The Asia-Pacific region (APAC) plays a hugely prominent role in global trade. Home to nine out of ten of the world’s busiest ports, the region’s shipping industry is expected to generate $3.6 trillion by 2030. With this growth, however, shipping firms operating in APAC can expect increased exposure to financial crime risk alongside rising profits.

The shipping sector’s cross-border operations, complex supply chains, and high transaction volumes and values make it vulnerable to various financial crime threats, including money laundering, terrorist financing, and sanctions evasion. Given these challenges, you must ensure you have effective anti-money laundering and countering the financing of terrorism (AML/CFT) measures in place to protect themselves and ensure regulatory compliance.

Financial crime risks affecting the shipping industry

Trade-based money laundering

Criminals have become increasingly sophisticated at using the complex mechanisms of international trade to launder money. Trade-based money laundering (TBML) involves manipulating the contents of shipments and invoices to move illicit funds through the global trade system and disguise them as the proceeds of a legitimate business.

TBML works by artificially transferring or retaining value from shipments. It occurs in several ways, from forging trade documents to misclassifying commodities. Common examples include:

- Over-shipment, or sending more goods than stated in shipping documents, to transfer value to the importer.

- Under-shipment, or sending fewer goods than stated, allowing the exporter to retain the extra value.

- Over-invoicing, so the exporter receives more money than the actual value of the shipment.

- Under-invoicing, so the importer receives goods worth more than what they have paid.

- Submitting multiple invoices for the same shipment.

Because it happens across multiple jurisdictions and involves several parties, TBML can sometimes be difficult to track, making it a significant risk for shipping firms. According to the Financial Action Task Force (FATF), TBML red flags include:

- Complicated or opaque corporate structures, including the use of shell companies.

- Companies registered at addresses that are apparently used for mass registration.

- Vague descriptions of commodities on invoices and contracts.

- Prices that do not align with typical market values.

