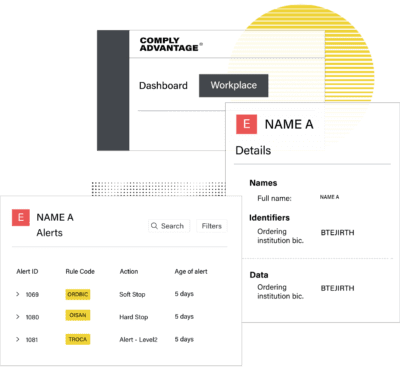

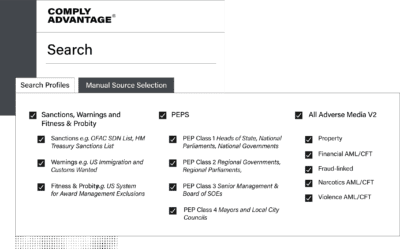

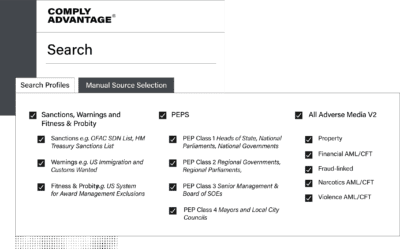

Transaction Monitoring and Screening

Transaction Screening and Monitoring in one unified platform

Learn More

ComplyTry

Remediate matches with more confidence using additional information from our Adverse Media search tool – For Free

Register For FreeMore customer success stories

Latest news and press releases

Top 5 fraud trends in 2024 and how to mitigate them