Understanding where customers have obtained the money that they are using to carry out transactions and make investments is an important part of the Know Your Customer (KYC) process and integral to AML/CFT compliance. As money launderers use increasingly sophisticated methodologies to conceal the source of illegal money, firms must work harder than ever to establish the source of funds and wealth. Practically, this means that firms must implement an array of KYC measures and controls, such as customer due diligence (CDD) and transaction monitoring measures, in order to protect both their assets and their customers, and to contribute to the global fight against financial crime.

Understanding source of funds and source of wealth

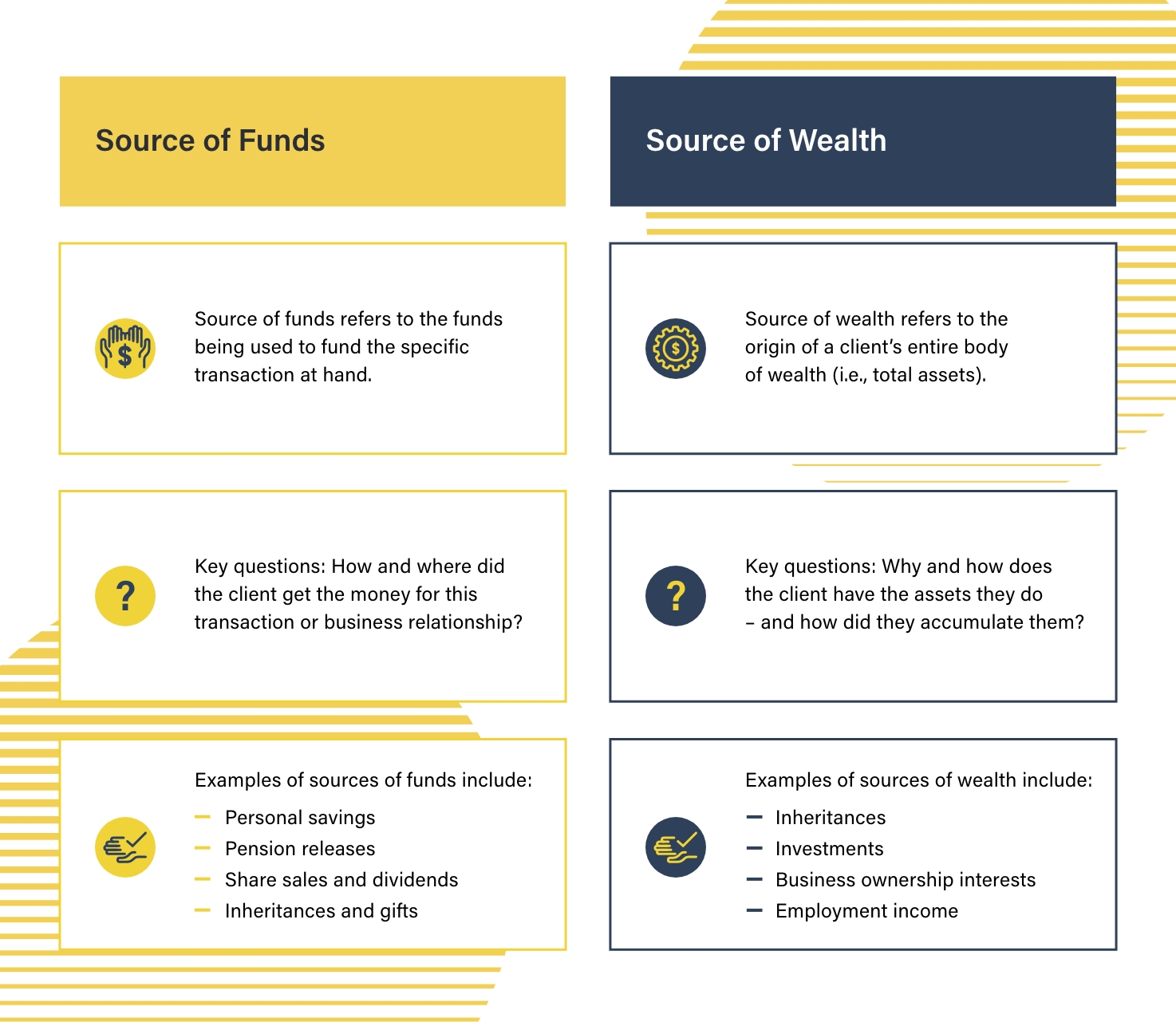

In order to scrutinize source of funds (SOF) and source of wealth (SOW) it is important to understand the distinction between the terms.

What is source of funds?

