How well can you identify PEPs?

Do you think you can answer 'what is a PEP' and identify one correctly?

Test your knowledgeWhile politically exposed person (PEP) status does not predict criminal behavior, the risk exposure that it brings means that financial institutions must apply additional AML/CFT measures when establishing a business relationship and conduct ongoing monitoring to ensure that they capture changes in their customer’s risk profile. PEP monitoring requirements are preventative in nature and should not be considered indicative of criminal behavior.

A politically exposed person (PEP) is an individual with a high profile political role, or someone who has been entrusted with a prominent public function. These individuals present a higher risk of involvement in money laundering and/or terrorist financing because of the position they hold.

The term “politically exposed person”, sometimes used interchangeably with “Senior Foreign Political Figure”, emerged in the late 1990s in the wake of the Abacha Affair: a money-laundering scandal in Nigeria which galvanized global efforts to prevent abuse of the financial system by political figures.

While it may be useful for financial institutions to build a list of designated PEPs to reference, doing so is often challenging since the criteria that qualify an individual as a PEP are broadly defined and vary from country to country. The FATF also periodically issues new AML/CFT recommendations on PEPs which further complicates the implementation of any ‘definitive’ PEP list.

The Financial Action Task Force (FATF) subsequently codified the term in its AML guidance, setting out the following 3 classifications of PEP:

Individuals entrusted with prominent public functions by a foreign country. This category of PEP may include: heads of state or of government, senior politicians, senior government, judicial or military officials, senior executives of state owned corporations, important political party officials’.

Individuals entrusted with prominent domestic public functions. This category includes ‘heads of state or of government, senior politicians, senior government, judicial or military officials, senior executives of state owned corporations, important political party officials’.

The FATF sets out a third category of ‘International PEP’ – known as an individual entrusted with a prominent position by an international organization. This category of PEP covers ‘members of senior management, i.e. directors, deputy directors and members of the board or equivalent functions’.

Relatives and Close Associates (RCA) of the individuals outlined above may also be categorized and treated as a politically exposed person. This category refers to immediate family members or close social or professional contacts of a government or political official, or senior executive – meaning spouses, parents, siblings, children, and spouses’ parents and siblings.

The FATF points out that its three classifications of PEP are ‘not intended to cover middle ranking or more junior individuals’.

Do you think you can answer 'what is a PEP' and identify one correctly?

How well can you identify PEPs?

Countries sometimes publish lists of domestic PEPs or prominent public functions. This is not required by the FATF standards, however, and such lists have potential shortcomings and might pose challenges for effective implementation.

Countries might publish two types of list: (1) a list of positions/functions that would be held by a PEP, or (2) a list of names of PEPs. In general, while inclusion on a list can confirm that a person is a PEP, not being featured on a list does not exclude the possibility that a person is a PEP.

Discover our guide to find out how to effectively manage challenges faced during the customer onboarding process.

