Adverse media, sometimes called negative news, refers to information from news and other media sources that suggest an individual or entity may represent a financial crime risk.

Because of the insights adverse media can provide, screening for it forms an essential part of firms’ customer due diligence (CDD) procedures, alongside other types of screening such as sanctions screening and politically exposed person (PEP) screening.

Types of adverse media

In an ever-expanding media and information landscape, adverse media covers both traditional news sources and newer, sometimes more informal, sources. Taken together, these can include:

- Newspapers

- TV news channels

- Social media platforms

- Online forums and blogs

- Information from regulatory bodies

- Court filings

Why is adverse media screening important?

Adverse media can give firms a fuller picture of their risk exposure by linking customers to financial crimes including:

- Money laundering

- Terrorist financing

- Fraud

- Sanctions evasion

- Bribery and corruption

- Tax evasion

It can also shed light on individuals’ or entities’ involvement in other relevant crimes (including predicate offenses in money laundering), such as:

- Drug trafficking

- Organized crime

- Human trafficking

- Environmental crime

- Illegal arms trafficking

These links pose a serious threat to firms’ reputations and can lead to regulatory and legal repercussions. Firms should therefore implement effective adverse media screening as part of their anti-money laundering and countering the financing of terrorism (AML/CFT) compliance programs.

Adverse media screening requires looking at unstructured or unverified data – unlike other types of screening, which look at official data such as sanctions lists. While it may seem less formal and more subjective than other CDD processes, it can give firms information about potential customers that may not yet be reflected in official sources. This allows for a more holistic view of the risks they face and enables FIs to make fully informed decisions about how much risk they are willing to take on.

Regulatory requirements around adverse media

The importance of adverse media screening is reflected – although sometimes implicitly or inconsistently – in AML/CFT global regulations. Firms across jurisdictions are legally required to conduct some level of due diligence on customers. This involves verifying their identities, establishing the nature of their relationship with the firm, and assessing their risk level and is clearly required by key AML regulations like:

- The Bank Secrecy Act (BSA) in the US.

- The Anti-Money Laundering Directives (AMLD) in the EU.

- The Proceeds of Crime Act (POCA) in the UK.

Adverse media specifically becomes relevant when screening customers for indicators of risk. The Financial Action Task Force (FATF), in its guidance to banks on applying a risk-based approach to AML, specifies “verifiable adverse media searches” as one factor in customer risk assessments.

While the FATF’s guidance is not legally binding, as the global standard-setter for AML, its advice is generally followed by domestic regulators: the Financial Crimes Enforcement Network (FinCEN), for example, has issued similar guidance to US firms. In the EU, the Sixth Anti-Money Laundering Directive (6AMLD) requires firms to carry out enhanced due diligence (EDD) on higher-risk customers, which should include “open source or adverse media searches.” The Australian Transaction Reports and Analysis Center explicitly lists adverse media as one avenue for conducting CDD, while the Monetary Authority of Singapore advises financial institutions (FIs) that they should take “adverse news” into account when assessing risk or filing suspicious transaction reports (STRs).

However, in legal terms the specifics of how firms carry out adverse media screening is often left up to firms. They must therefore understand in depth the challenges of adverse media screening and how best to deal with these.

A Guide to the Essentials of Anti-Money Laundering

Our expert guide explains how firms of all sizes can create effective AML programs, build trust with regulators, and turn compliance into a business advantage.

Download your copyThe challenges of adverse media screening

Used properly, adverse media screening can be an invaluable tool for regulated firms, but firms must understand the challenges of implementing it – otherwise, they risk using ineffective or resource-draining screening processes. The challenges include:

- Regulatory inconsistency: As detailed above, adverse media screening is only sometimes included in AML regulations. However, firms that fail to conduct adequate due diligence on their customers open themselves up to civil and criminal enforcement actions. In 2024, major financial institutions faced record-breaking fines for failing to identify and mitigate risks associated with high-risk customers. In one case, a US bank was fined over $3 billion after failing to perform adequate due diligence at account opening, particularly concerning customers with publicly available negative information. This deficiency allowed high-risk customers, including those linked to criminal activity, to operate undetected within the bank’s systems. This case, and many others like it, underscores that adverse media screening is not a mere “optional extra” but a critical safeguard against costly enforcement actions and reputational damage.

