Customer Screening

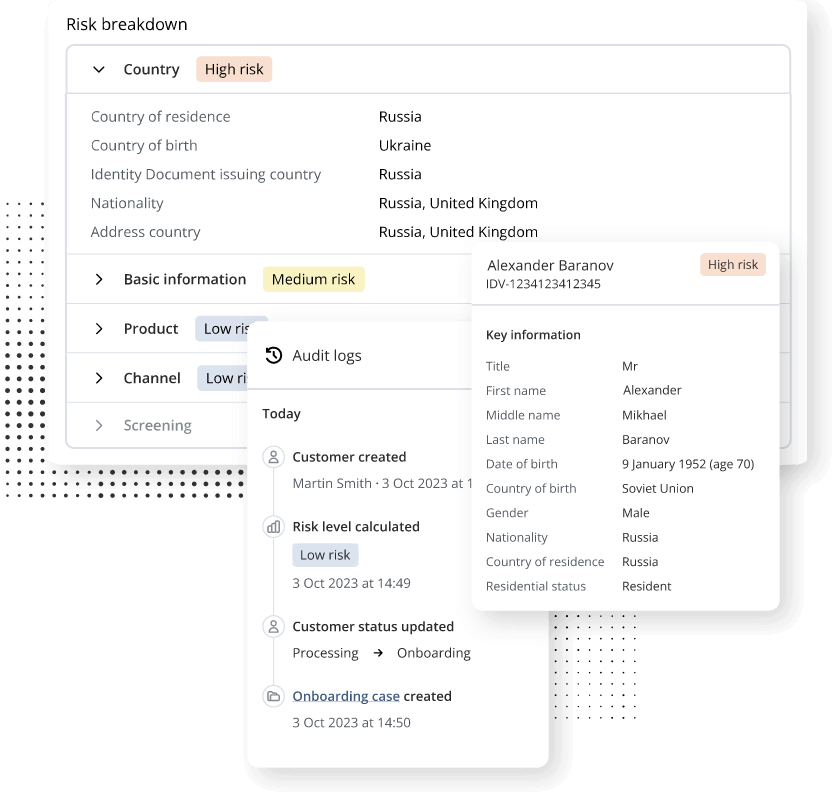

Streamline onboarding with quicker and more intelligent remediation by utilizing advanced AI to swiftly identify and assess clients’ risk profiles.

- Combines our risk screening solution and market-leading proprietary data on the ComplyAdvantage Mesh platform.

- Cutting-edge AI-powered matching algorithms. Screen new customers against sanctions, PEPs, watchlists, adverse media, and enforcement data.

Proven value for businesses

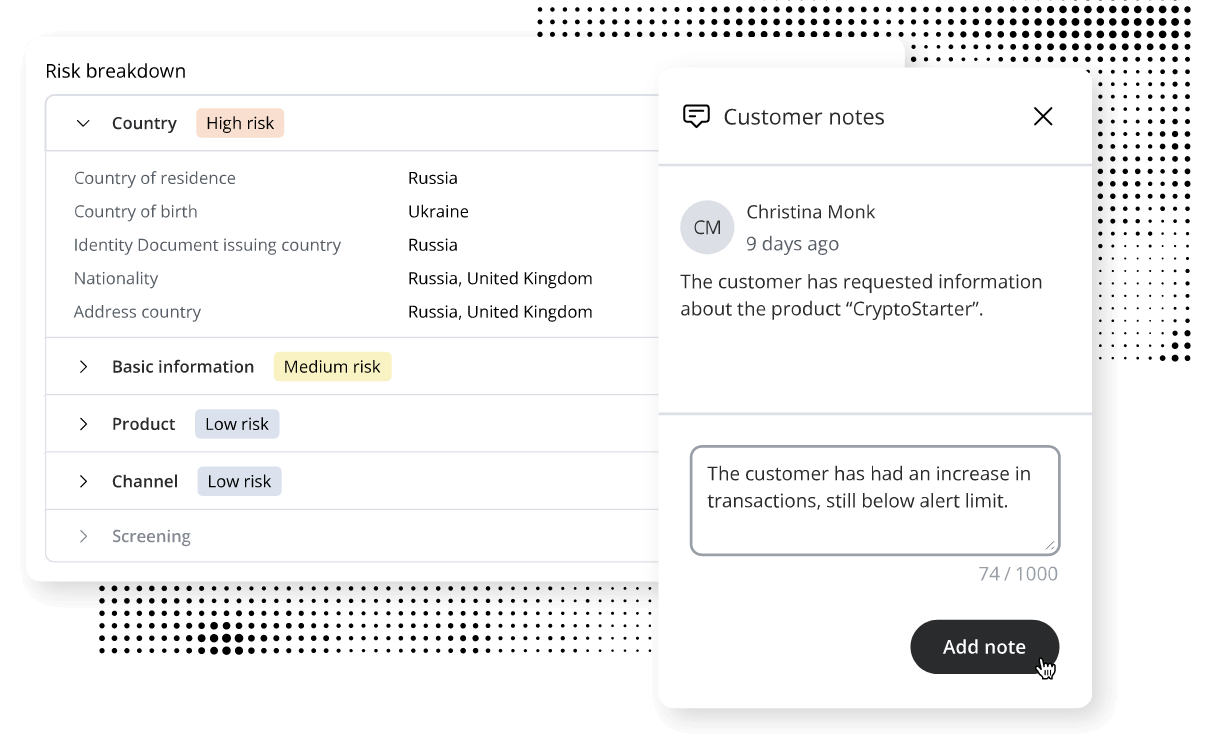

Mesh Customer Screening is a customizable screening solution designed to strengthen your business against financial crimes, ensuring compliance while fostering growth.

