Despite stringent regulations and heightened due diligence, online gambling remains a lucrative avenue for illicit actors seeking to launder their dirty funds. In fact, gambling emerged as one of the top three sectors that incurred the highest amount of anti-money laundering (AML) fines in 2023 – racking up over $475 million in penalties.

While traditional casinos can provide criminals with an avenue to convert physical “dirty” cash into casino chips, online gambling presents various different types of money laundering risks due to one aspect in particular: increased levels of anonymity.

This article details the financial red flags compliance staff should be aware of and provides best practices for mitigating these risks.

Money laundering risks in online gambling

To mitigate financial crime risks effectively, firms must be able to recognize red flag behaviors and activities in online gambling transactions. Understanding these indicators enables firms to fine-tune and customize their systems to align with their risk appetite and address the challenges online gambling poses within their industry and jurisdiction.

Some key money laundering risks in online gambling include:

- Unlike traditional casinos that require face-to-face interactions, online platforms allow users to gamble with minimal personal information. Criminals often exploit this by using stolen credit cards, fake identities, or cryptocurrencies to place bets and withdraw their “winnings,” effectively laundering their illegally obtained money.

- It’s common for online gambling sites to permit the creation of multiple accounts, which criminals can use to transfer money between accounts to obfuscate the origin of the funds.

- Like traditional casinos, online gambling platforms facilitate the movement of large sums of money, making it easier for criminals to integrate their dirty money into the legitimate financial system.

- Each jurisdiction regulates online gambling differently, which can create challenges for authorities attempting to combat financial crime, including money laundering. Some countries have strict regulations and robust monitoring systems (e.g., China), while others have more relaxed approaches (e.g., Malta). This inconsistency can create loopholes that criminals exploit to launder money through online gambling platforms.

