Several key factors are driving the growing demand for know-your-business (KYB) solutions, including the rise of digital and online transactions, which have expanded the scope and complexity of business relationships. Another critical factor is the increasing prevalence of shell companies being set up to obscure ownership structures, making it more challenging for organizations to verify the true identity and legitimacy of their business partners.

Since more FIs are dealing with a larger number of corporate customers – from startups to large-scale organizations – the need to verify their legitimacy and evaluate potential risks has become all the more essential. Globalized markets and increasingly strict regulations compound to amplify corporate customers’ need for comprehensive due diligence. By implementing the right KYB verification tool, firms can strengthen their risk management capabilities, comply with regulatory obligations, and maintain good levels of trust in the integrity of their business relationships.

What is KYB verification?

KYB verification refers to the process firms undertake to confirm the legitimacy of a company before entering into a business relationship with them. Once the business has been onboarded, ongoing KYB verification checks are performed periodically to ensure any changes in the entity’s risk profile are captured. KYB verification checks essentially help firms know who they are doing business with and can help inform the appropriate level of vendor due diligence that should be applied to the customer’s account.

Why is KYB verification important?

While know your customer (KYC) regulations have been a standard anti-money laundering (AML) obligation in the US since the passage of the US Patriot Act in 2001, the regulation did not initially require firms to scrutinize the identity of the businesses they had relationships with. In 2016, the Financial Crimes Enforcement Network (FinCEN) addressed the blindspot by establishing KYB rules in its Customer Due Diligence Requirements for Financial Institutions (the CDD Final Rule). The Final Rule made KYB verification an obligation for financial institutions entering into B2B partnerships or any other business relationship.

Being a critical component of an effective risk management framework, KYB solutions not only protect FIs and their customers, they also help protect the integrity of the financial system. Additional benefits that highlight the importance of KYB screening include:

- Mitigating the risk of onboarding illegal or illegitimate companies.

- Identifying ownership structures.

- Increasing efficiency, when using API-driven tools that utilize dynamic risk scoring.

- Creating a holistic overview of the customer.

6 steps for an effective KYB verification check

By streamlining workflows, centralizing risk data, and introducing a customer-friendly onboarding portal, our combined KYB solution with Detected reduces manual effort, accelerates onboarding, and minimizes operational costs. As a result, businesses can now benefit from dynamic risk scoring, continuous monitoring, and fewer false positives – ultimately driving revenue growth while enhancing compliance and customer experience.

With our combined solution, firms can perform an effective KYB verification check in six steps.