By effectively managing client, reputational, and regulatory risks, it enables you to implement a focused, risk-based strategy for customer screening, supporting your business objectives.

Compliance Officers & MLROs

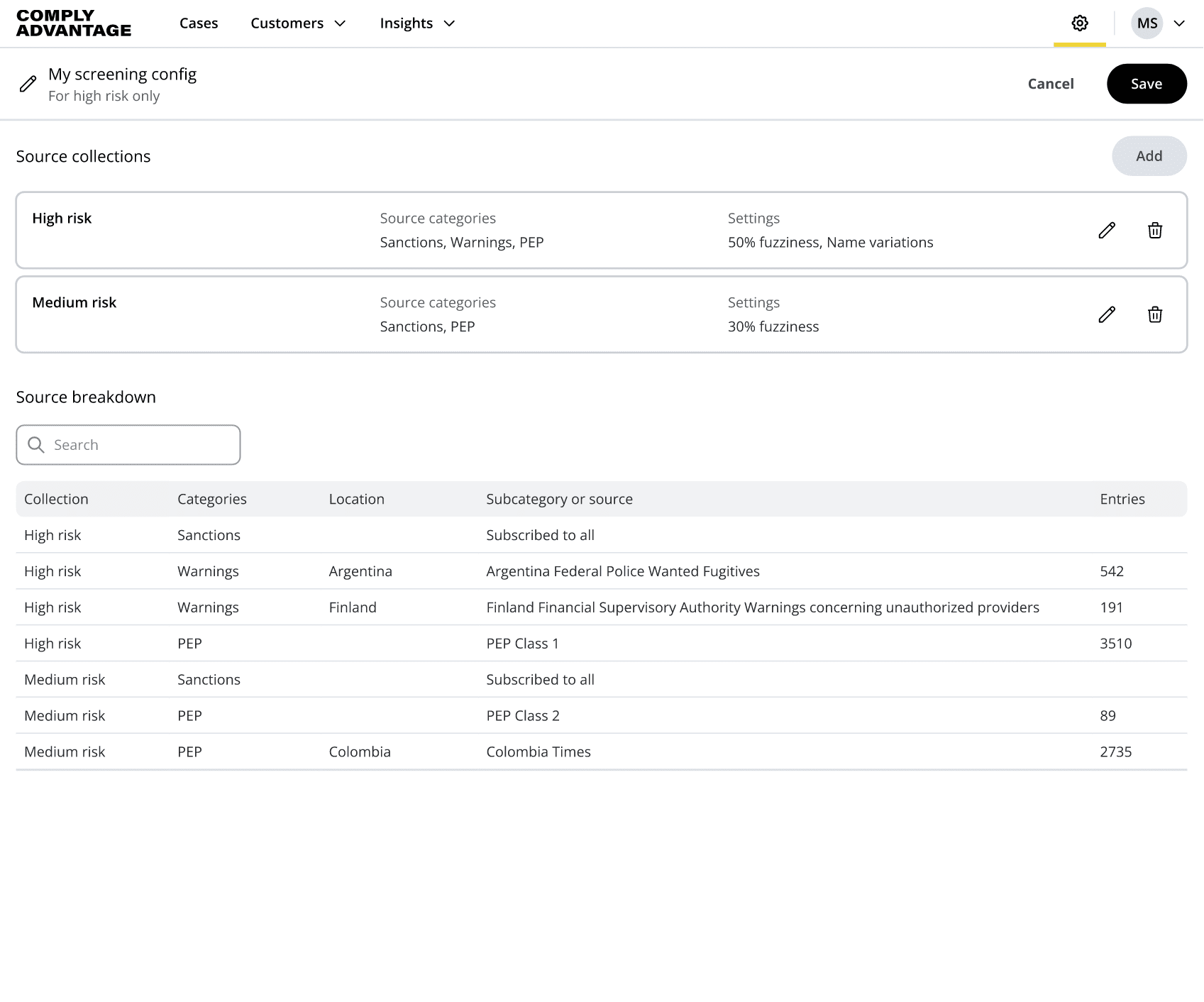

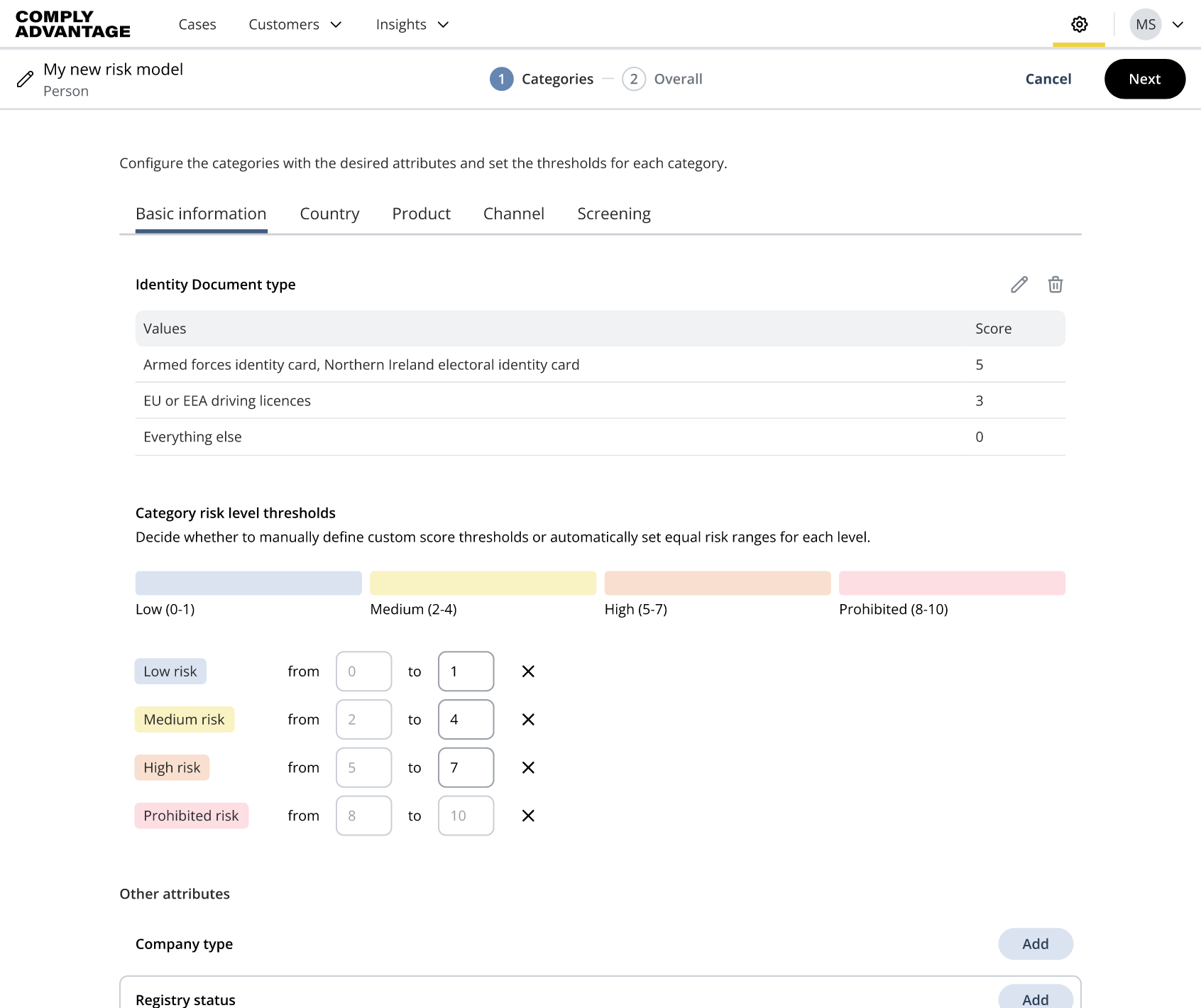

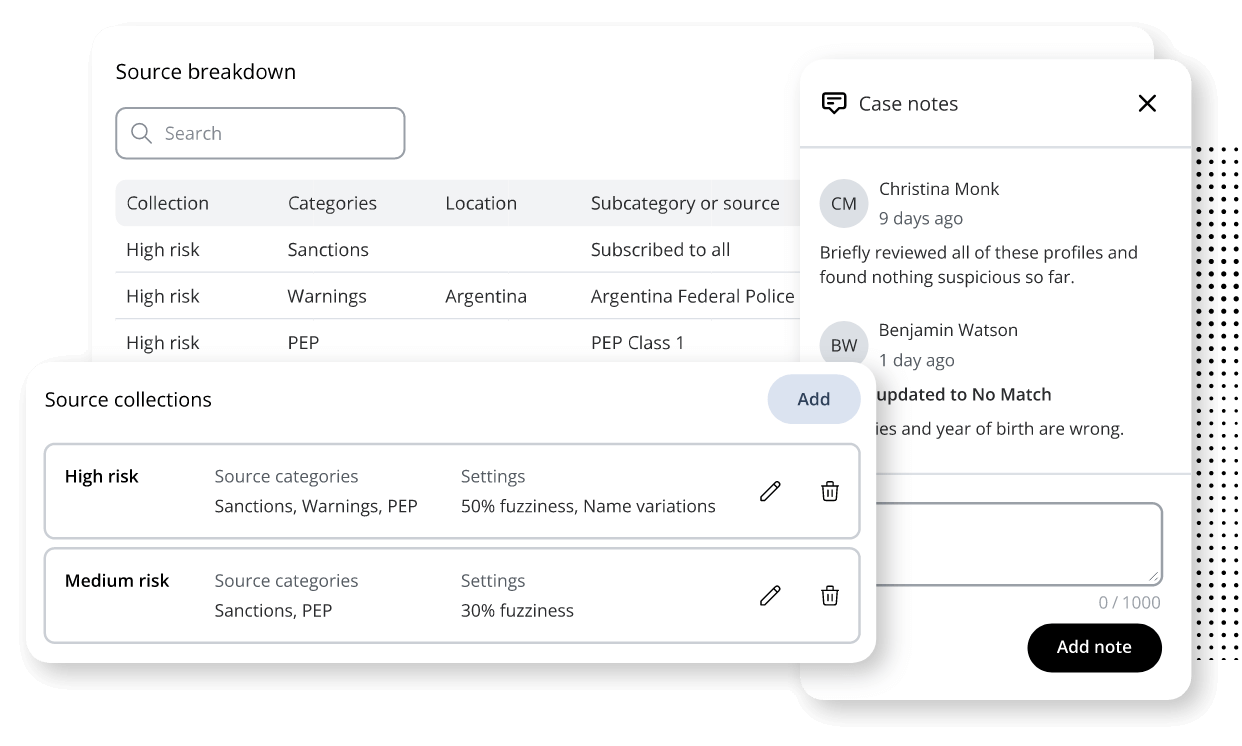

Configure customer screening to meet risk and cost of compliance goals.