Money laundering schemes in online gambling

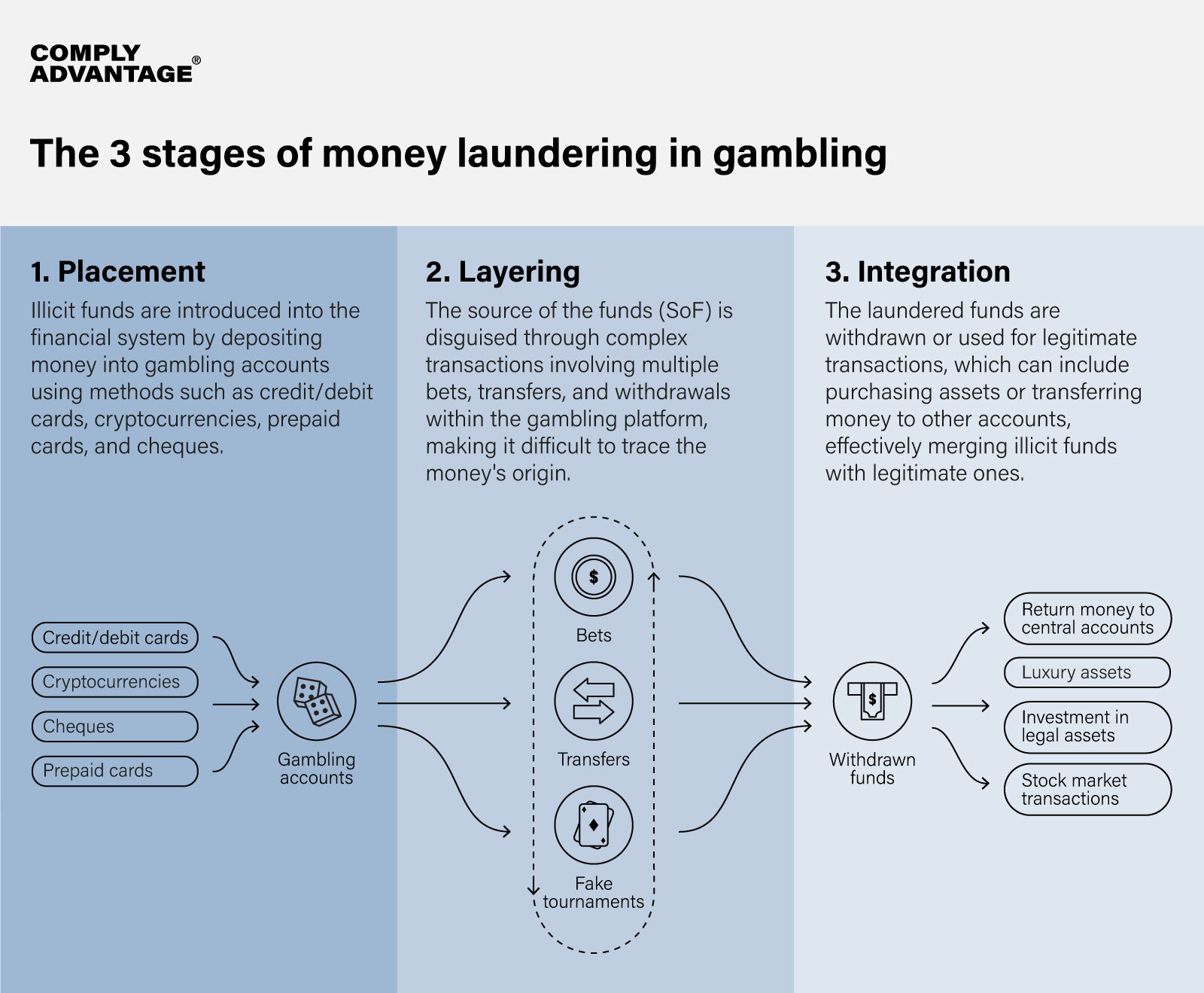

Online gambling platforms can be exploited by bad actors at each of the three stages of money laundering:

- Placement: Illicit funds are introduced into the financial system by depositing money into gambling accounts.

- Layering: The source of the funds (SoF) is disguised through complex transactions involving multiple bets, transfers, and withdrawals within the gambling platform.

- Integration: The laundered funds are withdrawn or used for legitimate transactions.

Understanding each of these stages can help compliance teams identify some of the common schemes fraudsters use to launder money through online gambling platforms. Key methods include:

- Smurfing: Breaking down large sums into smaller, less noticeable transactions to evade detection.

- Coordinated betting: Placing bets with deposited funds, colluding with other players, and making coordinated bets to obscure the money’s origin.

- Chip dumping: Intentionally losing chips to another player at an online poker table to transfer funds covertly.

- Player-to-player transfers: Using gambling accounts to facilitate illegal transactions between parties through direct transfers.

- Gnoming: Utilizing multiple accounts to help one player win and another lose in head-to-head games.

- Concealment: Hiding illicit funds in gambling accounts without immediate withdrawal, using the same anonymous banking method for future retrieval.

AML regulations for online gambling

In the US, online gambling falls under federal and state jurisdiction, with laws like the Wire Act governing interstate betting and payment processing. However, the Financial Crimes Enforcement Network (FinCEN) does expect online casinos to have the same robust Bank Secrecy Act (BSA) and AML programs as traditional brick-and-mortar casinos. In fact, in June 2021, FinCEN issued its first government-wide priorities for AML and countering the financing of terrorism (CFT) policy pursuant to Section 5318(h)(4)(A) of the BSA. The regulator’s new policy identified eight national priorities for all bank and non-bank FIs covered by the BSA, including online gambling establishments, that must be incorporated into existing BSA/AML programs. The eight priorities include:

- Corruption

- Cybercrime

- Foreign and domestic terrorist financing

- Fraud

- Transnational criminal organization activity

- Drug trafficking organization activity

- Human trafficking and human smuggling

- Proliferation financing

Meanwhile, the EU lacks unified gambling legislation, with member states like France, Italy, and Spain each governing their regulations at the national level. These entities enforce licensing, consumer protection, and anti-fraud measures.

