Anti-money laundering (AML) screening involves checking customer identities and payments against certain data to identify risk factors for financial crimes, including money laundering, terrorist financing, fraud, and corruption. Even if your team is already across the fundamentals, consistently getting them right is key to maintaining compliance and managing financial crime risk effectively.

Using the results of your AML screening processes, you can determine whether to accept customers or payments, taking into account your regulatory requirements and risk appetite.

What are the different types of AML screening?

Sanctions screening

Governments around the world maintain intensive and frequently updated financial sanctions regimes, which prohibit you from transacting with, or holding assets on behalf of, individuals and entities named on sanctions lists. Non-compliance with sanctions can result in severe financial penalties.

This means that sanctions screening forms a vital part of your customer screening obligations. You should check customers against all relevant sanctions lists across the jurisdictions you operate in.

PEP screening

Politically exposed persons, or PEPs, are figures holding government roles or other prominent public positions that increase their risk of being associated with financial crime. Because of this risk, AML/CFT regulations specify that you must screen customers to establish their PEP status.

Following guidance from the Financial Action Task Force (FATF), most regulatory regimes classify PEPs according to their prominence and risk level. In addition, domestic PEPs are often subject to different due diligence rules than foreign or international PEPs. PEP screening solutions often incorporate the relatives and close associates (RCAs) of PEPs, who are also deemed to represent a higher financial crime risk.

Like sanctions screening, PEP screening involves checking customers against a constantly evolving dataset. Unlike sanctions, however, governments and regulators do not maintain official lists of PEPs, leaving firms to compile their data or source it from reliable RegTech vendors.

Adverse media screening

Adverse media screening, or negative news screening, is a type of customer screening that involves checking customers against information from news and other media sources. Adverse media covers traditional news sources, such as newspapers and court filings, and newer, sometimes more informal, sources like online forums and social media platforms.

Adverse media screening requires analyzing unstructured or unverified data. This separates it from other kinds of screening, which revolve around official data such as sanctions lists. While adverse media screening may seem a less formal kind of AML screening, it often gives firms information about customers that is not yet reflected in official sources.

Payment screening

Payment screening applies to payments, rather than customers, and involves analyzing all incoming and outgoing transactions for signs of suspicious activity. Examples of these include payment parties or references that match sanctioned entities, or payments that do not match customer risk profiles and have no clear explanation. By screening payments, you can decide which to process and which to escalate for investigation and block if necessary.

Payment screening is distinct from transaction monitoring, which involves analyzing transactions at scale after they have been processed and aims to detect suspicious payment patterns that develop over time.

Which firms are required to perform AML screening?

Most jurisdictions have developed their own AML regulatory frameworks, which may vary in coverage over different sectors but derive largely from the FATF’s international standards. Some of the most important examples of AML regulations are:

- The Bank Secrecy Act (BSA) in the US

- The Proceeds of Crime Act (POCA) in the UK

- The ‘new’ Sixth Anti-Money Laundering Directive (6AMLD) in the EU

- The Corruption, Drug Trafficking, and Other Serious Crimes Act (CDSA) in Singapore

You should consult the relevant AML legislation covering the locations you operate. Still, as a general rule, these firms are subject to AML regulation and must carry out AML screening:

- Banks and credit unions.

- Brokers and dealers.

- Currency exchanges and other money services businesses (MSBs).

- Credit card operators.

- Cryptocurrency and virtual asset service providers (VASPs).

- Insurance companies.

- Real estate firms.

- Casinos and gambling operators.

- Dealers in precious metals, stones, or jewels.

- Loan and finance companies.

- Travel agencies.

- Futures commission merchants and commodity trading advisors.

- Informal financial businesses.

How does the AML screening process work?

Sanctions screening, PEP screening, and adverse media screening are all types of customer due diligence (CDD), which takes place according to these steps:

- Data collection: You should ask customers for identifying information such as their name, address, and the nature of their intended business relationship with you, and verify this information with appropriate documentation. For business customers, you should identify the account’s ultimate beneficial owners (UBOs).

- Name screening: Customers are screened against data relating to sanctions, PEPs, and adverse media, using a specialist software solution to identify any matches.

- Risk scoring: Any matches, as well as other information such as location or occupation, inform the risk level you assign to a customer. While low-risk customers can be onboarded without further action, medium- or high-risk customers require additional measures such as enhanced due diligence (EDD). Customers above a risk threshold, defined by your risk appetite and regulatory requirements, are proscribed and should be reported to the relevant authorities.