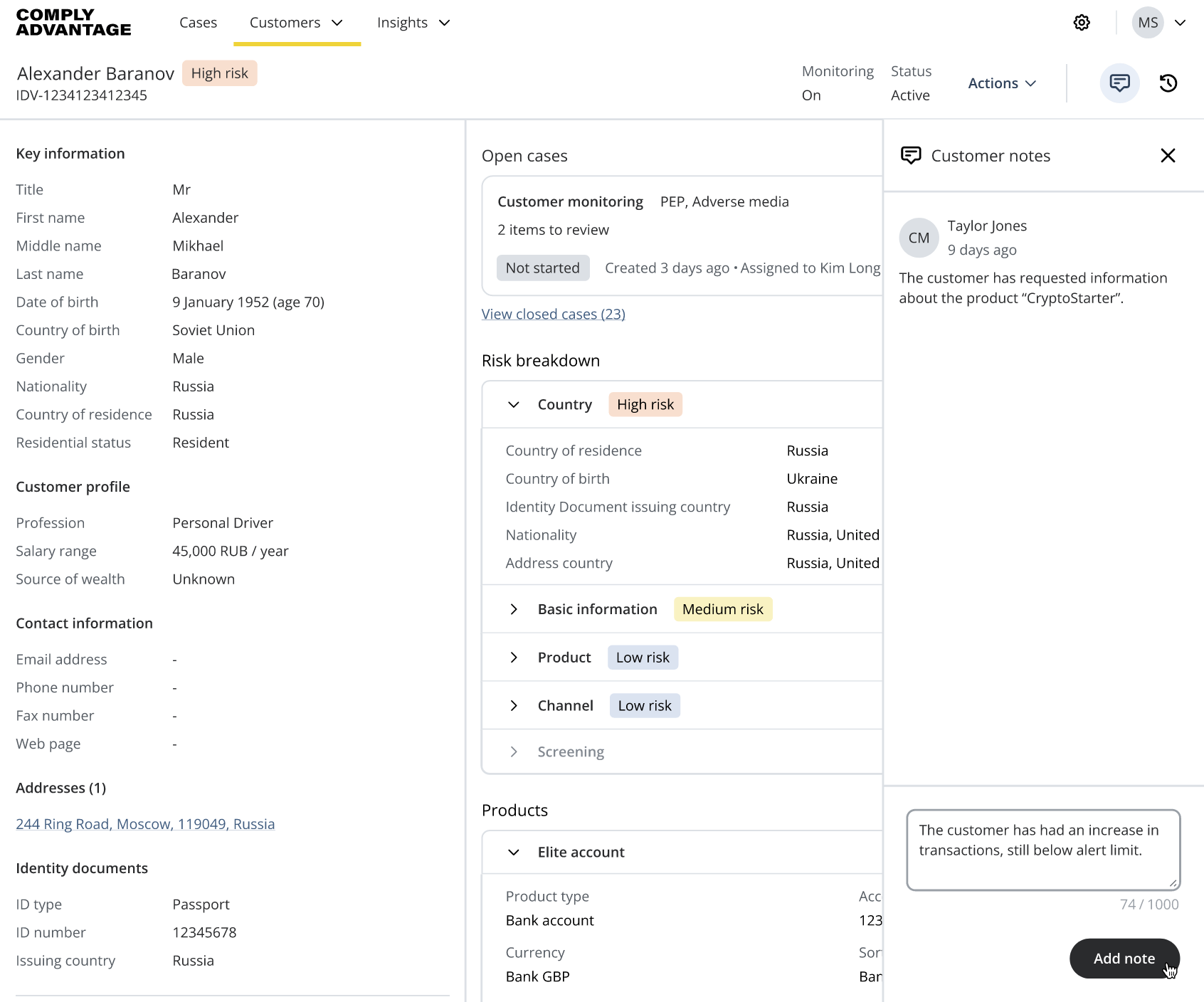

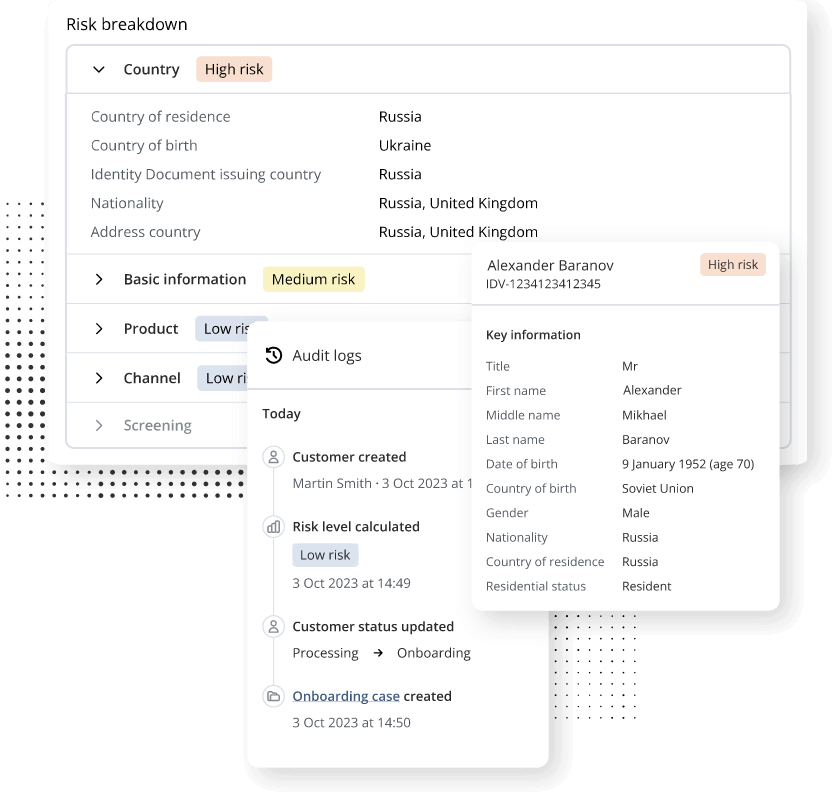

- Automate risk assessments to help teams focus on the highest-risk customers first.

- Ensure compliance teams are ready