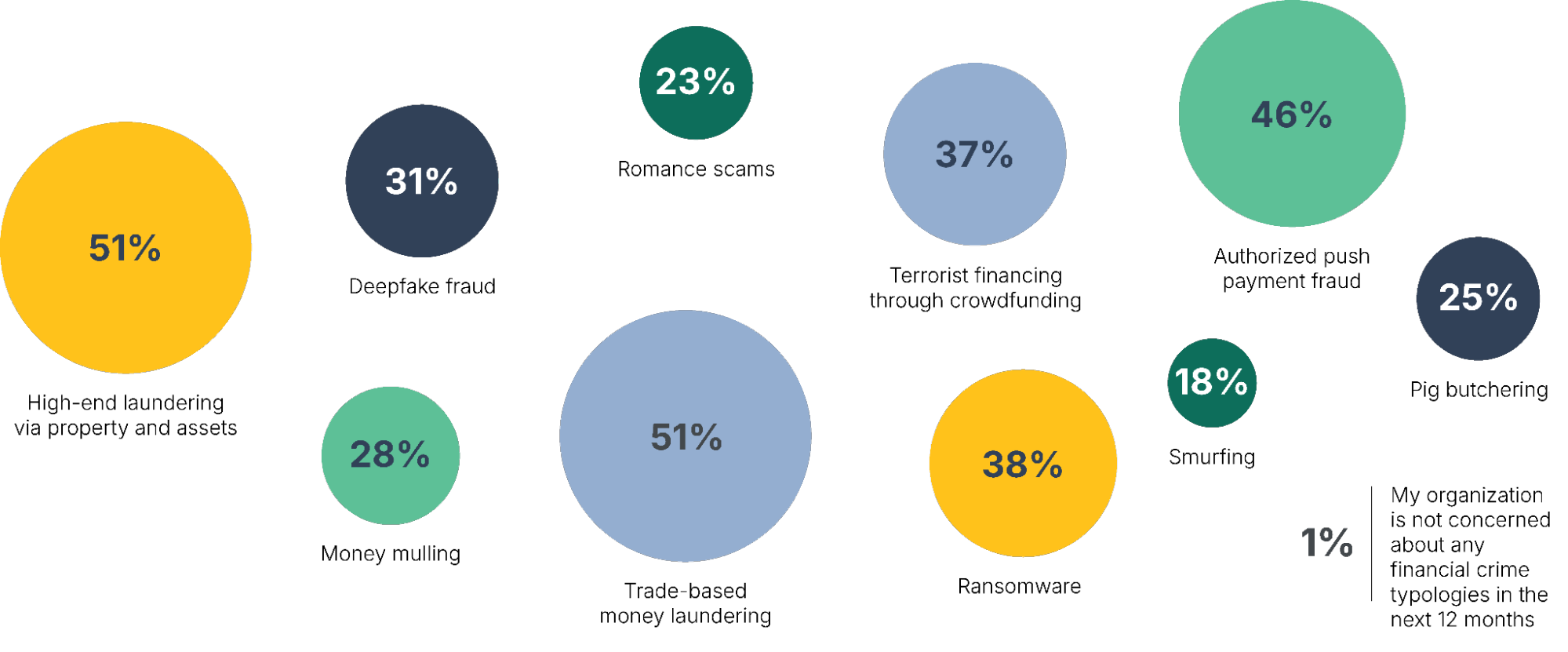

TBML poses a growing threat across the financial landscape: in our State of Financial Crime 2025 survey, 51 percent of global compliance leaders identified it as one of their top financial crime concerns.

From the list below, what financial crime typologies is your organization concerned about in the next 12 months?

Sanctions evasion

Governments impose sanctions on countries, businesses, or individuals to punish violations of international law. Because sanctions often restrict the movement of goods across international borders, if your business operates in the maritime sector, you must pay them particular attention to avoid breaches. Deliberate or accidental sanctions violations can result in severe civil and criminal penalties.

Sanctions that are particularly relevant to the shipping industry are:

- Import and export embargoes: These ban buying or selling specific goods from or to a designated entity. Arms embargoes, which prevent the trade of weapons or dual-use goods, are a common type of trade restriction.

- Transport sanctions: These restrict the movement, registration, or ownership of specific vessels, including ships and aircraft. They are often imposed on vessels or operators carrying goods on behalf of sanctioned entities. So-called ‘dark’ or ‘shadow’ fleets have become a significant issue in relation to Russian sanctions evasion, with the UK government introducing sanctions against ten ships belonging to an illicit fleet trading Russian oil in September 2024.

To avoid facilitating sanctions breaches, APAC shipping businesses should stay updated on the latest sanctions lists, including Singapore’s Targeted Financial Sanctions, Australia’s Consolidated List, and Japan’s economic sanctions list.

The complexity of the sanctions landscape poses particular problems for the shipping sector. These include:

- Evolving sanctions lists: Many jurisdictions update their sanctions lists extremely regularly, which means you should ensure their sanctions data is constantly up to date to avoid trading with sanctioned entities.

- Establishing beneficial ownership: Obtaining information on a vessel’s ultimate beneficial ownership (UBO) can be difficult. Each vessel operates under the flag of its country of registration but may be operated by a firm located elsewhere and owned by an entity in yet another jurisdiction. This can make establishing control of vessels difficult, especially when corporate structures are exploited to disguise ownership.

- Convoluted supply chains: Shipping requires vessels to move goods through various handlers and locations. This gives criminals opportunities to manipulate shipping information or exploit regulatory differences between countries. It also means you must understand who they are doing business with to avoid exposing themselves to risk.

Third-party risks

In practice, shipping companies rely on several parties to complete trades and transactions. This means they risk interacting with businesses or vessels acting on behalf of sanctioned entities or criminal groups seeking to launder money. This complicates compliance procedures by requiring them to screen a range of individuals and entities for money laundering, terrorist financing, and sanctions risks, including suppliers, traders, distribution centers, vessel captains, insurance companies, and crewing companies.

