As the second-largest economy in North America, Canada is an important financial center on the global stage – and its crypto market is no exception. The country is expected to have 12.95 million cryptocurrency users by 2028, according to Moonpay, reflecting a broader global shift towards virtual assets as financial services continue to diversify.

Canada was also an early adopter of anti-money laundering and countering the financing of terrorism (AML/CFT) regulation for the virtual asset sector, first introducing crypto-specific rules in 2014. With crypto-related suspicious activity on the rise – a 2025 report by Chainalysis highlighted $46.1 billion in illicit finance received in crypto by bad actors – implementing smart AML compliance has become a priority for crypto firms.

This article explores the AML requirements for crypto providers in Canada and how you can take action to achieve strong regulatory compliance without inhibiting growth.

Crypto regulations in Canada

Canada’s AML/CFT regime centers around the Proceeds of Crime (Money Laundering) and Terrorist Financing Act 2001 (PCMLTFA) and is overseen by the Financial Transactions and Reports Analysis Centre (FINTRAC). All financial institutions (FIs), including crypto firms or any payment service provider (PSP) able to receive crypto payments, must comply with the PCMLTFA and include the following steps in their compliance programs:

- Policies and procedures: Your AML compliance program should be implemented and overseen by a specialist compliance officer, and be based on the results of regular business-wide risk assessments that identify the risks you are likely to face. You must also create written compliance policies and procedures and ensure staff are trained to implement these. Finally, you should have your compliance programs regularly audited by external or independent teams.

- Customer due diligence (CDD): You must identify and verify your clients at the onboarding stage, which includes verifying ultimate beneficial ownership (UBO) for business accounts. You must also be able to identify any customers who are politically exposed persons (PEPs) or their relatives and close associates (RCAs).

- Ongoing monitoring: After onboarding, you must monitor customer transactions to detect any suspicious behavior patterns.

- Record-keeping: You should document customer and transaction data and be able to transfer this data to FINTRAC within 30 days if requested. FINTRAC retains transaction reports for ten years, after which time it must either be disclosed or destroyed.

- Reporting: You must submit suspicious transaction reports (STRs) to FINTRAC when you have reason to believe a transaction may be linked to a money laundering or terrorist financing offense, including predicate crimes in money laundering. As of August 2024, this also includes suspicious behavior relating to sanctioned entities. They must also report any transactions at or over the value of $10,000 (whether as a single payment or accumulated transactions within 24 hours).

- The travel rule: Introduced via a 2021 amendment to the PCMLTFA, the travel rule means crypto firms (and other electronic payment providers) must include certain information with all transactions. This information includes the names, addresses, and account numbers of senders and beneficiaries. Your AML policies must address the circumstances under which you will suspend or reject a transaction if you cannot obtain this information.