for an external audit at any time.

- Provide teams with market-leading software and risk intelligence.

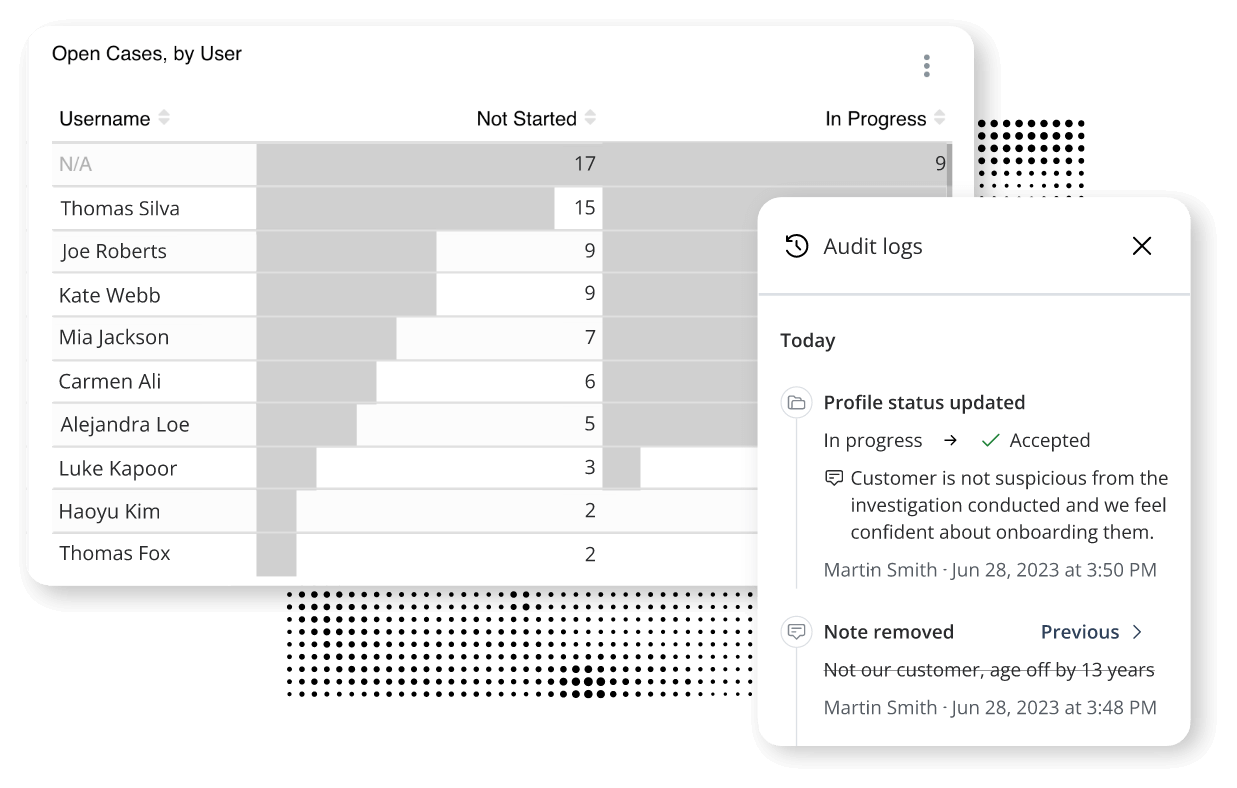

Team Leaders

Make screening backlogs a thing of the past.