- Establishing reliable sources: Given the proliferation of possible adverse media sources – including unverified social media posts, satirical content, or biased outlets – firms must be able to sort trustworthy from untrustworthy information. They must strike a careful balance here: relying solely on established sources, like national news outlets, is tempting, but this approach would mean missing out on additional risk alerts since not all stories will be covered by these sources.

- Noisy data: Analysts face the challenge of selecting relevant data from huge amounts of irrelevant information. An online search for someone’s name, for example, can yield thousands or millions of results. The majority of these will be irrelevant or out of date – compliance teams must be able to filter these out.

- Legacy approaches to screening: Technologies such as artificial intelligence (AI) and machine learning (ML) have transformed the results firms can expect from their screening solutions. Still, an outdated understanding of adverse media screening can hold firms back from adopting them. Manual screening processes or an overreliance on keyword searches are common signs that firms should look to upgrade their solutions.

Adverse media screening best practices

When implementing adverse media screening as part of their compliance programs, firms should ensure they have a suitably capable tool dedicated to this process rather than relying on individual searches at onboarding by compliance analysts. In particular, they should make sure their screening solution can help them:

- Screen related parties as well as customers: For true visibility into their risks, firms should screen not only their customers but also related account parties and beneficial owners. This can help prevent money laundering through shell companies or sanctions evasion through business associates.

- Move beyond keywords with machine learning: ML, particularly natural language processing (NLP), can assess the context and relevance of an adverse media mention, automatically distinguishing new information from previously encountered data. It can also assess media sources across multiple languages. This both broadens the scope of an adverse media screening solution and sharpens its accuracy, allowing firms to minimize false positives while detecting true matches.

