ComplyAdvantage extensively leverages artificial intelligence (AI). We recognize that legacy technology has not solved the problem of fighting financial crime risk in a dynamic financial services environment.

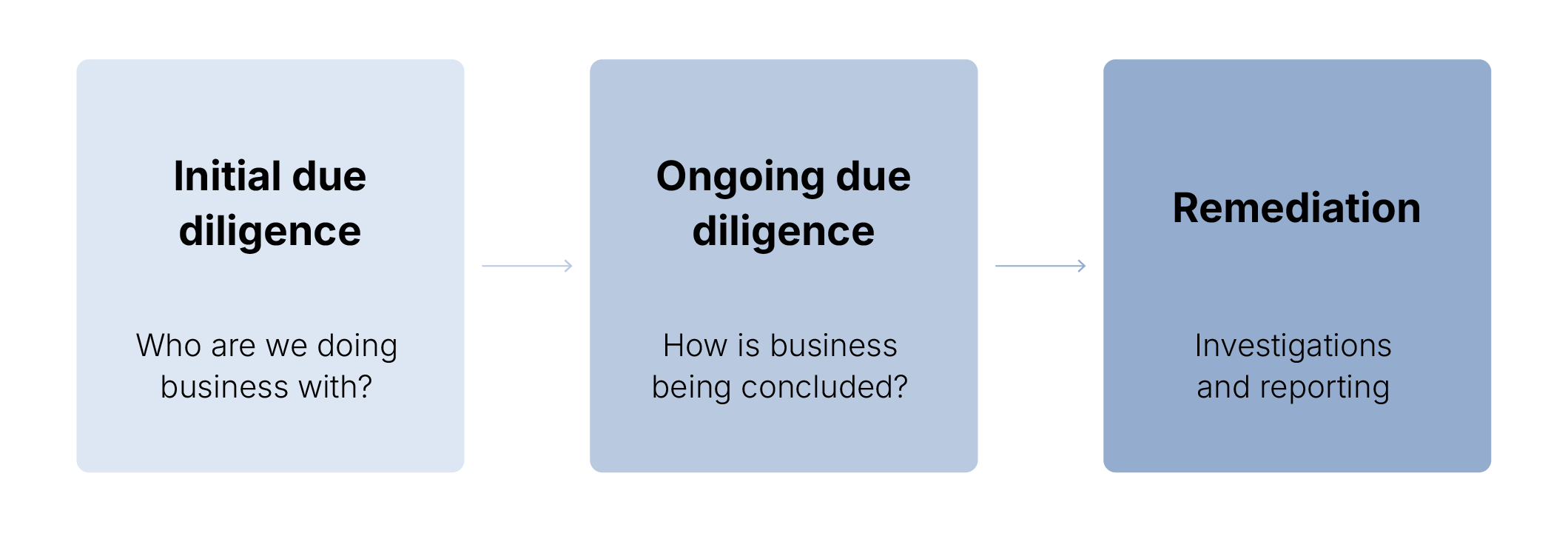

We see financial crime risk management as a lifecycle, starting with initial due diligence, moving through ongoing screening and monitoring as part of ongoing due diligence, and then through remediation and reporting.

Our use of AI spans all three stages of this lifecycle: initial due diligence, ongoing due diligence, and remediation and reporting.

The financial crime risk management lifecycle

Initial due diligence

In the initial due diligence phase, which focuses on understanding the risk associated with new business relationships, our AI capabilities include:

- Agentic AI collects information from multiple data sources, including sanctions lists, warning lists of known bad actors, lists of politically exposed persons (PEPs), heads of international organizations (HIOs) lists (as required by Canadian legislation), and adverse media.

- Natural language processing (NLP) is employed to curate this data. This results in data that is significantly more accurate than that provided by legacy providers, forming a foundational layer for financial crime risk management.

- Entity resolution and entity clustering are applied to the curated data to optimize the accuracy of alerts generated when screening customers.

- Advanced search techniques with probabilistic scoring are used in our search engine, which goes beyond the simple text-matching algorithms used for name screening by legacy solutions. More than 25 ComplyAdvantage models in global production factor elements such as name commonness, gender matching, and transliteration into the screening process.

This multi-layered, AI-driven approach across data acquisition and curation, entity resolution, and advanced scoring models yields the industryʼs most accurate results. This accuracy is crucial for reducing customer friction (something especially important for digital financial services) by only showing analysts alerts genuinely worthy of investigation.

Our initial due diligence capabilities also include customer risk scoring, which combines static customer information, such as geo-demographic information, with screening results to provide an overall risk score that can be assessed against a financial institution’s risk tolerance.

As customer information and risks are not static, our focus then shifts to the ongoing due diligence phase.