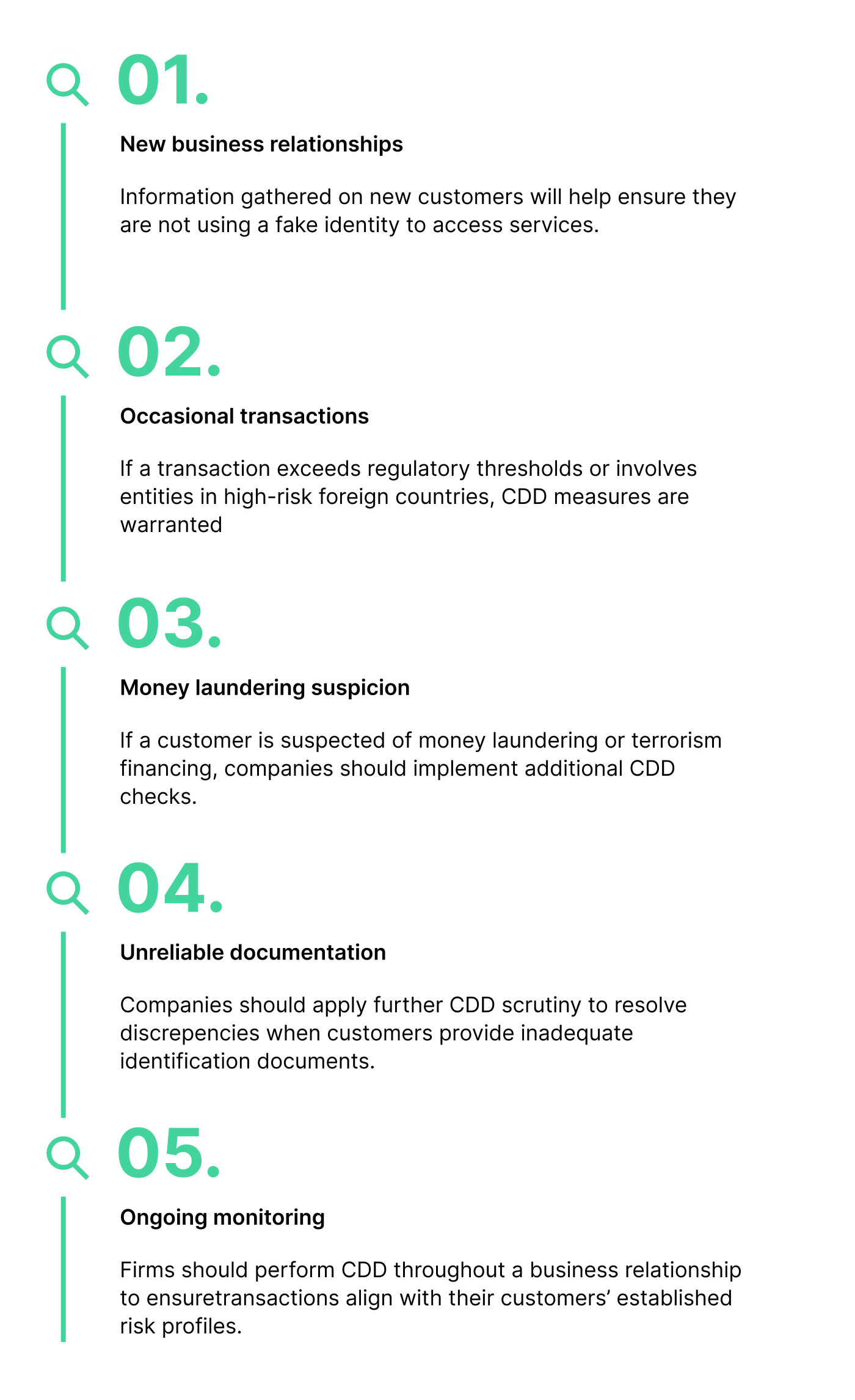

You must carry out CDD in the following cases:

The State of Financial Crime 2025

Get ahead on the latest financial crime typologies and regulatory developments with our latest state-of-the-industry report.

Download your copyWhat are the most common challenges in AML screening?

Effective AML screening places significant demands on your tech stack and compliance resources. As a result, maintaining accurate solutions that protect you from risk while ensuring efficiency can be a real challenge.