In the UK, the Gambling Commission oversees online gambling regulation, ensuring compliance with laws like the Gambling Act 2005. Specifically, all operators must comply with the following:

Penalties for non-compliance

The UK’s Gambling Commission has the authority to issue fines for breaches of the Gambling Act 2005. These fines can range from a percentage of annual revenue to substantial fixed penalties, depending on the severity of the violation – non-compliant operators may face license suspension or cancellation.

Similarly, in the EU, member states enforce penalties for non-compliance with gambling regulations. For example, under France’s Autorité de Régulation des Jeux En Ligne (ARJEL), operators can face fines of up to €30,000 for violating licensing conditions or regulatory requirements. Repeated offenses may lead to higher fines or even license suspension or cancellation.

In the USA, penalties for failing to comply with online gambling regulations vary at both the federal and state levels. Under the Unlawful Internet Gambling Enforcement Act (UIGEA), FIs can face civil penalties for processing illegal gambling transactions, with fines reaching up to $1 million per violation. Operators may also face prosecution under state-specific laws, such as New Jersey’s Casino Control Act, which imposes fines of up to $200,000 for each regulatory violation. Regarding BSA violations, the US government imposes statutory penalties – which can range from $10,000 dollars for record-keeping violations to over $200,000 for more serious infractions.

Money laundering red flags in online gambling

Recognizing financial red flag indicators about online gambling money laundering is crucial to helping firms develop and implement specific rule sets to identify and mitigate risks, ensuring they do not inadvertently facilitate illegal activities. Some common indicators of potential money laundering in online gambling include:

- Players who consistently place large bets on low-risk games or matches.

- Individuals making numerous substantial deposits or withdrawals within a short time.

- Gaming deposits originating from cryptocurrency. In February 2024, the UK Gambling Commission reminded operators that crypto-assets are considered high-risk, and licensees must appropriately scrutinize crypto transactions throughout customer and business relationships.

- Operating multiple accounts under different names or using various IP addresses.

How can online gaming platforms mitigate money laundering risks?

Firms can enhance their defenses against online gambling risks with the right application of due diligence, software, and training. Some best practices include:

- Ensuring risk assessments align with the latest red flag indicators. This should include evaluating the risks associated with specific products and services, taking into account the user and the product’s functionality.

- Implementing blockchain technology, giving online gambling companies a transparent way to record transactions.

- Providing comprehensive staff training on AML procedures and regulations to ensure compliance and fostering a culture of vigilance within any organization. Regulations in 21 US jurisdictions mandate that online gaming operators must prepare and submit a plan for addressing responsible gaming issues, which must include employee training and public awareness efforts.

Detect money laundering with advanced AML solutions

Advanced AML solutions employ a mix of sophisticated techniques to help compliance teams effectively monitor and prevent illicit financial activities. At the core of these strategies is transaction monitoring, which scrutinizes financial transactions to spot suspicious activities. Utilizing cutting-edge machine learning algorithms, these systems can identify irregular patterns like significant transfers to offshore accounts, recurring high-value transactions, or movements inconsistent with a customer’s usual profile, triggering alerts for further investigation.

Customer screening is also vital as it aims to verify the identities of both new and existing customers against databases of known criminals, politically exposed persons (PEPs), and sanctioned individuals. This step is crucial for preventing high-risk individuals from using online gaming platforms for money laundering, helping firms mitigate the risk of non-compliance and protect their reputations in the market.

Find out how ComplyAdvantage can help you fine-tune your risk management processes

1000s of organizations like yours are already using ComplyAdvantage. Learn how to streamline compliance and mitigate risk with industry-leading tools and solutions.

Book your free demoOriginally published 10 June 2024, updated 05 September 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2026 IVXS UK Limited (trading as ComplyAdvantage).