Business brief: Agentic AI and AML compliance

Learn how to test and implement agentic AI across your organization to scale your business while streamlining compliance.

Download your copyOngoing due diligence

During the ongoing due diligence phase, which focuses on understanding the risk associated with established relationships over time, we use these AI capabilities:

- The same AI-collected and curated data is continuously screened against any changes, either in underlying data sources or in customer information, to reflect evolving risk exposure over time.

- AI models referred to as “advanced detectors” monitor customer activity indicative of financial crime. Our advanced detectors focus on money laundering and fraud detection, but can also uncover predicate crimes for money laundering to align with regulatory priorities from bodies like FinCEN, the EU (via 6AMLD), FATF, and FINTRAC. Our adverse media data is also mapped to many of these predicate crimes to enable effective risk management across these dimensions of risk.

- AI also helps prioritize alerts generated from ongoing monitoring to ensure analysts focus on the highest-risk alerts first.

- AI is used for scenario optimization. This means continually refining and improving detection scenarios over time, reflecting the fact that financial crime methods are not static.

Remediation and reporting

During the remediation and reporting stages, which focus on managing investigations and informing regulators and law enforcement of suspicious activity, we use the following AI capabilities:

- Agentic AI remediates specific low-risk alerts and cases, further optimizing the speed and accuracy of investigations and minimizing customer friction.

- Agentic AI enriches cases by gathering information from other systems, providing analysts with comprehensive details before starting investigations.

- We are exploring the use of generative AI to create reports, particularly regulatory reports requiring narrative text. We aim to develop standard, consistent narrative responses welcomed by regulators. Using generative AI for STR narratives can also yield common tags from investigations, which can be leveraged to inform more sophisticated analyses and improve alert prioritization in the future.

- Our scenario optimization AI analyzes investigation outcomes. This helps identify detection scenarios that may be generating unproductive alerts or cases. The goal is to optimize the process so that a high proportion of alerts lead to cases and a high proportion of cases lead to reports for law enforcement, such as suspicious transaction reports (STRs) or equivalent.

The efficacy of our AI use

To establish trust with our customers and ensure our solutions are in line with regulatory expectations, we focus on three critical governance pillars: responsible AI, high-quality data, and our team of financial crime data experts.

Responsible AI

Our commitment to responsible AI is deeply embedded in our development process, ensuring our AI technologies adhere to rigorous ethical guidelines. This includes proactive risk management strategies and comprehensive, independent validation to guarantee fairness, transparency, and reliability in our AI-driven insights. By prioritizing ethical considerations, we build customer confidence through the integrity and accountability of our solutions.

High-quality data

The foundation of our AI models lies in our unwavering dedication to high-quality data. We implement stringent data quality controls and cultivate strategic partnerships with customers to ensure the data that fuels our systems is accurate, consistent, and comprehensive. This meticulous approach to data management guarantees that our AI algorithms are trained on reliable information, leading to more precise risk assessments and reduced false positives. By emphasizing data excellence, we empower financial institutions with dependable and actionable intelligence.

Financial crime data experts

Our exceptional team of financial crime data experts complements our technological prowess. These professionals have extensive experience navigating financial crime data complexities, bringing deep domain knowledge and practical insights to address intricate challenges. This expertise ensures our solutions are technologically advanced and grounded in a thorough understanding of the evolving landscape of financial crime. Combined with cutting-edge AI, this human element provides customers with a holistic and robust approach to mitigating risk.

We acknowledge and actively manage model risks associated with AI deployment, using proactive strategies to identify, assess, and mitigate potential biases or inaccuracies that may arise. This commitment to risk management ensures our solutions’ ongoing effectiveness and trustworthiness.

We also emphasize data quality throughout our operations, recognizing that the integrity of our data is paramount to delivering accurate and reliable results for our customers. We demonstrate a comprehensive and responsible approach to leveraging AI in the fight against financial crime by prioritizing model risk management and continuous data quality improvement.

Our AI outcomes: Speed and security

This holistic, AI-driven approach throughout the financial crime risk management lifecycle allows our customers to fulfill their compliance obligations, minimize reputational risk, and support the moral imperative of fighting financial crime. Crucially, alongside effectively managing risk, our solutions also support the business imperative of reducing customer friction, ensuring a positive customer experience even amidst stringent compliance requirements.

Transform your AML compliance with AI-powered solutions

A cloud-based compliance platform, ComplyAdvantage Mesh combines industry-leading AML risk intelligence with actionable risk signals to screen customers and monitor their behavior in near real time.

Get a demoOriginally published 18 June 2025, updated 13 January 2026

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2026 IVXS UK Limited (trading as ComplyAdvantage).