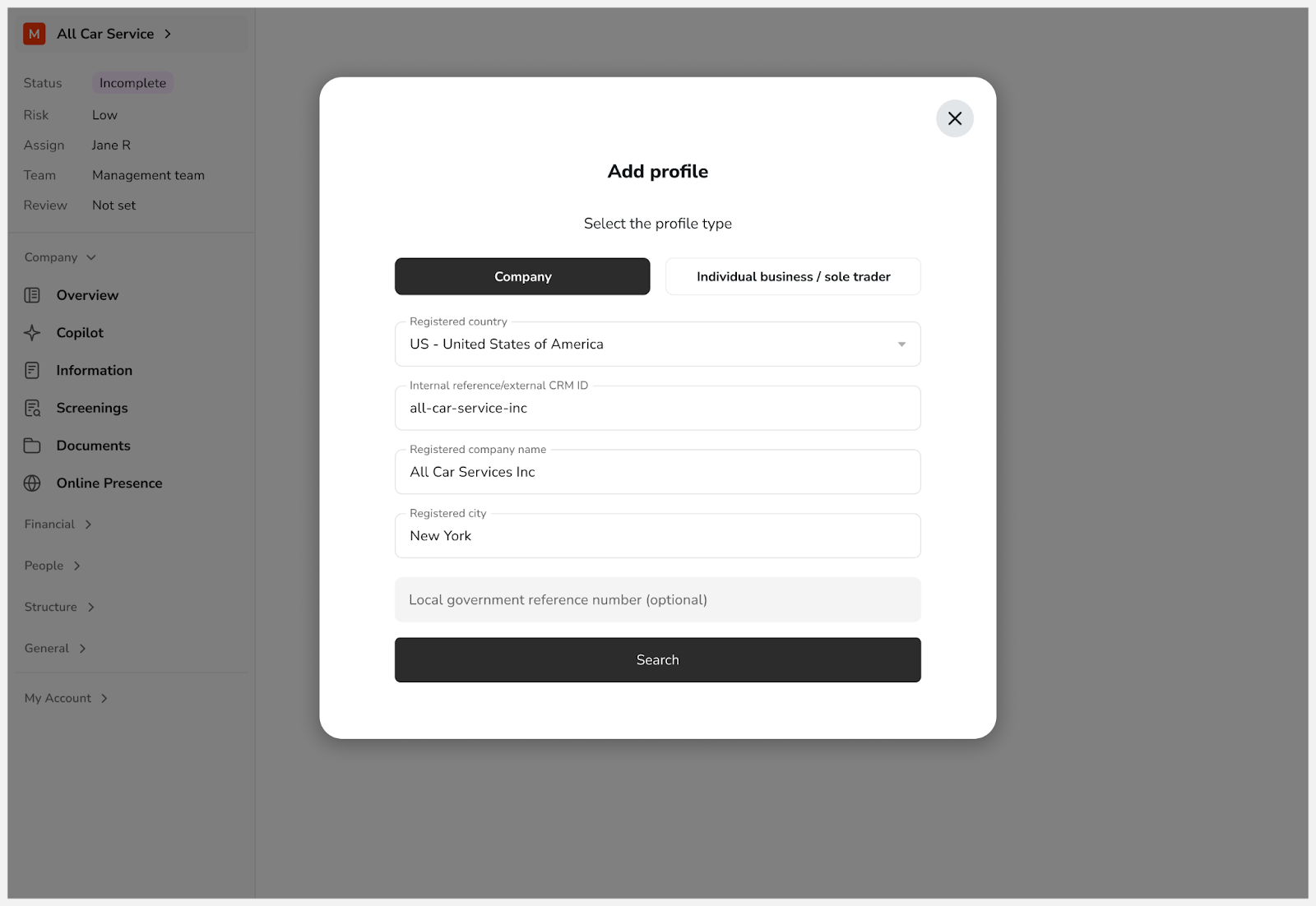

1. Create and validate a profile

Creating a customer profile is simple and efficient. Simply log in to the Compliance Operations Platform and enter minimal details, such as the company name, city, and country. Leveraging Detected’s Global Risk, Fraud & Compliance Network, the platform then validates the data using trusted sources and presents a list of potential matches. After selecting the correct entity, the customer profile is automatically saved in the platform for further action.

