The State of Financial Crime 2025

Read our state-of-the-industry report, built around a global survey of 600 senior compliance decision-makers and packed with expert analysis.

Download your copyTo avoid detection by financial institutions (FIs), criminals often use surrogates, known as money mules, to conduct illegal activities on their behalf. Money mule networks are a global problem, moving vast sums of illegal money between accounts and facilitating a range of criminal and terrorist activities.

The UK’s National Crime Agency (NCA) estimates that over £10 billion is laundered by money mules in the UK alone every year. This threat means banks and other FIs must understand how mules operate as part of money laundering schemes and ensure their anti-money laundering and countering the financing of terrorism (AML/CFT) compliance programs are set up to detect and prevent the relevant methodologies.

A money mule (sometimes referred to as a “smurfer”) is an individual recruited, knowingly or unknowingly, to act on behalf of criminals as part of a money laundering scheme. While historically they have been used to transfer physical amounts of cash between locations, today they are generally used to open and manage bank accounts to facilitate the deposit, transfer, and withdrawal of illegal funds.

Money mules may be recruited from a range of backgrounds, ages, and gender groups (although most tend to be younger men). When recruiting mules, criminals often approach potential mules with an offer of seemingly legitimate employment that masks the illegal nature of the work – although mules are sometimes complicit in the criminal enterprise.

Criminals looking for money mules often seek to take advantage of certain social trends or crises that have resulted in a high number of unemployed people. While criminals may specifically target vulnerable people or those with criminal backgrounds for money mule roles, they may equally seek to hire candidates without criminal backgrounds to better evade the scrutiny of authorities. 2024 guidance from the Australian Transaction Reports and Analysis Center highlighted the widespread use of international students as money mules.

Money mules may be paid directly for their participation in a money laundering scheme or retain a portion of the illegal funds for themselves as a fee.

Read our state-of-the-industry report, built around a global survey of 600 senior compliance decision-makers and packed with expert analysis.

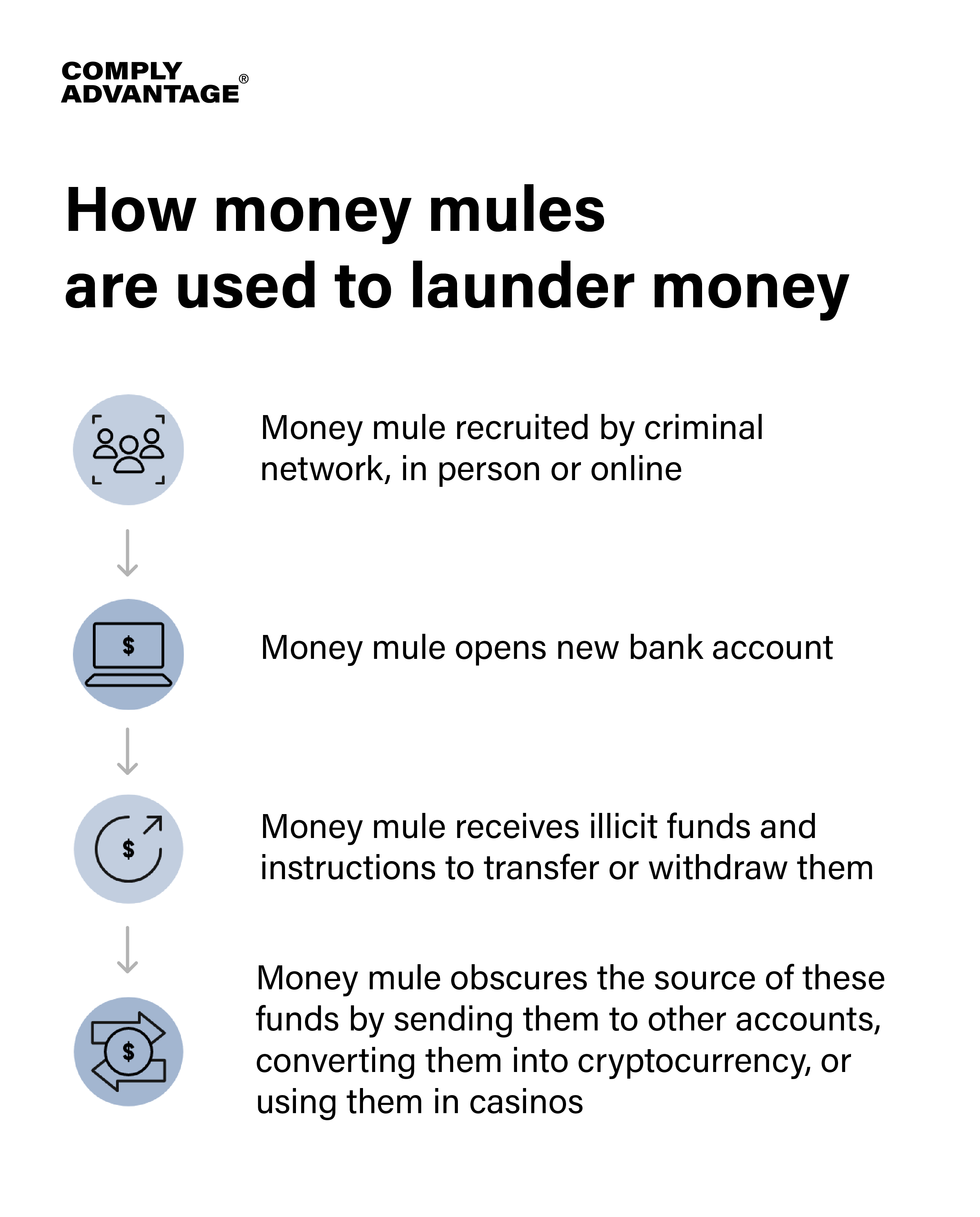

Download your copyCriminals recruit money mules with the incentive of lucrative employment or by using leverage or intimidation; according to AUSTRAC, recruiting occurs through online platforms and advertisements as well as via trusted insiders.

After being recruited, mules are directed to open bank accounts in their names, using their personal details. This allows criminals to conceal their identities and the source of their illegal funds, and evade the customer due diligence (CDD) measures that would otherwise raise red flags.

Once the money mule account has been set up, criminals can use it to transfer illegal money into the legitimate financial system. The laundering process may proceed in the following way:

Money mules complicate the process of detecting and remediating financial crime and so represent a significant AML/CFT compliance challenge. Firms that fail to detect these criminals using their services to launder money risk regulatory penalties, fines, and significant reputational damage.

FIs must ensure their AML programs can detect when customers are being used as mules. In the first instance, this means implementing sufficient risk-based AML measures, including:

When applying these measures, firms should be aware of the red flag behaviors and characteristics of money muling to look for. These include:

ComplyAdvantage helps FIs across the world, from startups to large enterprises, detect and respond to their financial crime risks with cloud-based AML/CFT software. Our solutions empower firms to protect their operations and meet their regulatory obligations while growing their business at scale, and cover:

Detect and mitigate money mule transactions and other financial crime risks with AI-powered compliance software.

Get a demoOriginally published 10 September 2020, updated 14 February 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).