Webinar: Navigating global risks, AI, and key regulatory milestones in 2025

Unpack the results of our global survey on what compliance leaders think will shape 2025.

Watch on demandThroughout 2024, financial regulators worldwide continued to demonstrate their intent to crack down on non-compliance with anti-money laundering and countering the financing of terrorism (AML/CFT) rules. Firms that breached these regulations, including high-profile institutions with significant public profiles, were met with substantial monetary penalties. These costs and the reputational fallout that came with them reinforced the business case for prioritizing compliance.

This article explores the AML fines issued in 2024, looking at the failings that caused them and highlighting areas firms should look to address. While some sectors received higher penalties than others, the most significant fines and the number of firms and industries to have paid them demonstrate the importance of maintaining an effective AML compliance program across all regulated sectors.

Several sectors were subject to significant regulatory action last year. While AML fines are normally issued several years after regulatory breaches occur, these were the most heavily fined sectors in 2024:

Having received the second-highest AML fines in 2023, the banking sector saw a significant increase in penalties in 2024, with both large institutions and challenger or neo-banks receiving huge fines. In one high-profile case, a bank was fined billions of dollars by multiple regulators for several failings, including:

In the UK, two well-known challenger banks racked up almost $60 million in Financial Conduct Authority (FCA) fines between them: one for systemic problems with its sanctions screening solution and one for inadequate transaction monitoring processes. In two other cases, regulators mentioned a failure to carry out adequate due diligence on correspondent banking accounts as a reason for imposing large fines on institutions. Correspondent banking is often recognized as high-risk; the Financial Action Task Force (FATF), for example, recommends carrying out enhanced due diligence (EDD) on correspondent banking relationships.

In 2023, the cryptocurrency industry ranked first in our top AML enforcement actions list. Although the amount it has had to pay in fines dropped in 2024, several crypto firms still received large fines. In one case, a firm was fined tens of millions of dollars for deficiencies in its transaction monitoring system, which led to a failure to detect $9 billion in suspicious payments.

Another firm, despite having already been fined billions of dollars in 2023, received two further fines in 2024 for reasons including a failure to report transactions over regulatory thresholds. Sanctions breaches and taking on high-risk customers without conducting the necessary due diligence checks were further regulatory breaches mentioned in other crypto AML enforcement cases.

As in previous years, Australian gambling and entertainment firms suffered significant AML fines in 2024. One company was ordered to pay in the region of $70 million for allowing high-risk customers to use its casinos to obscure their source of funds (SOF) and for failing to apply risk-based controls to customers. Another casino, based in the US, was found to lack even basic AML controls and failed to file SARs and CTRs.

Meanwhile, in the UK, a well-known betting firm was fined for having ineffective know-your-customer (KYC) EDD checks relative to its AML risks, inadequate risk ratings, and failing to screen customers against sanctions lists. Other causes of AML gambling fines included:

The payments sector was missing from our 2023 fines roundup but has returned to this year’s list thanks to a large penalty for a fast-growing FinTech firm. The business was fined tens of millions of dollars for significant weaknesses in its AML compliance measures, which included a failure to properly consider how its services could be used for money laundering or terrorist financing. This serves as a reminder to carry out effective business-wide risk assessments and apply a risk-based approach to compliance.

Although the fines received by trading and brokerage firms last year tended to be lower than in other sectors, such as banking, the number of companies subject to regulatory action was enough to see the sector complete our list of 2024’s top AML fines.

More than one firm, including a subsidiary of a leading European bank, was charged with failing to file SARs on time. Others were criticized by regulators such as the Financial Industry Regulatory Authority (FINRA) for an inability to monitor and detect suspicious transactions or for a lack of written AML policies and procedures. In one case, a firm was found to have inadequate fraud prevention measures, allowing criminals to open accounts using fake or stolen identities.

Unpack the results of our global survey on what compliance leaders think will shape 2025.