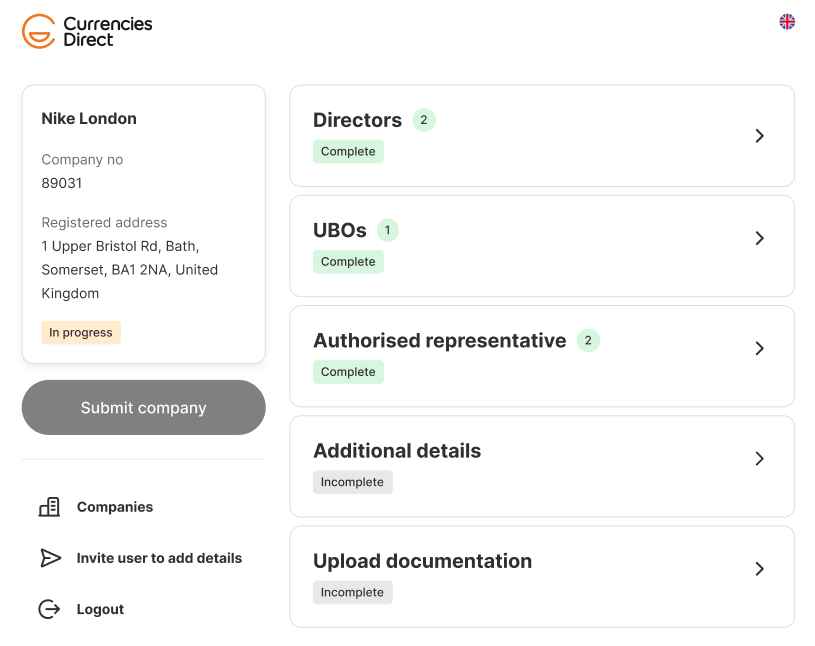

2. Collect and verify customer information

At this point, customers can log in to the white-labeled front-end user interface, complete email authentication, upload documents, complete questionnaires, declare UBOs or related entities, and much more. This flow is configurable based on location, product requirements, or any other factors that might require custom sign-up journeys. Once the requested actions are finalized, the profile is updated within the Compliance Operations Platform.