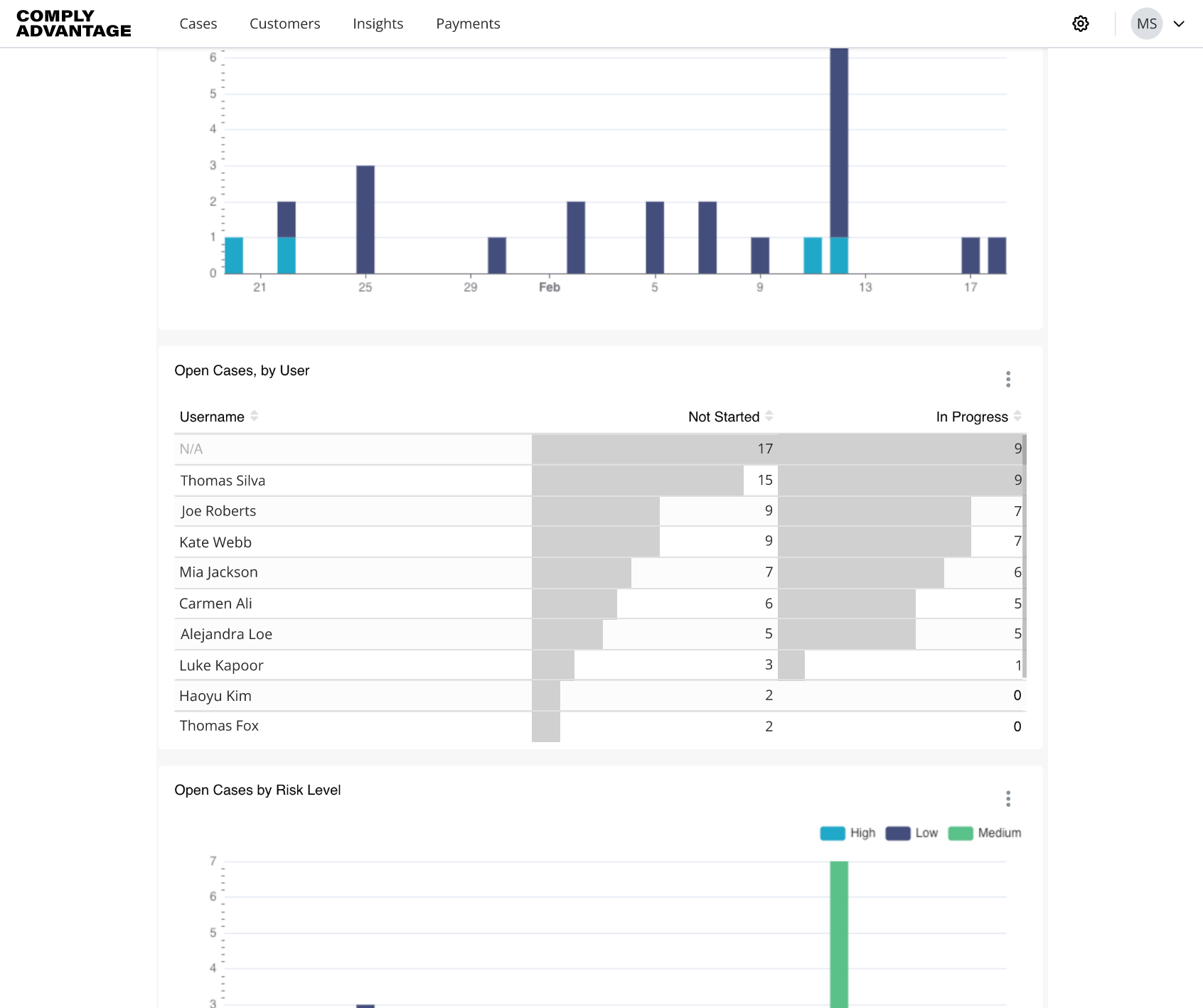

- Easily analyze your team’s screening workload and performance.