Watch on demandAcross these sectors, several firms committed similar compliance failings, which led to regulatory enforcement action. Some of the most significant were:

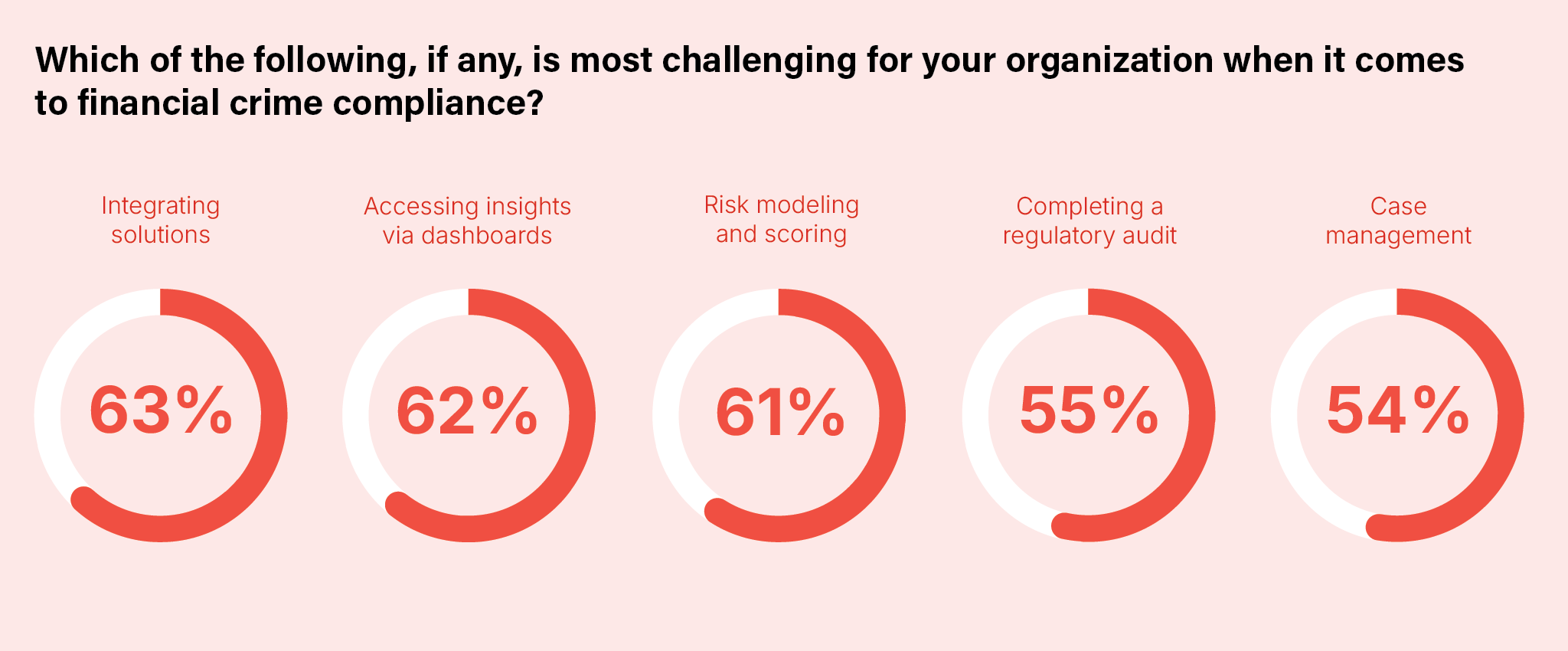

Regulatory compliance is top of mind for many firms, who realise that rather than simply being a matter of checking the right boxes, audits can be time-consuming, resource-intensive, and potentially disruptive to business operations if firms aren’t properly prepared. In our latest global survey of compliance decision-makers, 55 percent cited completing a regulatory audit as one of their most significant challenges.

A proactive approach, which includes anticipating legislative developments and understanding regulators’ expectations, is key to meeting compliance requirements efficiently. Below are some of the most important regulatory updates of 2024, and some upcoming changes you should look out for in the year ahead. The impact of recent and anticipated regulatory changes is explored in depth in our annual report, The State of Financial Crime 2025.

As the size of some of the fines firms received demonstrates, AML failings can have a profound financial impact on firms. This is often compounded by the reputational damage these fines can cause. Consumers are less likely to do business with firms known for poor financial crime detection measures, with one study suggesting that global executives attribute 63 of their company’s market value to its reputation.

To protect themselves from the immediate and long-term consequences of non-compliance, you should:

Read our annual report to explore the most important trends affecting the financial crime landscape and how firms can prepare for the year ahead.

Download nowOriginally published 04 February 2025, updated 13 February 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).