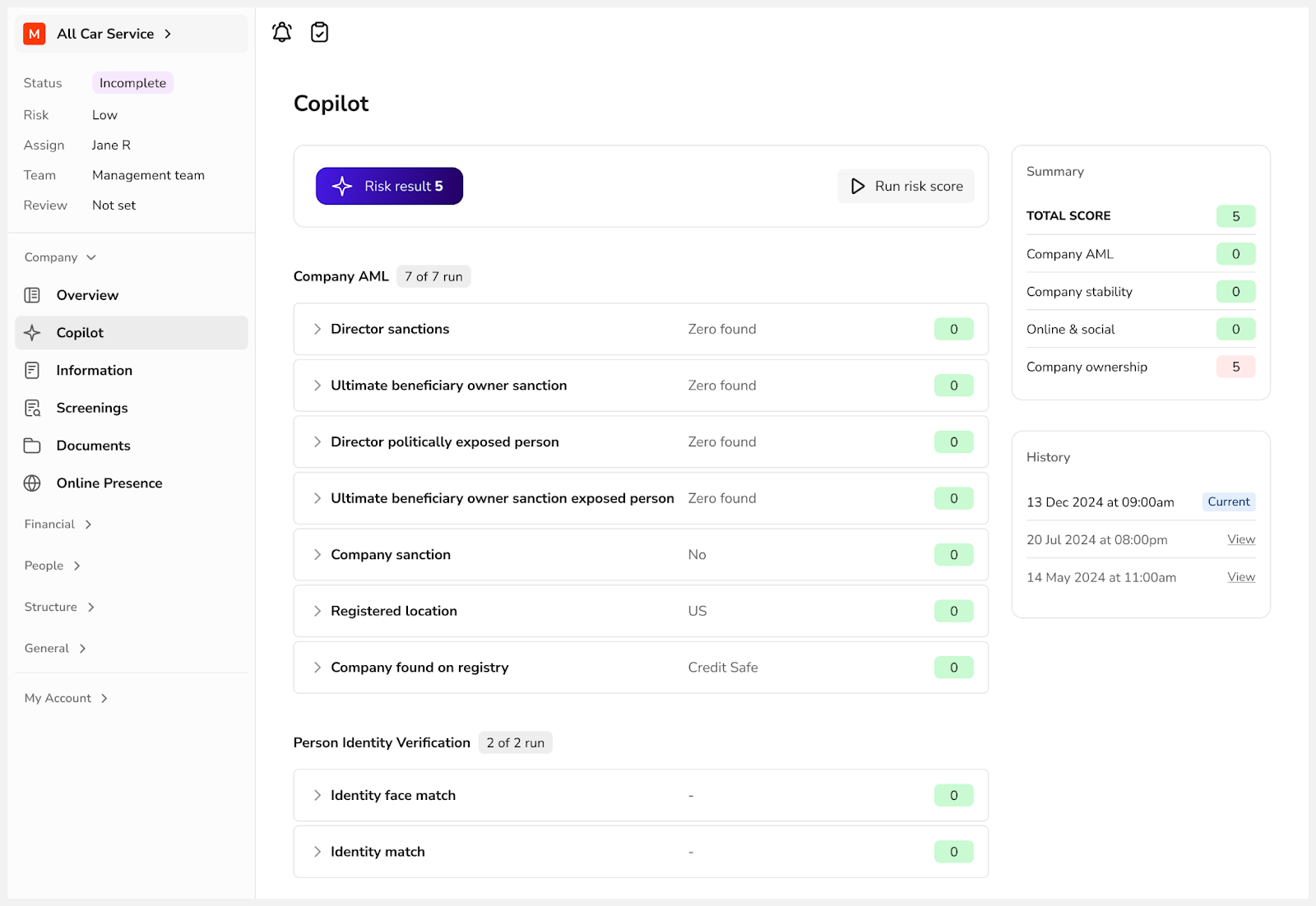

3. Assess the automated risk score

The platform then performs an automated profile analysis, generating a risk score defined by your company’s custom risk scoring framework. This score is based on key factors such as checks for politically exposed persons (PEPs), sanctions, adverse media, company age, credit ratings, and source of funds – all of which can be investigated in the left-hand view.

