The Role of Technology and Talent in Transaction Screening

Discover how firms are investing to improve transaction screening processes and manage risk in an increasingly complex environment.

Download NowTransaction screening is part of a robust anti-money laundering and counter-terrorist financing (AML/CFT) framework. Along with customer identification and verification, transaction monitoring, and regulatory reporting, transaction screening helps firms engage in sound due diligence and compliance processes.

But what’s involved in effective transaction screening? How does it differ and overlap with a firm’s overall compliance process? And how can up-to-date technology enable it?

Discover the ins and outs of transaction screening, what separates it from transaction monitoring – and the best way to ensure an effective process.

Transaction screening analyzes transactions for suspicious or prohibited activity before they are approved. If analysis confirms illicit or excessively risky activity, the transactions are stopped. This is necessary to filter out blatant attempts to get around regulations such as international sanctions. It also contributes to a layered, risk-based approach to AML/CFT due diligence.

Transaction screening looks at individual transactions, such as payments, before they’ve been approved to stop especially high-risk activity. For example, a transaction to a sanctioned entity or for prohibited goods can be denied regardless of the customer’s past activity.

On the other hand, transaction monitoring analyzes transaction patterns for suspicious activity after they’ve been approved. Some transactions may not be obviously high risk on their own and pass the screening process. Yet, if they are part of a wider network of suspicious activity, their relationship to past transactions can alert monitoring teams to investigate further.

Payment screening, while a type of transaction screening, only deals with payments before they are processed. On the other hand, transaction screening may deal with other types of transactions, from payments to cash deposits, withdrawals, and ACH transactions.

The steps each screening process follows is similar, but can vary based on the specific risk factors involved in the transaction types being screened.

Regulators generally focus on a risk-based approach to AML/CFT rather than dictating tools and processes at a granular level. Still, transaction screening is a vital component of any sound program.

Regulators require a customer due diligence program that enables firms to have sufficient customer information and to identify and report suspicious activity. Firms found to be lacking in customer due diligence can be penalized. For example:

A lack of sound screening could lead to CDD failures, including sanctions violations. This, in turn, could lead to regulatory penalties.

Discover how firms are investing to improve transaction screening processes and manage risk in an increasingly complex environment.

Download NowWhen teams review transaction alerts during screening, they look for red flags that could indicate illicit or risky activity. These can include signs that the transaction:

Red flags are meant to be initial indicators that further investigation is needed. When analysts encounter any of the above red flags, they will generally initiate a deeper review. Sometimes, an activity that initially seemed suspect will be labeled legitimate after further clarification of the context. Other times, a payment will be confirmed as illicit (for example, if it involved sanctioned entities) – or at least high-risk enough to be stopped.