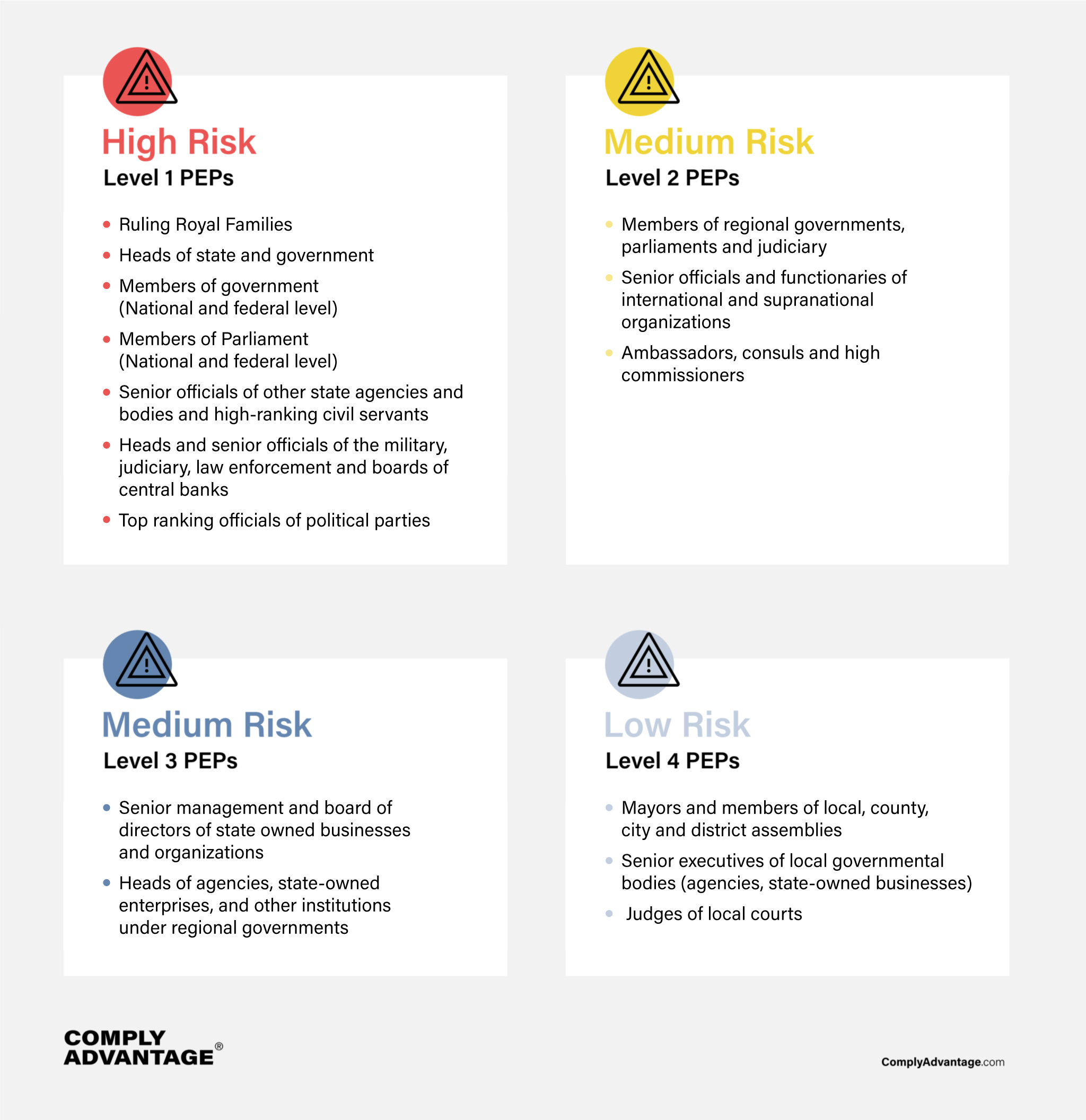

Learn moreSome PEPs pose a greater AML/CFT risk than others. With that in mind, the levels of PEP risk may be organized into the following 4 quadrants:

It is important for financial institutions to conduct suitable customer due diligence in order to establish a client’s PEP status and accurately determine the level of risk that they present. Accordingly, firms should assess new clients at onboarding as part of the risk-based approach to AML recommended by the FATF.

A risk based approach requires firms to deploy AML/CFT measures commensurate with the level of risk their clients present – applying enhanced due diligence measures (EDD), for example, to higher risk customers. In the context of PEP screening best practices, firms should ensure that their definition of the term is broad enough to capture all relevant roles and positions, along with family members and close associates.

A risk based approach to PEP screening should be built around the following principles:

Customers become PEPs in a variety of ways including through electoral victories, changes in employment, political appointments, and promotions – and firms must be able to capture that change in risk profile as soon as possible. Similarly, firms should also know when customers may be declassified as PEPs.

The FATF also sets out guidance for detecting changes in PEP status:

Although there is no accepted time limit for PEP declassification, the FATF emphasizes that the declassification process should be based ‘on an assessment of risk and not on prescribed time limits’.

Financial regulators require businesses to implement PEP screening measures as part of their AML programs. Businesses must be aware of the PEP regulations applicable in their jurisdiction so that they can implement AML/CFT measures in line with money laundering regulation.

With that in mind, an effective PEP screening process should be built on the following principles and considerations:

Originally published 21 November 2019, updated 16 September 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).