The source of funds (SOF) is the origin of a person’s money or financial assets. In establishing the source of funds, firms must seek to understand not only where funds came from (in terms of the account from which they were transferred) but the activity that was involved in generating those funds – for example, a source of employment, the sale of a house, or an inheritance.

Examples of sources of funds include:

- Personal savings

- Pension releases

- Share sales and dividends

- Property sales

- Gambling winnings

- Inheritances and gifts

- Compensation from legal rulings

What is source of wealth?

The source of wealth (SOW) refers to the means by which a person has acquired their entire body of wealth. In establishing the source of wealth, financial institutions must ascertain why the client has the assets they do and how they came to accumulate them.

Examples of sources of wealth include:

- Inheritances

- Investments

- Business ownership interests

- Employment income

While the source of funds may be more immediately pertinent to AML/CFT compliance efforts, both SOF and SOW should be considered when establishing a customer’s potential involvement in criminal activity. When a customer is flagged as ‘high risk’ and an enquiry into the origin of their funds is initiated, SOW may be used as a way to support a decision about SOF.

Read our Guide to Customer Onboarding

Discover our guide to find out how to effectively manage challenges faced during the customer onboarding process.

Learn moreThe importance of AML source of funds enquiries

Source of funds and source of wealth are crucial to the fight against money laundering and terrorism financing since both can be good indicators that customers are involved in criminal activity. In contexts where SOF and SOW do not match a customer’s risk profile, or established transaction activity, firms should use that information to inform their AML/CFT compliance response, and when submitting suspicious activity reports (SAR) to relevant domestic authorities.

An AML source of funds enquiry should involve the following measures and considerations:

- SOF enquiries should be conducted in alignment with a customer’s risk profile. A greater degree of scrutiny should be applied to higher risk customers.

- Firms should collect documentary evidence to support the SOF enquiry but also seek to obtain an explanation from the customer.

- Firms should scrutinize customer bank statements to support the SOF enquiry.

- Firms should document every step of the SOF process in order to inform subsequent law enforcement investigations.

Not all suspicious transactions and financial activities warrant source of funds enquiries and financial authorities do not recommend them for every suspicious incident. The Australian Transaction Reports and Analysis Centre (AUSTRAC), for example, points out that customer identification discrepancies and other identification concerns may be better resolved by triggering enhanced due diligence measures (EDD), rather than implementing an SOF investigation.

Source of funds compliance responses

If there are concerns about a customer’s SOF, firms must be ready to take the necessary compliance steps to address the potential compliance risk. Depending on regulatory requirements, compliance responses to source of funds may include:

- A decision to halt a customer transaction.

- A decision not to commence a business relationship, or to terminate an existing business relationship.

- Enhanced monitoring of a customer’s transactions

- Oversight from senior management employees

Where scrutiny of a customer’s SOF reveals suspicious activity, a firm should submit a suspicious activity report (SAR) to the relevant authorities. In the US, for example SAR should be filed with the Financial Crimes Enforcement Network (FinCEN).

Source of funds AML compliance

In order to effectively establish SOF, firms must develop and implement suitable KYC measures in order to understand who their customers are, and what type of business they are engaged in.

Under the risk-based approach to AML compliance recommended by the Financial Action Task Force (FATF), those KYC measures should be proportionate to the risk that different customers present. This means that higher risk customers should trigger enhanced compliance measures, while lower risk customers may warrant simplified measures.

The KYC process should feature the following measures and controls:

- Customer due diligence: Firms should screen their customers in order to make reliable decisions about their SOF, requesting a range of identifying information including names, addresses, dates of birth, and company incorporation information. Firms should also establish the beneficial ownership of customer entities.

- Transaction monitoring: Firms should monitor their customers’ transactions for activity that isn’t consistent with their established SOF. In particular, firms should be vigilant for unusual volumes or frequencies of transactions, or transactions with high risk jurisdictions.

- Sanctions screening: Firms must ensure they do not do business with customers that are subject to international sanctions. Accordingly, firms should be prepared to check customer names against the relevant sanctions and watchlists, such as the OFAC SDN list, or the UNSC consolidated list.

- Politically exposed persons: Elected and government officials present an elevated money laundering risk and firms should scrutinize their SOF carefully. With that in mind, firms should screen customers to establish their PEP status. The PEP screening solution should include the customer’s family and close associates.

- Adverse media: News stories are good indicators that a customer’s SOF may warrant AML scrutiny. Firms should monitor for adverse media that involves their customers, and include traditional screen and print media and online news sources within the scope of their solution.

The State of Financial Crime 2025

Our annual report combines expert industry analysis with a global survey of 600 compliance leaders to offer a roadmap for 2025.

Download your copyOriginally published 12 October 2021, updated 22 January 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2026 IVXS UK Limited (trading as ComplyAdvantage).