A Guide to Anti-Money Laundering for Digital Banks

Based on expert advice and interviews with sector leaders, our comprehensive guide takes you through every step in the compliance process for digital banks.

Download nowIn a constantly evolving financial landscape, challenger banks have become increasingly mainstream, with one study suggesting 14 percent of UK adults hold an account with one of the four largest institutions.

Challenger banks disrupt the space occupied by legacy banks and financial institutions (FIs) to capitalize on consumer demand for seamless banking experiences delivered via digital platforms. However, their increased appeal presents new risks as criminals find ways to exploit emerging vulnerabilities for illegal activities such as money laundering and terrorism financing. Given these risks, challenger banks must understand their regulatory responsibilities and how to implement anti-money laundering (AML) programs to fulfill them.

A challenger bank is an FI that offers banking services through digital channels, often mobile apps. The name “challenger” comes from the fact they are challenging the traditional banking system by offering cost-effective, novel, and versatile financial products without compromising the customer experience. The term ‘challenger bank’ is often used alongside similar designations such as ‘digital bank’ and ‘neobank’, but these are in fact distinct:

New challenger banks debut every year, offering a range of traditional and FinTech services to compete with their brick-and-mortar counterparts, including:

Jurisdictions worldwide have developed AML/CFT regulatory frameworks, which all FIs, including challenger banks, must conform to. Challenger banks sometimes partner with established banks for licensing, brand recognition, or financial reasons. However, these banks should be aware they remain fully obligated to conform to all relevant AML/CFT legislation, even if an FI they partner with already is. Challenger banks should, therefore, be familiar with the specific AML/CFT laws and regulatory bodies.

All US banks’ AML/CFT programs are regulated by the Financial Crimes Enforcement Network (FinCEN) and the Office of Foreign Assets Control (OFAC).

In the UK, all FIs are regulated by the Financial Conduct Authority (FCA).

Also included in this package was a new EU-wide regulator, the Authority for Anti-Money Laundering and Countering the Financing of Terrorism (AMLA), will begin operating in 2025. Previously, challenger banks in the EU were overseen by individual states’ regulators, as well as by the European Banking Authority (EBA).

Based on expert advice and interviews with sector leaders, our comprehensive guide takes you through every step in the compliance process for digital banks.

Download nowAll FIs face unique AML/CFT risks based on their customers, location, and products. Because of their innovative nature, challenger banks face both conventional and newer money laundering risks. Often, the features that make their offering attractive to customers are also the ones criminals seek to exploit. Therefore, they must find ways to continue playing to their strengths while mitigating risks such as:

