Cryptocurrencies and virtual assets (VAs) remain high on the global financial agenda in 2025, and the UK is no exception.

Crypto’s decentralized nature allows for fast and low-cost transactions, including across borders. While this clearly appeals to consumers, crypto’s speed and anonymity also make it an attractive option for money launderers. Therefore, like many other jurisdictions, the UK requires virtual asset service providers (VASPs) to comply with anti-money laundering and countering the financing of terrorism (AML/CFT) regulations.

In one survey, 27 percent of UK respondents said they would be more likely to invest in crypto if the sector was more heavily regulated. As crypto increases in popularity, AML/CFT measures remain crucial not just for protecting the sector against financial crime and regulatory enforcement but also for ensuring firms retain the consumer trust they need to grow.

This article explains UK crypto firms’ regulatory requirements, the likely avenues future regulation will explore, and how you can optimize and future-proof your compliance setup.

Crypto regulations in the UK

Whether your organization is a specialist crypto firm or another financial institution (FI) with virtual asset capabilities, you are subject to the same regulatory framework as other FIs in the UK. The regulations you must comply with are:

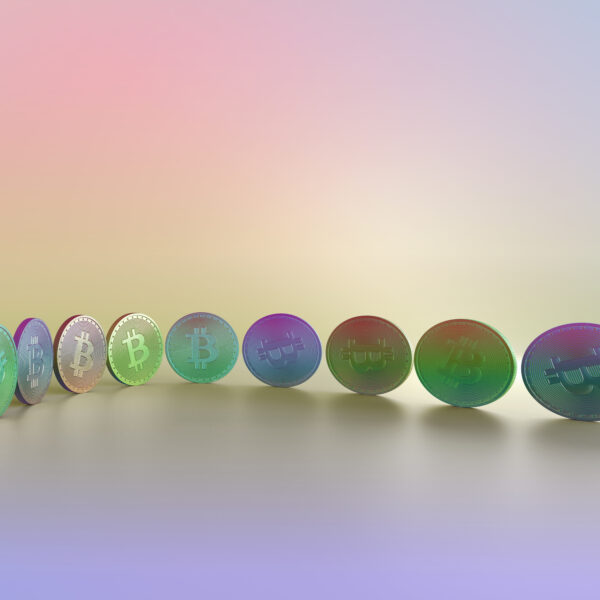

- The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations (MLRs): Under the MLRs, you must be registered with the Financial Conduct Authority (FCA). Like other regulated FIs, you must also conduct AML/CFT risk assessments and create written compliance policies based on their results, supervised by a nominated compliance officer. Specific AML controls must include customer due diligence (CDD), enhanced due diligence (EDD) for higher-risk customers, ongoing customer monitoring, and transaction monitoring. These principles derive from recommendations by the Financial Action Task Force (FATF), as summarized below.

- The Travel Rule: Based on another FATF recommendation, the Travel Rule is an amendment to the MLRs requiring cryptoasset businesses to collect, verify, and share information relating to crypto transfers, including identifying information on the sender and receiver. The FCA has clarified that you must comply with the Travel Rule even when sending transfers to jurisdictions without an equivalent rule, and has suggested that crypto transfers from jurisdictions with no Travel Rule should be treated as higher-risk.

Non-compliance with the UK’s AML legislation can be costly for firms: several crypto companies were subject to expensive, high-profile enforcement actions in 2024. In addition to the financial consequences, compliance failures can cause reputational damage, with a loss of consumer trust limiting how much firms can grow.

UK regulatory priorities for crypto

In November 2024, the FCA published its crypto roadmap, setting out a program of policy areas where the regulator will seek crypto firms’ feedback. While crypto firms are already regulated, this agenda is designed to develop a comprehensive, sector-specific set of regulations, reflecting the long-term trend towards widespread crypto adoption by consumers and FIs. The roadmap therefore includes, but is not limited to, AML/CFT priorities and covers:

- Admission and disclosures.

- Market abuse.

- Trading platform rules.

- Stablecoin rules.

- Record-keeping.

- Third-parties and outsourcing.

- Prudential regulations.

- Conduct and firm standards, including operational resilience and financial crime controls.

The FCA will gradually roll out policies and consultations in these areas by 2026 when it will publish its final rules. From an AML perspective, you should pay particular attention to the conduct and firm standards, due to be published in Q3 2025. The FCA’s Head of Department, Payments and Digital Assets has cited “shockingly bad examples in firms where they have not had money laundering practices or systems,” including the “basics” of AML/CFT, as one motivating factor behind these updates. This could indicate significant revisions to your regulatory requirements, so you should prepare your compliance setup to withstand enhanced future scrutiny.

The State of Financial Crime 2025

Uncover the compliance trends you need to know about in our report, based on a survey of 600 industry professionals and packed with expert analysis.

Download your copyHow to comply with UK crypto regulations

Existing AML/CFT regulations in the UK place clear requirements on FIs, while the FCA’s crypto roadmap suggests regulatory oversight of the crypto sector will only increase going forward. In the event of stricter rules being implemented, following these principles will ensure you are well-placed to meet enhanced regulatory standards:

- Tailor solutions to your specific risks: Your AML compliance program should proceed from regularly updated business-wide risk assessments, considering any risks posed by the locations you operate, the customers you serve, and the products and services you offer. This allows you to customize your internal controls to the actual threats you face so you avoid over-committing resources where they are not needed.

- Combine AML screening types: When onboarding new customers, you should aim for a complete picture of their risks. To achieve this, make sure you have solutions for sanctions and watchlist screening, politically exposed person (PEP) screening, and adverse media screening – ideally on the same platform to avoid toggling between systems and datasets.

- Continue to monitor customers after onboarding: The information you collect and verify at onboarding should allow you to assign a risk score to each customer and inform them whether you do business with them and the kind of due diligence you carry out. However, even after accepting a new customer, you should conduct ongoing monitoring to capture any changes in their information that may affect their risk profile.

- Adopt advanced AML technology: As businesses whose ability to grow depends on how well they can innovate and leverage technology, crypto firms cannot afford to be held back by legacy compliance solutions. You should capitalize on the availability of cloud-based AML software using artificial intelligence (AI) and machine learning (ML) to streamline compliance, provide more accurate results, and reduce your overall compliance spend.

Advanced compliance technology for crypto firms

ComplyAdvantage helps global crypto firms identify and mitigate risks efficiently with proprietary data and industry-leading screening and monitoring solutions. We enable our customers to build trust with regulators and protect their reputation with consumers with features such as:

- Real-time screening capability: We use ML to constantly scan for changes to sanctions, watchlist, PEP, and adverse media data so you receive updates without delay. ComplyAdvantage Payment Screening has a high straight-through processing (STP) rate, supporting your need for instant payments and showing security doesn’t have to be traded for speed.

- In-depth risk data: Get a deeper understanding of your customer networks with sanctions-related data that goes beyond just listing the names of sanctioned entities to include entities they control or are related to.

- Integrated platforms: Review alerts faster with profiles consolidating all alerts and customer information on a single screen.

This article is part of a series on the state of global crypto regulations in 2025. Find out more by reading the other articles in the series:

- AML regulations for US crypto firms: A 2025 guide

- AML regulations for Australian crypto firms: How to comply

- How to comply with Singapore’s AML regulations for crypto firms

- AML regulations for Canadian crypto firms: 2025 updates

- An overview of crypto AML regulations in the EU

AML compliance software for crypto firms

Scale your business securely with efficient compliance software used by innovative virtual asset businesses around the world.

Get a demoOriginally published 06 July 2018, updated 23 October 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2026 IVXS UK Limited (trading as ComplyAdvantage).