In our global survey of compliance leaders, 43 percent cited an inability to successfully screen customers against sanctions lists and watchlists. Common causes of screening difficulties include:

- Balancing regulatory requirements with customer experience: Slow onboarding or payment experiences are likely to put customers off – but given your regulatory obligations, and the serious consequences of non-compliance, you cannot sacrifice AML screening checks to ensure seamless customer experiences. A key challenge is implementing screening solutions that enable, rather than prevent, fast customer acquisition.

- Legacy approaches to screening: Despite the clear need for speed and accuracy in screening checks, some firms are held back by outdated tech stacks, inflexible rule-based systems, and a reliance on manual processes. Using legacy screening solutions means robust internal controls come with the trade-off of poor customer experiences likely to inhibit business growth.

- Poor data quality: Even firms that have recognized the need for automated screening can experience challenges if their risk data is flawed. Information that is inaccurate, incomplete, outdated, or irrelevant will drive up your rate of false positives when screening customers. This means your analysts have to sift through long lists of legitimate customers or transactions when assessing cases, reducing the time and energy they can spend on investigating genuinely suspicious behavior and increasing the chances of making an error. Your AML screening solutions are only as effective as the data you give them.

What are the main limitations to your organization’s current approach to financial crime detection?

What are some best practices for AML screening?

To overcome these challenges, you should be continually optimizing your screening solutions to keep pace with technological developments, the global risk landscape, and emerging financial crime threats. In particular, you should seek to:

- Screen against the latest data: Real-time data updates help you keep pace with rapidly changing sanctions lists and PEP designations while eliminating the need for your analysts to constantly check information sources. Use automated systems that constantly monitor these sources and can alert you to changes in customer profiles without delay. For maximum coverage, use a screening solution that incorporates information on entities related to or controlled by sanctions targets, as well as data on previous enforcement actions and fitness and probity.

- Continue to screen customers after onboarding: Ongoing monitoring is a crucial part of compliance, and you should treat customer risk profiles as dynamic, not static. Only screening customers at onboarding increases your exposure to risk and regulatory enforcement – make sure you are continually monitoring for updates, ideally using a solution that integrates all relevant information into a single profile for each customer to prevent threats being lost in siloed datasets.

- Prioritize your risks: Even if you use reliable, up-to-date information to carry out checks, the efficiency of your screening setup can be compromised if you cannot distinguish between low-risk and high-risk alerts. If analysts have to work through alert queues without being able to prioritize the most important cases, they risk wasting time resolving low-risk alerts while letting high-risk ones go unattended. Using AI agents to analyze case backlogs ensures alerts are automatically triaged and helps teams fine-tune risk thresholds to optimize workflows.

- Enhance screening with automation: Using artificial intelligence (AI) to automate screening processes can significantly improve accuracy and efficiency. Advanced matching algorithms in sanctions and PEP screening, for example, can reduce false positives by considering global naming conventions and spellings. AI-based negative news screening, meanwhile, can help analysts move beyond keywords and manual filters by building a dynamic adverse media database.

“The differences we have seen with this solution have really been around automation. This solution has built operational efficiency, it has built seamless customer interactions, and compliance within all of our markets.”

Shellie Schumaker, VP, Global Compliance, Tala

Advanced AML screening solutions

Rated as market-leading by G2 and Chartis, ComplyAdvantage’s proprietary risk intelligence allows you to maintain a 360-degree coverage without sacrificing your customers’ experience. Turn AML compliance into a competitive advantage with market-leading solutions across:

- Sanctions and watchlist screening: Receive accurate, verified updates to sanctions data in under an hour. Go beyond the minimum regulatory expectation with data on entities owned by or connected to sanctioned individuals.

- Adverse media screening: Move beyond keyword-based screening with ML systems able to achieve swift, name-narrowing screening for a true picture of your risk exposure.

- PEP screening: Stay ahead of the changing global picture with comprehensive, real-time PEP and RCA screening with critical data points consolidated into a single profile.

- Payment screening: Prepare your organization for instant payments with a solution able to process 99 percent of transactions in under half a second.

Streamline compliance with automated screening tools

Get a comprehensive view of your risks with ComplyAdvantage’s AI-powered screening platform and real-time proprietary data.

Get a demoOriginally published 28 April 2025, updated 23 October 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2026 IVXS UK Limited (trading as ComplyAdvantage).