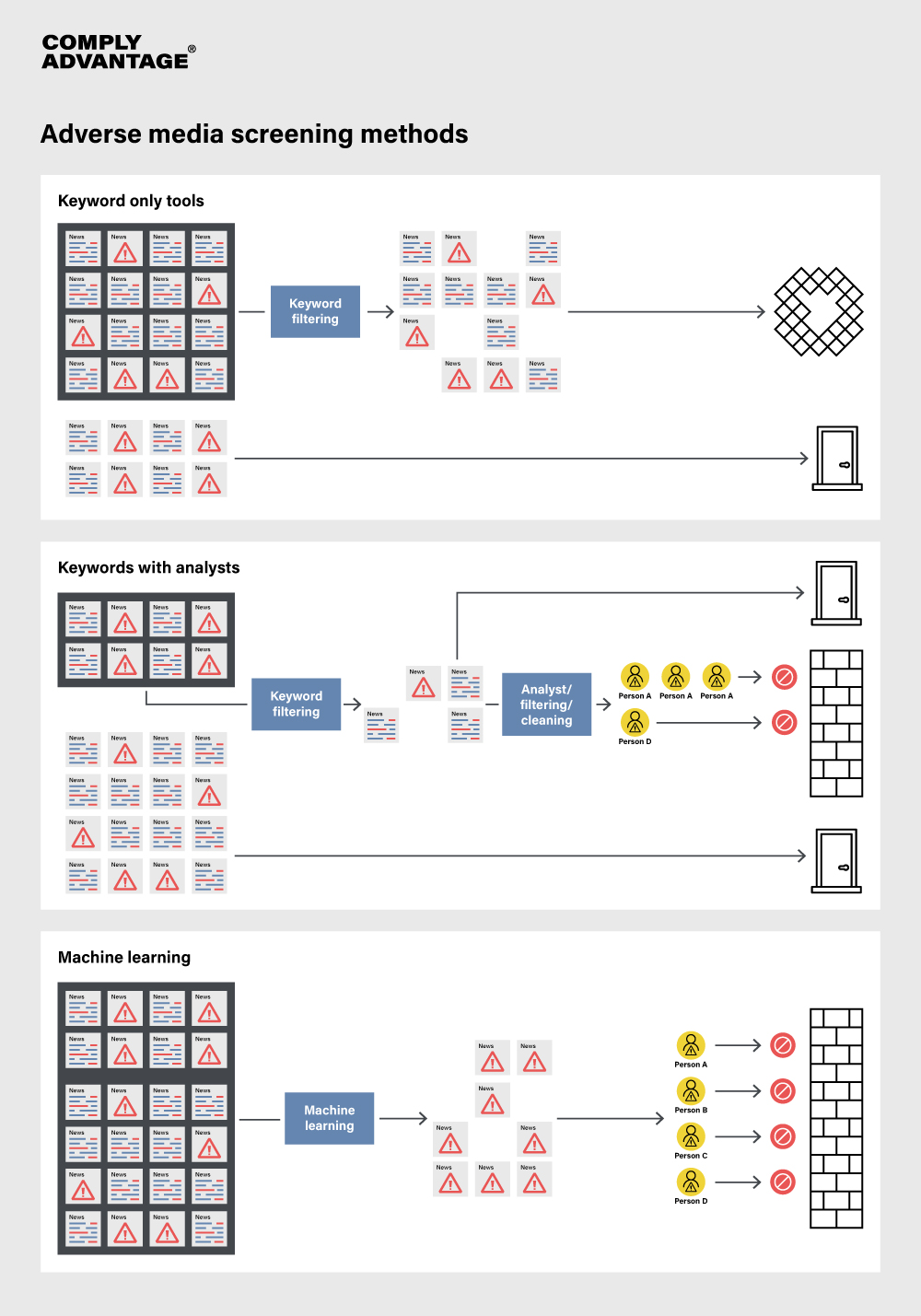

- Conduct ongoing monitoring with AI tools: User-initiated searches provide only a static snapshot of risk levels. This is not enough in a world where media coverage updates by the second. Whereas manual monitoring will inevitably result in some stories being missed, real-time adverse media tools allow firms to capture changes in a customer’s risk profile as soon as possible and address those threats effectively. AI-based solutions can help firms build an intuitive adverse media database against which entities can be screened, rather than rely on analysts filtering results imperfectly. The difference is shown in the diagram below.

Comparing adverse media screening methods

When designing and implementing an adverse media screening program, firms need to consider which approach to take. Each has a role in different kinds of institutions – the choice ultimately depends on an organization’s needs, risk appetite, and resources. However, firms seeking scalability and long-term precision often benefit most from adopting ML solutions, complemented by expert oversight for critical decision-making.

- Keyword-only tools: These rely on predefined terms to search for adverse media mentions. While straightforward and cost-effective, they are prone to high volumes of false positives, as they cannot distinguish between relevant and irrelevant contexts. For example, a generic search for “fraud” might flag articles about unrelated fraud prevention efforts, creating unnecessary noise. These tools also struggle with linguistic variations, requiring manual updates to keyword lists to stay current with emerging terminology and threats.

- Combining keyword tools with analyst expertise: This enhances relevance by adding a human layer of judgment. Analysts can refine results, filter out false positives, and interpret nuanced information, such as context or tone, that automated tools may miss. While this approach reduces inaccuracies, it is resource-intensive and relies heavily on the expertise of analysts. It also presents challenges in scalability as the volume of media and data increases.

- Machine learning (ML): This transforms adverse media screening by automating the identification and contextual analysis of risks. ML systems adapt over time, recognizing patterns and reducing reliance on static keyword lists. They excel in managing large datasets, analyzing unstructured text, and discerning subtle linguistic cues, such as sarcasm or irony, that might indicate adverse information. While ML offers unparalleled scalability and accuracy, it tends to require significant initial investment.

Advanced adverse media screening solutions

ComplyAdvantage assists regulated firms with market-leading adverse media screening, adding 5x more profiles than competitors each month. With a bespoke, collaborative integration process, ComplyAdvantage gives FIs like Allianz Benelux an efficient way of understanding customer risks with adverse media.

“We were looking for an efficient tool to perform adverse media checks. It had to be easy to use, with efficient support, and the price was also important. In-house, we consider the support we receive from ComplyAdvantage to be the best we have ever received. If you’re looking for an adverse media solution, it would be a mistake not to explore ComplyAdvantage’s proposed solution.”

Yves Declercq, AMLCO Compliance Officer, Allianz Benelux

ComplyAdvantage’s adverse media screening solution helps firms to:

- Achieve a dynamic customer onboarding experience with swift and name-narrowing screening, meeting regulatory requirements around CDD while providing a best-in-class customer experience.

- Reduce false positives through precise alerts driven by next-generation ML models.

- Enhance productivity with screening workflows driven by actionable insights that minimize time spent on redundant or repetitive tasks.

Upgrade your AML compliance tools

1000s of organizations like yours are already using ComplyAdvantage. Learn how to streamline compliance and mitigate risk with industry-leading solutions.

Get a demoOriginally published 09 December 2017, updated 14 February 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).