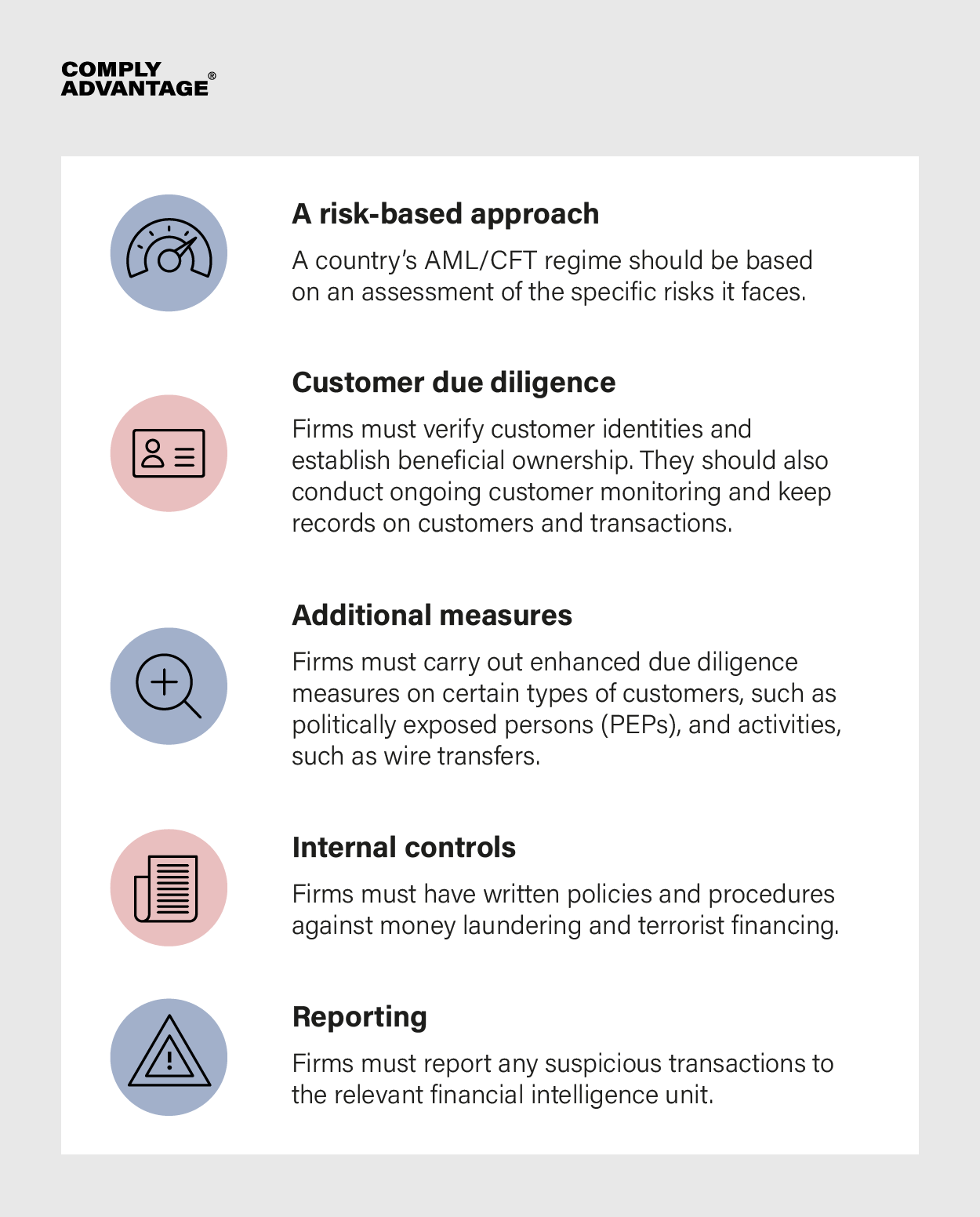

All FIs, including challenger banks, should design their AML compliance programs with the Financial Action Task Force’s (FATF) International Standards on Combating Money Laundering and the Financing of Terrorism & Proliferation, or ‘40 Recommendations’. These set the standard for AML globally and include core principles widely adopted across regulated industries.

Challenger banks should also consider their unique risks and advantages when developing compliance programs. A risk-based AML program is important for challenger banks because it balances regulatory compliance and customer experience. It allows lower-risk customers to engage with services without needless friction while ensuring more robust scrutiny is applied to higher-risk customers.

AML regulations dictate that firms must establish and verify their customers’ identities. Challenger banks are well-placed to use digital identity verification, including biometric data or scans of official documents, to onboard customers quickly but securely. At onboarding, they should also screen customers against international sanctions lists and watch lists, monitor their politically exposed person (PEP) status, and monitor their involvement in adverse media stories that might reveal a change in their AML risk profile. Once onboarding has been completed, banks should monitor customer transactions so they can investigate and report any suspicious financial behavior.

Crucially, as forward-thinking, tech-native institutions, challenger banks are well-positioned to adopt smart AML technology to address their compliance needs. The compliance burden on these banks is substantial, requiring the collection and analysis of vast amounts of customer data. However, managing this data manually is impractical, making integrating specialist AML software essential. To maximize its effectiveness, this technology should be supported by in-house expertise through the appointment of a skilled compliance officer and regular AML training for all employees.

FIs operating globally partner with ComplyAdvantage to meet regulatory obligations and fuel business growth. Challenger banks can build on their reputation for innovation by deploying leading-edge AML compliance technology, benefitting from:

Fortify your organization and fuel your growth with dynamic solutions tailored to your needs. Book your free demo today and find out why 1000s already use ComplyAdvantage.

Get a demoOriginally published 01 March 2021, updated 12 November 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).