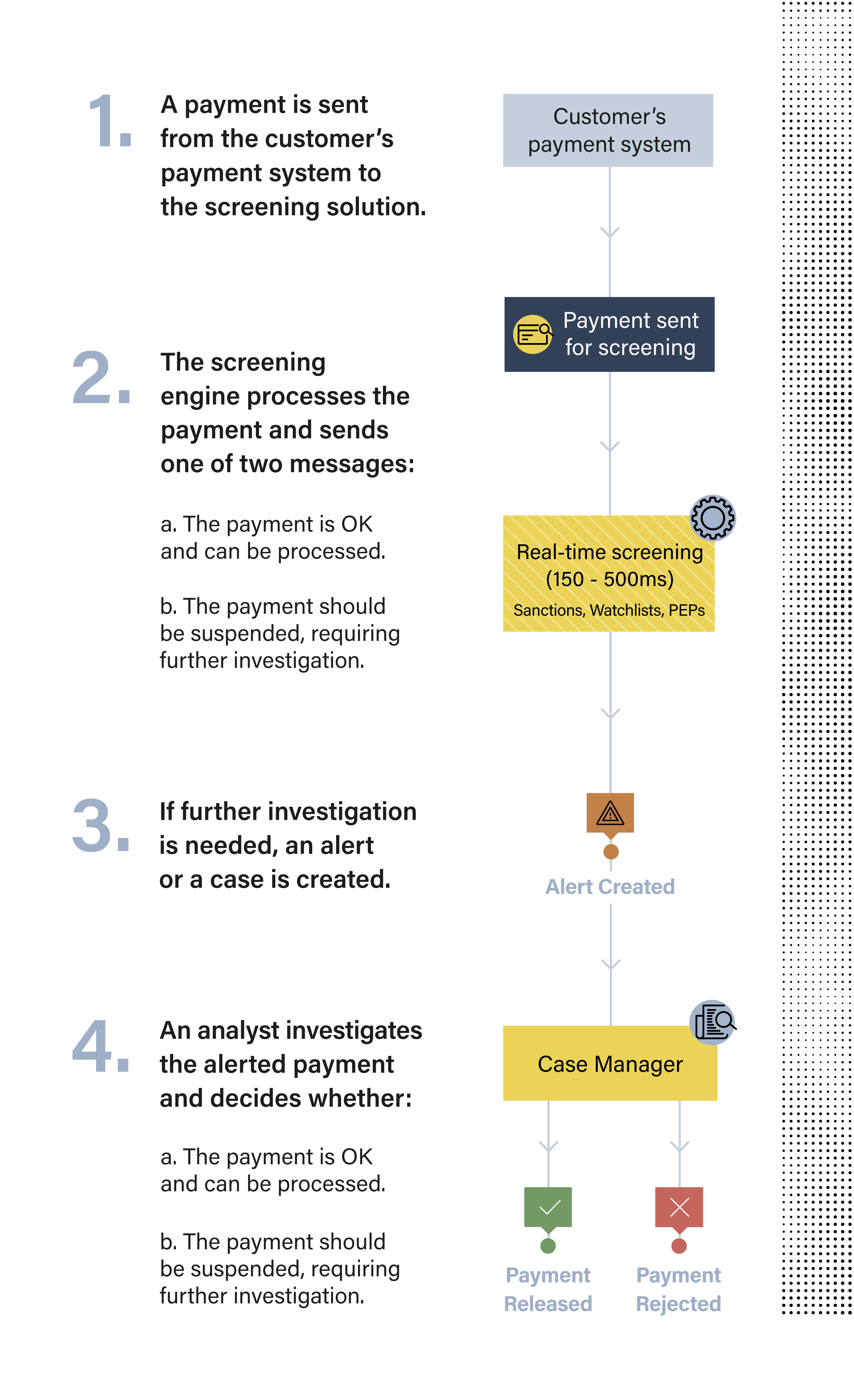

Each transaction passes through a screening process before being approved. The exact steps may vary between institutions, depending on their policies and the tools they use. However, the process will often follow a pattern like this:

Payments that make it through the screening process are approved but are usually only looked at individually. After approval, those transactions are subject to ongoing monitoring alongside other transactions to ensure approved payments aren’t part of a larger pattern of suspicious activity.

Regulators encourage firms to maintain appropriate transaction monitoring, but transaction screening is equally important owing to the following benefits:

Firms can encounter transaction screening challenges related to outdated systems, unreliable or poorly processed data, and overwhelmed teams facing unrealistic screening workloads. These can include:

To keep pace, firms will need solutions that are not slowed down by inaccurate data or an inability to identify targeted risks. Even expert analysts are hampered in curbing a firm’s AML risks without adequate screening tools.

To stay ahead of growing financial crime risks and regulatory requirements, firms must provide robust analyst support for alert investigations. This includes ensuring their transaction screening system provides clear, accurate, and comprehensive data for investigations.

ComplyAdvantage’s payment screening solution can help firms reach this goal. Using data-optimized screening algorithms, most payment transactions can be processed without delay. This is because screening lists can be tailored to a firm’s unique and changing risks, focusing on relevant risks without clogging analyst workflows with irrelevant ones. At the same time, sanctions lists are regularly updated straight from regulator sources. Firms can integrate these updates into their screening process within as little as an hour. The system supports fast payments and ISO 20022, ensuring firms are ready for the payments future.

See how leading companies are screening against the world's only real-time risk database of people and businesses.

Request a DemoOriginally published 06 October 2023, updated 13 May 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).