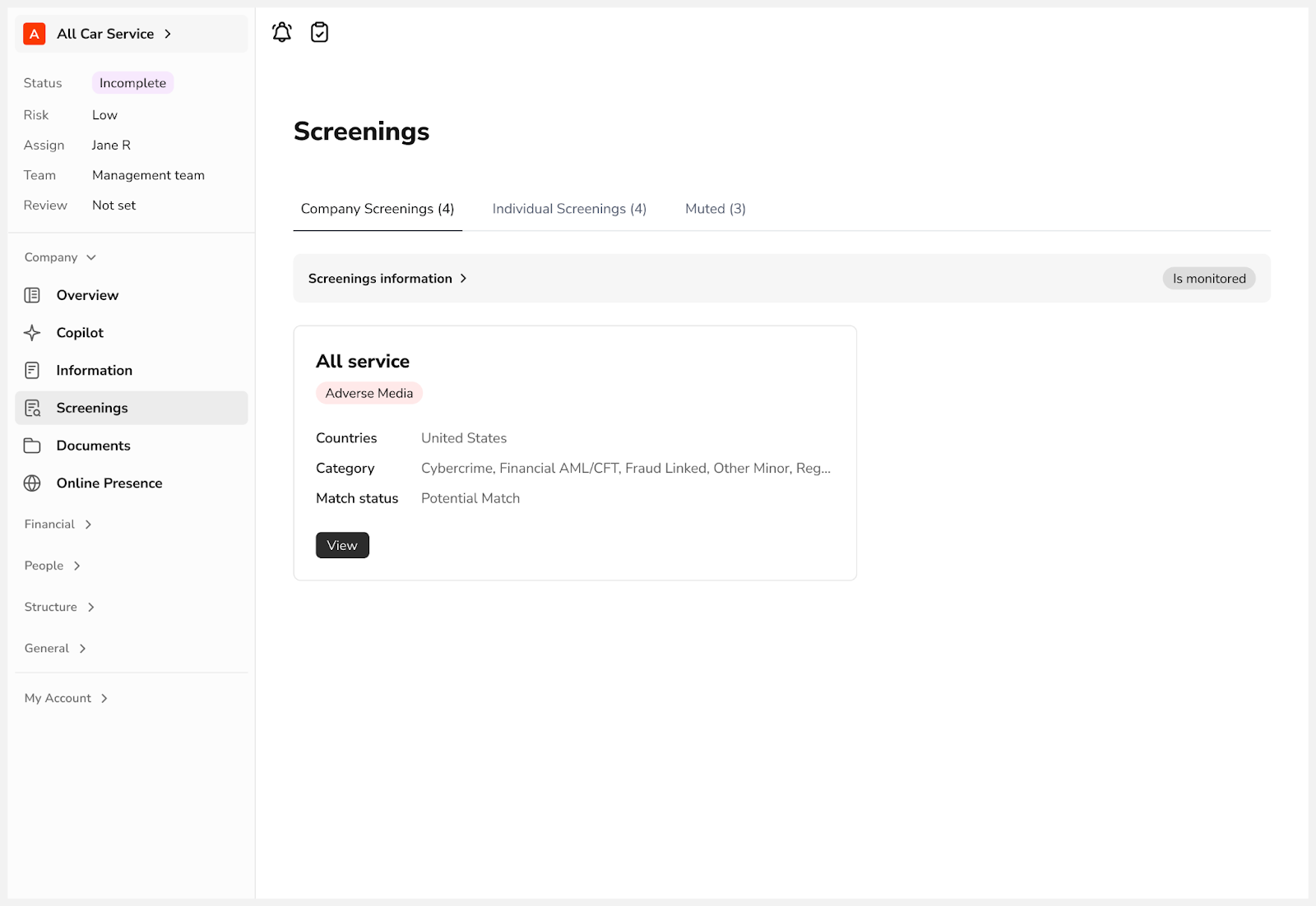

4. Conduct continuous screenings

The platform’s real-time monitoring continuously updates the risk score as new information becomes available through screenings, global sanctions, watchlists, and adverse media databases. This covers both the entity and individuals, such as Directors and ultimate beneficial owners (UBOs), associated with the business.