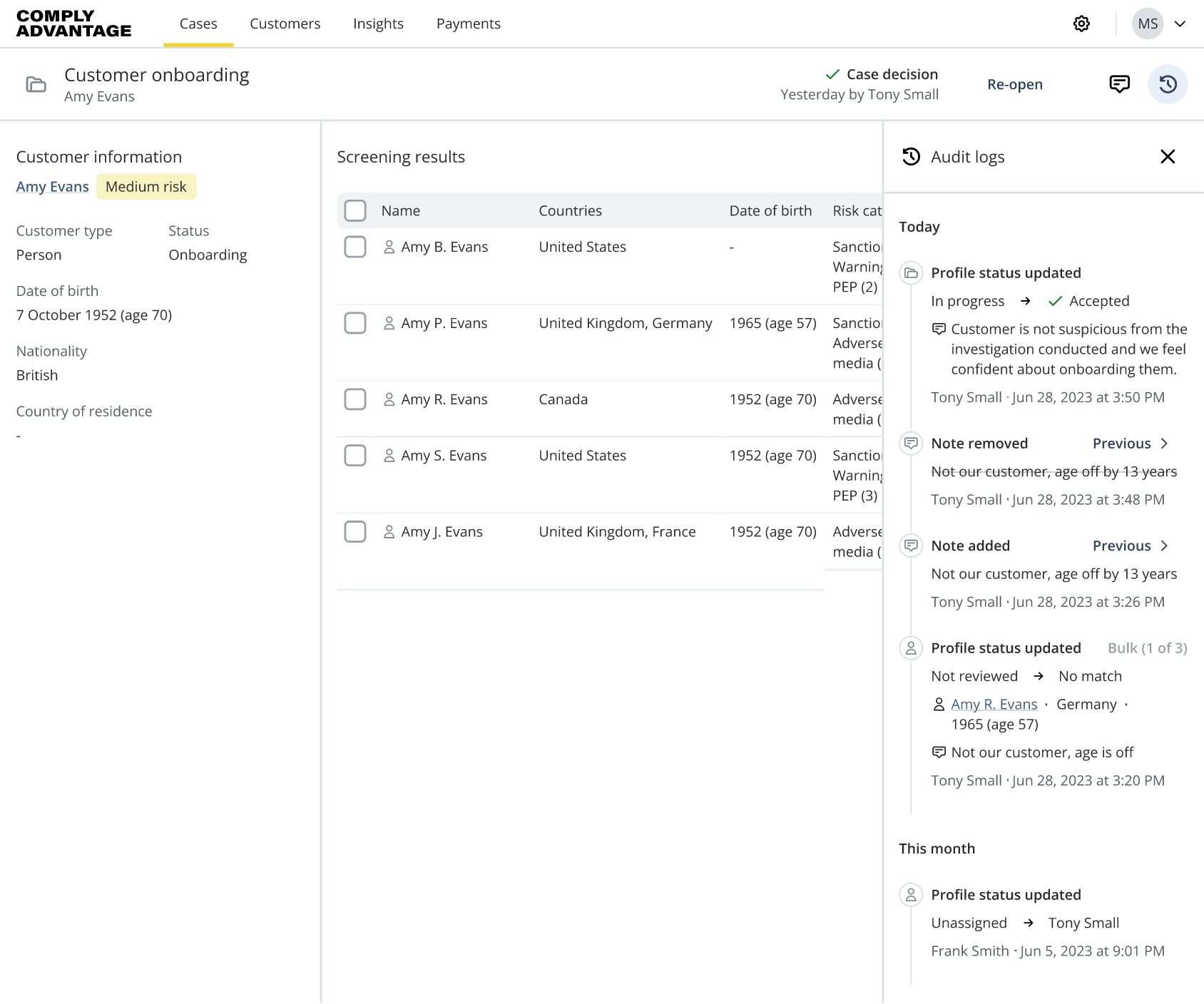

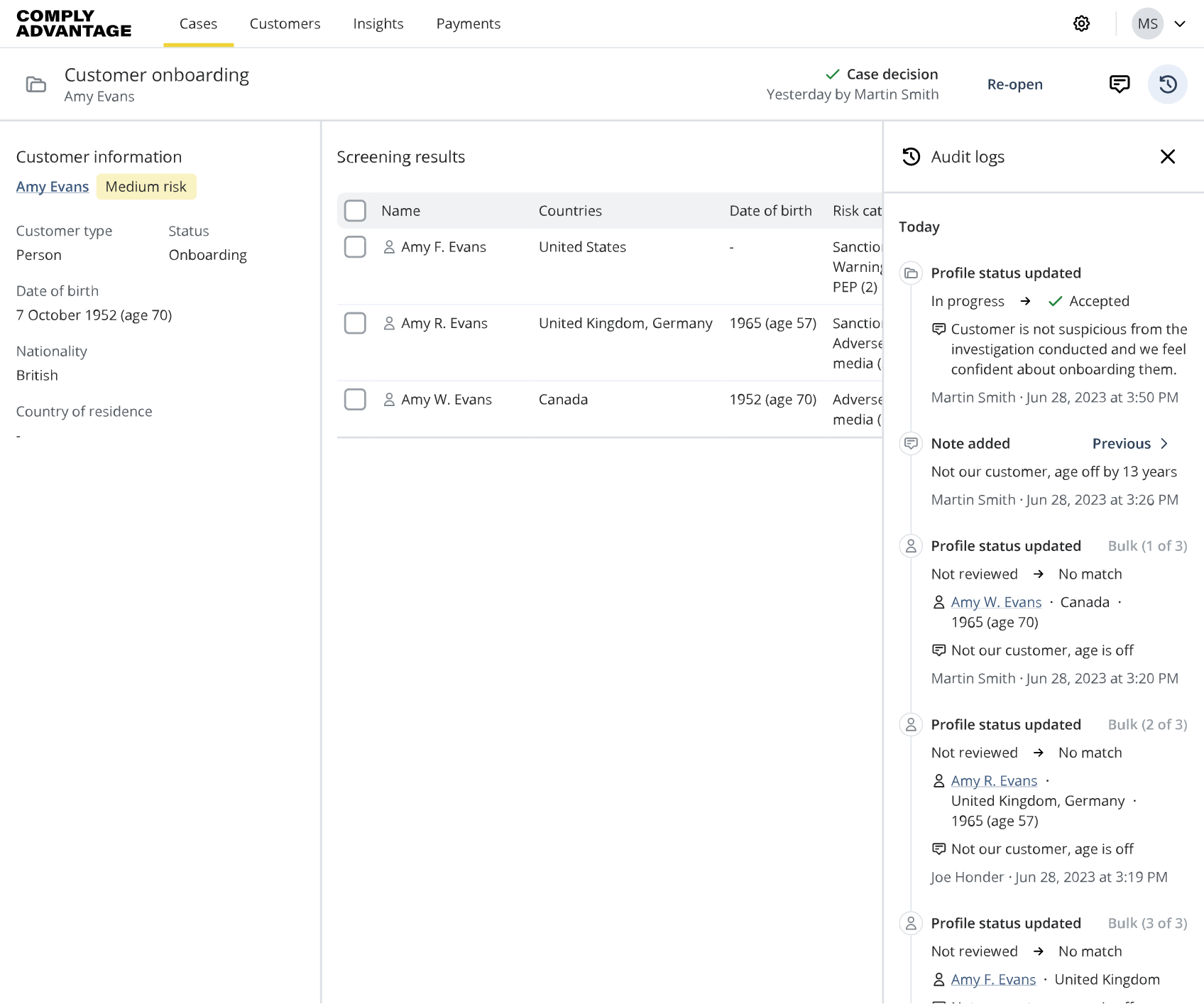

- Access a detailed audit trail showing every event and decision.

- Enable your teams to prioritize the highest-risk cases first.