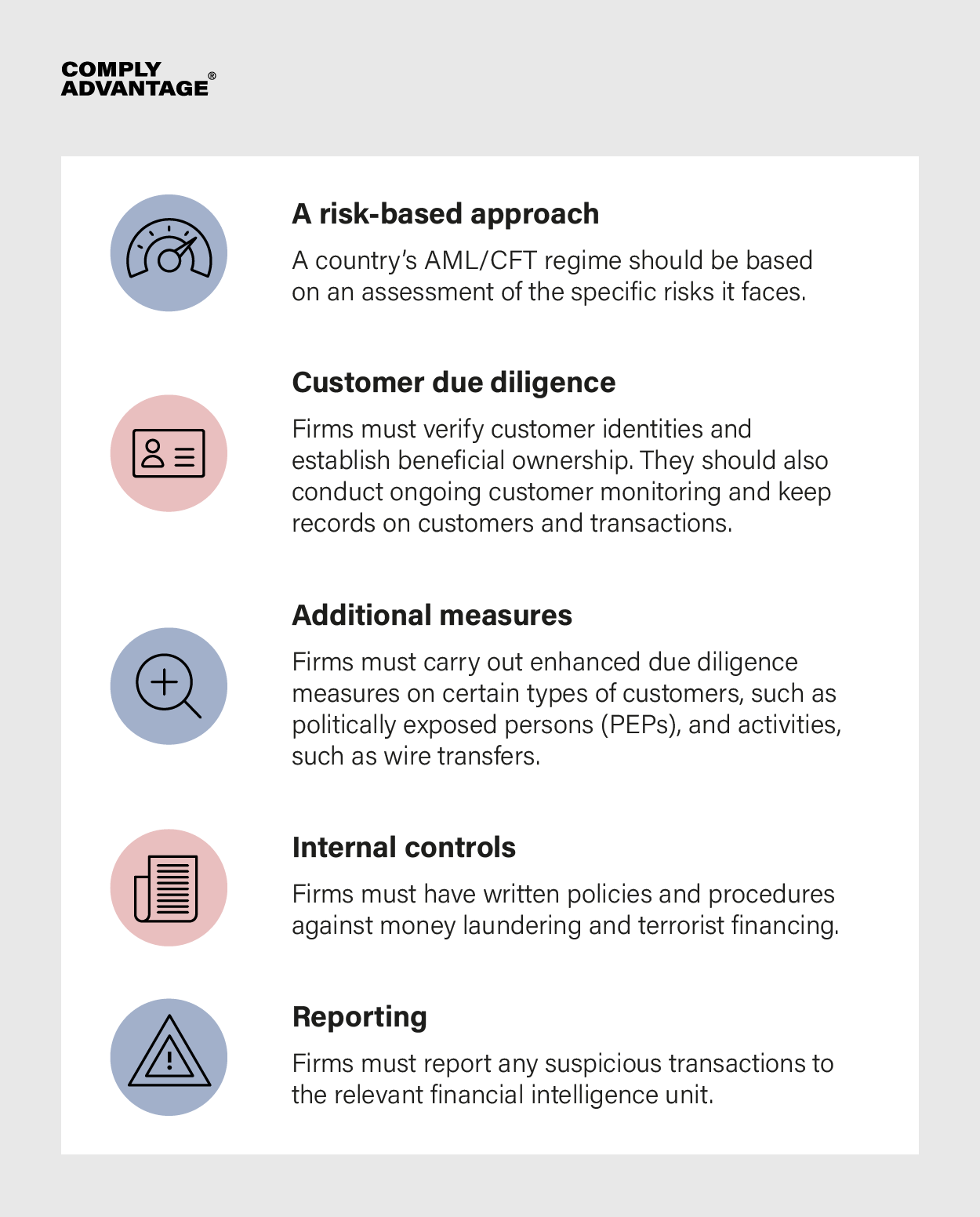

Canada’s AML regulations broadly align with the principles recommended by the Financial Action Task Force (FATF), as pictured below. Non-compliance with the PCMLTFA carries severe punitive measures for firms, such as fines between $250,000 and $2 million, or imprisonment for up to five years.

The regulatory outlook for crypto in Canada

Canada’s 2023–2026 national AML strategy recognizes the growing importance of virtual assets across financial services, particularly in cross-border payments. Noting the relative degree of anonymity virtual assets can provide and their potential to make international payments faster and easier, the report states “coordination on a global level is essential to addressing the money laundering and terrorist financing risks posed by these emerging technologies, as well as capitalizing on the opportunities they present for both AML/ATF compliance and economic growth.”

FINTRAC has also committed to continuing to assess and mitigate AML/CFT risks in the crypto sector, especially relating to decentralized finance (DeFi) and enhanced privacy cryptocurrencies.

The State of Financial Crime 2025

Uncover the compliance trends you need to know about in our report, based on a survey of 600 industry professionals and packed with expert analysis.

Download your copy

How to comply with Canada’s crypto regulations

Solutions built around artificial intelligence (AI) and machine learning (ML) can automate parts of the compliance process for you and have emerged as a crucial way to maximize your analysts’ expertise while keeping your costs down. For efficient compliance that balances regulatory and security concerns with business priorities, you could consider:

- Tailoring due diligence to customer risk levels: To reduce unnecessary delays when onboarding new customers, calibrate your customer due diligence (CDD) processes to the varying levels of risk they represent. Higher-risk customers require enhanced due diligence (EDD), such as extra identification checks or source of funds (SOF) and source of wealth (SOW) checks.

- Adopting integrated risk screening: When onboarding new customers, you should aim for a holistic insight into the risks they pose. To achieve this, make sure you have solutions in place for sanctions and watchlist screening, politically exposed person (PEP) screening, and adverse media screening – ideally on the same platform to avoid toggling between systems and datasets, and refreshed in real-time to prevent you from missing out on key changes in information.

- Automating ongoing monitoring: Continuing to check customer information manually or on a fixed schedule after onboarding reduces your visibility of risk and exposes you to financial crime threats. You should instead research solutions that use AI to continuously monitor customer information and automatically update risk scores to reflect any changes.

- Enhancing transaction monitoring with machine learning: With data ingestion and analysis capabilities far beyond what human teams are capable of, machine learning (ML)-based technology can help you monitor billions of transactions and flag hidden risks in real-time.

- Building agentic AI into your roadmap: Moving from manual to automated compliance only represents one step on the compliance maturity curve. With applications from automatically collecting risk data from multiple sources, to auto-remediating alerts according to your chosen risk thresholds, agentic AI is set to transform what efficiency and scalability look like in compliance.

Smart crypto compliance tools from ComplyAdvantage

ComplyAdvantage partners with growth-focused crypto firms around the world, allowing them to unlock growth with AI-native AML tools that meet all regulatory requirements while keeping the cost of compliance in check. Our solutions include:

- Customer Screening: We use advanced matching algorithms to ensure highly accurate alerts and reduce the false positives that create customer friction and wasted compliance resources. Our systems also refresh politically exposed person (PEP), sanctions, and adverse media data for automated customer and event risk scoring in real-time.

- Transaction Monitoring: Scalable to billions of transactions, our solution leverages a market-leading rule and scenario library, with advanced ML capabilities models to identify emerging suspicious payment typologies not yet covered by existing rules.

- Payment Screening: With a high straight-through processing (STP) rate and real-time sanctions updates, and a single consolidated view of payment alerts, our solution supports compliant and hassle-free crypto operations.

This article is part of a series on the state of global crypto regulations in 2025. Find out more by reading the other articles in the series:

AML compliance tools for growing crypto firms

Scale your business securely with efficient compliance software used by innovative virtual asset businesses around the world.

Get a demo