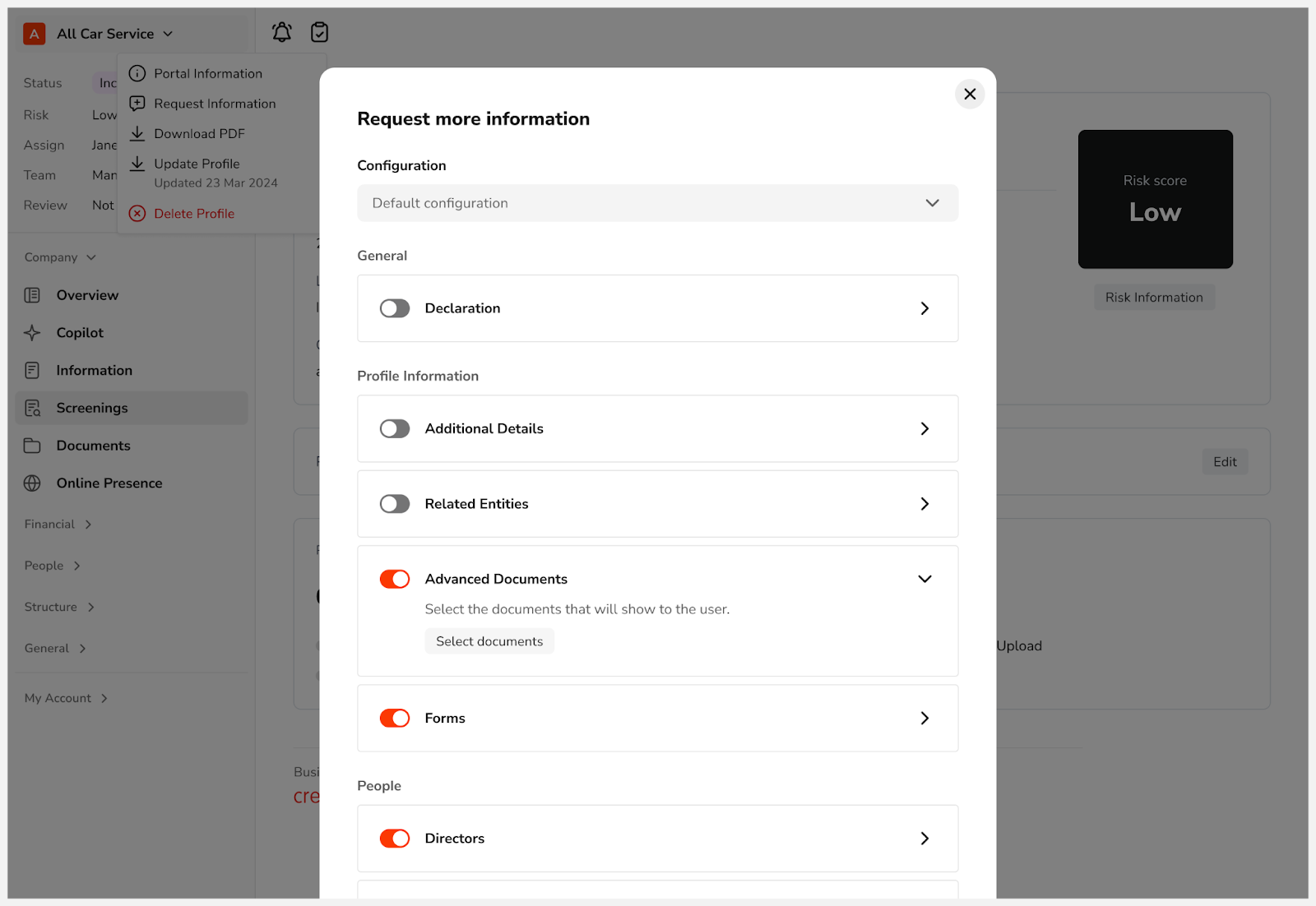

5. Request more information

If additional information is needed from the customer, your compliance team can configure tailored requests via the Compliance Operations Platform. These requests automatically prompt customers to log in and provide specific details, such as questionnaires, source of funds (SoF) documentation, or IDVs. The ‘Portal Progress’ section offers a clear overview of the onboarding status and next steps.