Compliance Analysts

Process onboarding cases easily and effectively.

- Access all the details needed to make swift case decisions on a single screen.

- Record all observations to defend case decisions confidently.

- Reduce repetitive and manual tasks to tackle screening case backlog like never before.

Reduce repetitive and manual tasks to tackle your screening case backlog like never before.

View full interfaceScreening efficiencies you can measure

Reduction in false positive rates

![]()

![]()

Reduction in false positive rates

![]()

![]()

Improvement in

account-opening efficiency

![]()

![]()

Increase in remediation speed

![]()

![]()

Starter Plan ($99/month)

- Run up to 100 checks each month

- Screening & monitoring included

Premium Plan (Custom price)

- Over 100 searches per month

- Tailored package for your business

Frequently asked questions

We provide in-depth, reliable, and actionable proprietary risk data. This includes sanctions, PEPs, RCAs, watchlists, adverse media, and enforcement data.

We leverage thousands of sources contributing to our comprehensive global coverage, including OFAC, UN, HMT, EU, DFAT, and many more. Lists are crawled from around the world, with 14 languages supported.

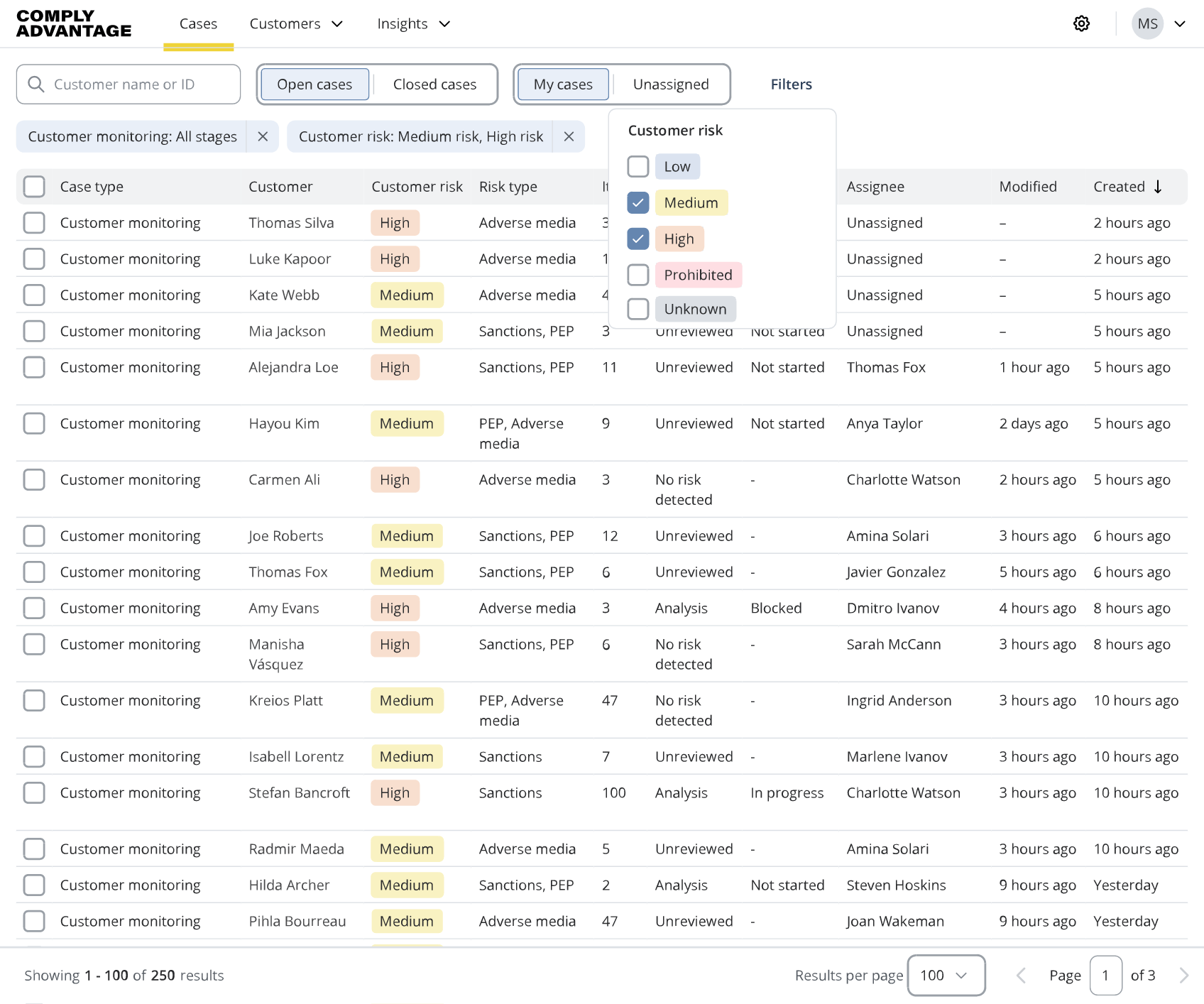

You can assign and unassign cases in bulk. You can also make decisions on several cases in a single go. In addition, you can benefit from a wide range of case filtering options, including case owners, case types and stages, case creation date, level of customer risk, and risk type.

Using the insights section, select your date range and access a host of dashboards covering:

- Team performance

- Cases per risk level

- The number of screenings completed

- The number of hits produced

- Hit rate

- Average number of profiles per hit

You can also adjust the frequency by selecting options ranging from daily, weekly, and yearly.