The involvement of third parties also exposes firms to the wide range of shipping fraud typologies that occur across the industry. These can include criminals posing as official personnel to collect goods, misdirecting goods while in transit, or double brokering (when a carrier collects payment for moving a shipment but subcontracts the job to a third-party carrier at a profit). In recent years, a string of cases involving shipping container scams have been reported across the industry, with fraudsters estimated to make over $2000 for every fake container sold. Shipping fraud disrupts supply chains and leaves businesses out of pocket for lost or stolen goods.

The State of Financial Crime 2025

Read our fifth annual state-of-the-industry report, built around a global survey of 600 senior compliance decision-makers.

Download your copyHow you can mitigate your financial crime risks

These risks may seem challenging for the APAC shipping sector, especially given the additional time, resources, and labor costs they imply. However, aided by appropriately trained staff and specialist compliance software, you can adapt to the changing financial crime landscape without compromising your business operations by adopting these best practices:

- Conduct due diligence on all customers and suppliers: Your firm should have strong know your customer (KYC) and know your business (KYB) processes in place. These involve gathering and verifying key identifying information about an entity, including its beneficial owner(s). As part of their due diligence obligations, you should use this information to assess the risk level of every business relationship they undertake and base your compliance procedures on these risks (as well as their risk appetite).

- Tailor compliance strategies to local regulations: The shipping sector’s cross-border nature calls for flexible compliance solutions rather than a one-size-fits-all approach. You should ensure you are up to date on your regulatory obligations and be able to apply different rulesets across your AML/CFT screening and monitoring to avoid both the dangers of non-compliance and the inefficiencies of over-compliance.

- Enhance screening with automation: When conducting due diligence, use a variety of screening tools – not only for sanctions, but also for adverse media and politically exposed person (PEP) status. Combining screening tools can create a comprehensive view of any entity’s risk; adverse media stories, for example, can sometimes alert compliance teams to risks not reflected in official sources. Screening software that leverages artificial intelligence (AI) to automatically scan for updates can reduce compliance costs and risk exposure.

- Continue to monitor business relationships: You should carry out ongoing monitoring of partners, vendors, and customers to ensure you remain alert to any changes affecting their risk levels. As with screening, this should be done continually using automated monitoring systems, rather than periodically with manual checks.

Integrated AML/CFT solutions for shipping firms

Given that shipping companies in the APAC region face various compliance risks, from sanctions compliance to shipping fraud, they should use specialized compliance software capable of carrying out essential due diligence checks.

Singapore-based firm Hafnia began using ComplyAdvantage’s screening software after searching for a solution that matched the needs of their large global operation. Since then, the software’s insights and ease of use have significantly enhanced their screening capabilities.

“We previously had trouble getting people across the shipping industry to comply and ensure transparency, especially when it came to obtaining UBO data. […] But with ComplyAdvantage, the simplicity of the search functionality has made it easy to onboard people and explain the necessity of client references and ongoing monitoring.”

Sinclair Coghill, Manager, Compliance and Executive Projects, Hafnia

ComplyAdvantage Mesh Customer Screening combines a cutting-edge risk screening solution with market-leading proprietary data so you can:

- Get updates in real-time: ComplyAdvantage’s data is sourced straight from regulators and refreshed using automated systems, so you receive updates well ahead of competitors.

- Detailed risk intelligence: Access more than just names on sanctions lists with sanctions-related data that shows entities related to or controlled by sanctioned individuals and businesses. Go beyond the minimum expected by regulators and ensure compliance with true, in-depth insights.

- Process case decisions efficiently: Customer profiles are integrated and viewable on a single screen, allowing analysts to swiftly access all the information they need to make informed decisions.

Speed up your sanctions screening

Unlock more time by automating your sanctions screening. Book a free demo with one of our experts and see our easy-to-use UI and seamless integration.

Get a demoOriginally published 27 January 2025, updated 11 February 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2026 IVXS UK Limited (trading as ComplyAdvantage).