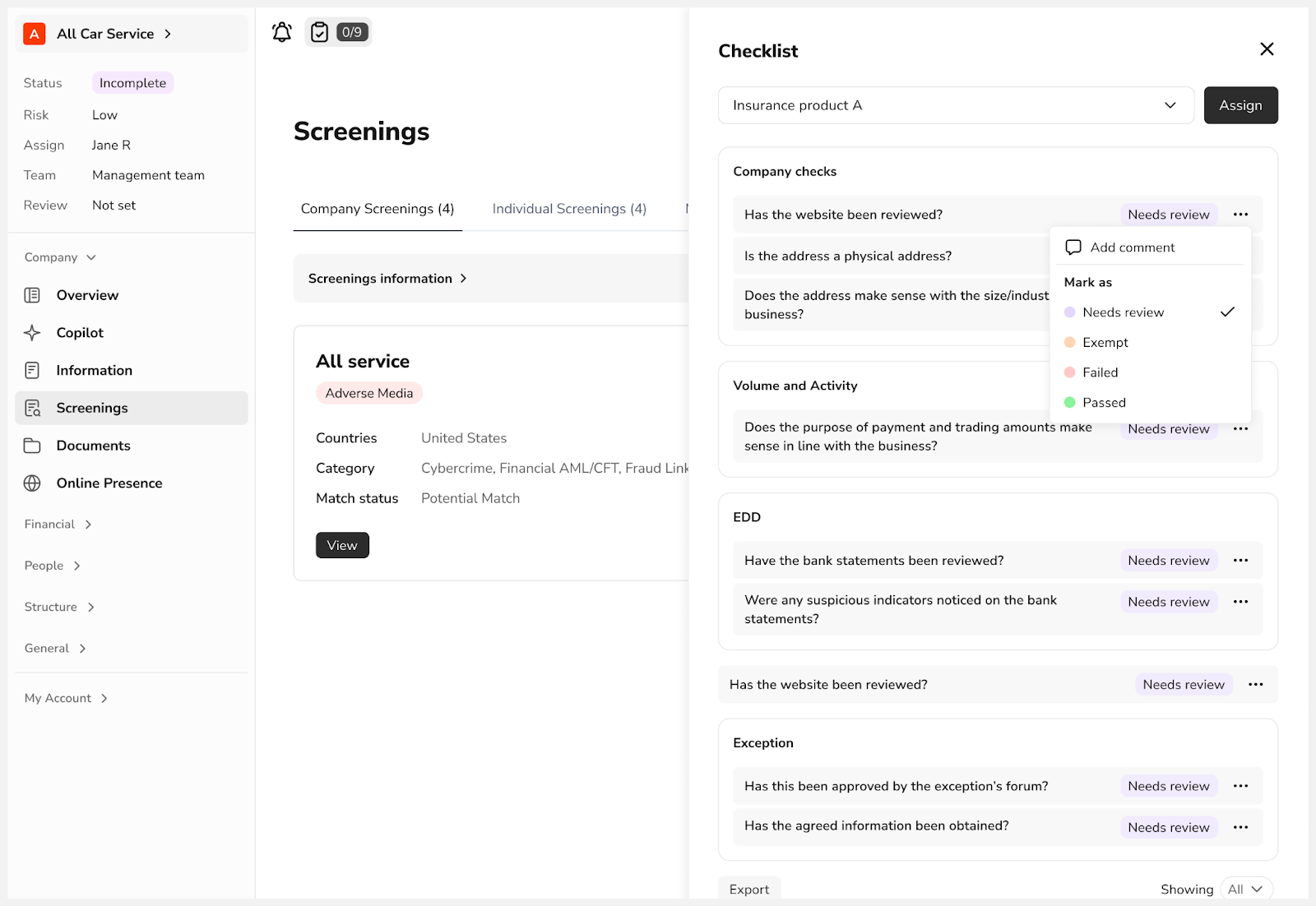

6. Implement a tailored review process

Your team can also leverage the checklist functionality, which is fully customizable to align with your internal processes and regulatory requirements. The checklist allows teams to systematically work through necessary actions, ensuring all requirements are reviewed.

Teams can assign tasks to specific users or groups, add comments, and update statuses such as Needs Review, Passed, or Failed. By tailoring the checklist to their needs, compliance teams can streamline workflows, maintain accountability, and ensure efficient progress tracking throughout the review process.

Once checklists and reviews are complete, you can decide to onboard or reject the entity based on all information gathered from data sources and supplemented by the customer.

The Importance of automated KYB verification checks

To meet the challenge of AML/KYB compliance without negatively affecting the customer experience, technological solutions need to be deployed. Practically, this means automating the collection and analysis of vast amounts of data from a range of sources while building enhanced speed and efficiency into verification measures to reduce administrative friction.

- Efficiency: Automated KYB solutions allow firms to process more KYB checks in a shorter time, helping them onboard customers faster and reducing alert remediation time.

- Accuracy: By using automated processes, firms can minimize the risk of human error and validate data with a high level of accuracy. This helps reduce the chance of data entry mistakes or oversights.

- Scalability: Manual KYB screening processes can become overwhelming and time-consuming, especially when dealing with many customer applications or during periods of high demand. Automated solutions are scalable and can handle increased columns without compromising efficiency or accuracy.

- Compliance: When partnering with a KYB vendor, firms should ensure their automated tool complies with relevant regulations and requirements. The solution should integrate with compliance databases, sanctions lists, and regulatory frameworks, ensuring businesses are consistently screening against up-to-date and relevant information.

- Risk mitigation: Automated KYB functionalities such as dynamic risk scoring are key for firms conscious of implementing a risk-based approach when making decisions about onboarding or conducting EDD.

Our expert team can bring to life how our partnership delivers a connected KYC/KYB process for your company.

Book a KYC/KYB demo today

Originally published 11 July 2023, updated 13 February 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2026 IVXS UK Limited (trading as ComplyAdvantage).