The State of Financial Crime 2025

Uncover the compliance trends you need to know about in our report, based on a survey of 600 industry professionals and packed with expert analysis.

Download your copyCryptocurrencies and virtual assets (VAs) remain high on the global financial agenda in 2025, and the UK is no exception.

Crypto’s decentralized nature allows for fast and low-cost transactions, including across borders. While this clearly appeals to consumers, crypto’s speed and anonymity also make it an attractive option for money launderers. Therefore, like many other jurisdictions, the UK requires virtual asset service providers (VASPs) to comply with anti-money laundering and countering the financing of terrorism (AML/CFT) regulations.

In one survey, 27 percent of UK respondents said they would be more likely to invest in crypto if the sector was more heavily regulated. As crypto increases in popularity, AML/CFT measures remain crucial not just for protecting the sector against financial crime and regulatory enforcement but also for ensuring firms retain the consumer trust they need to grow.

This article explains UK crypto firms’ regulatory requirements, the likely avenues future regulation will explore, and how you can optimize and future-proof your compliance setup.

Whether your organization is a specialist crypto firm or another financial institution (FI) with virtual asset capabilities, you are subject to the same regulatory framework as other FIs in the UK. The regulations you must comply with are:

Non-compliance with the UK’s AML legislation can be costly for firms: several crypto companies were subject to expensive, high-profile enforcement actions in 2024. In addition to the financial consequences, compliance failures can cause reputational damage, with a loss of consumer trust limiting how much firms can grow.

In November 2024, the FCA published its crypto roadmap, setting out a program of policy areas where the regulator will seek crypto firms’ feedback. While crypto firms are already regulated, this agenda is designed to develop a comprehensive, sector-specific set of regulations, reflecting the long-term trend towards widespread crypto adoption by consumers and FIs. The roadmap therefore includes, but is not limited to, AML/CFT priorities and covers:

The FCA will gradually roll out policies and consultations in these areas by 2026 when it will publish its final rules. From an AML perspective, you should pay particular attention to the conduct and firm standards, due to be published in Q3 2025. The FCA’s Head of Department, Payments and Digital Assets has cited “shockingly bad examples in firms where they have not had money laundering practices or systems,” including the “basics” of AML/CFT, as one motivating factor behind these updates. This could indicate significant revisions to your regulatory requirements, so you should prepare your compliance setup to withstand enhanced future scrutiny.

Uncover the compliance trends you need to know about in our report, based on a survey of 600 industry professionals and packed with expert analysis.

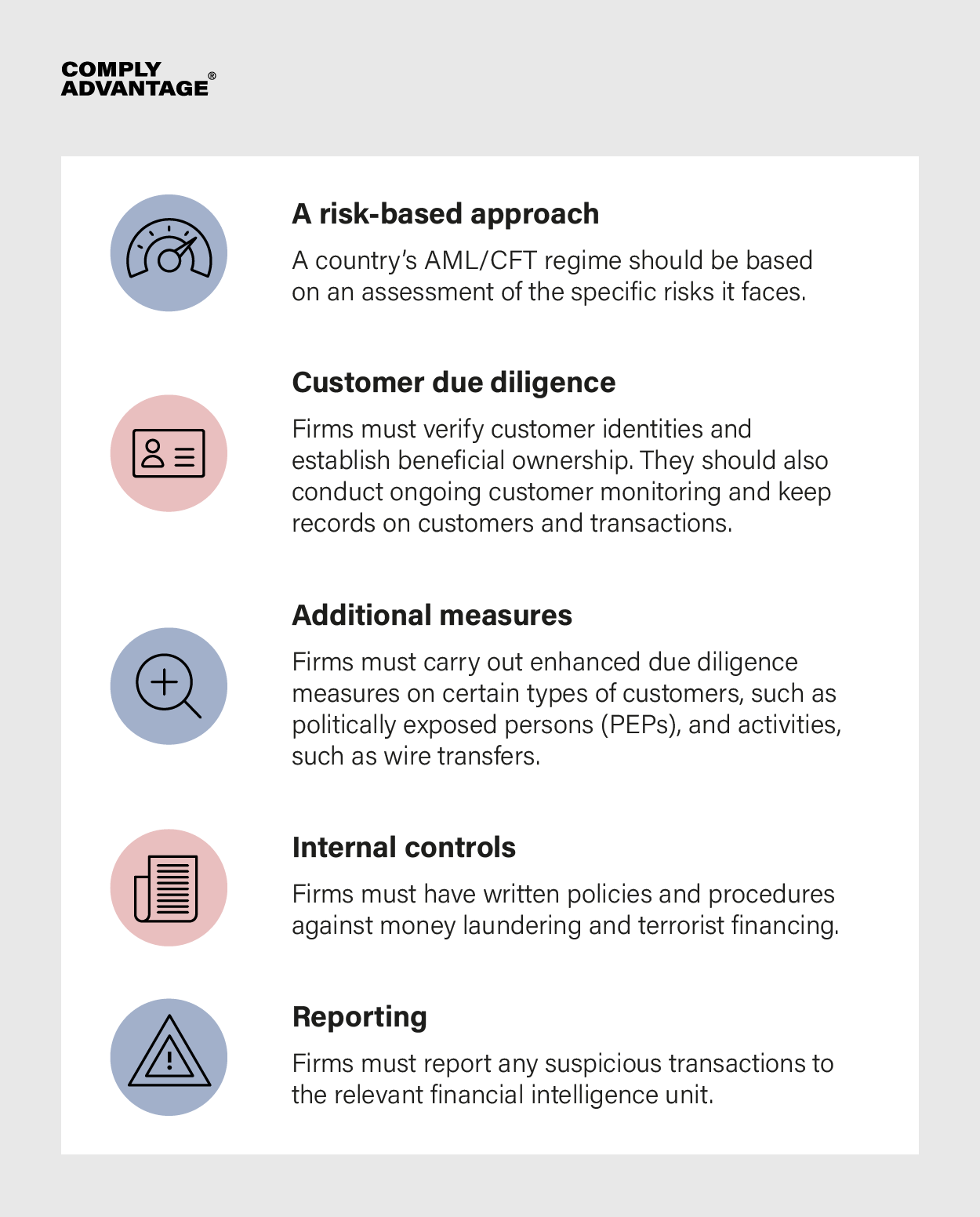

Download your copyExisting AML/CFT regulations in the UK place clear requirements on FIs, while the FCA’s crypto roadmap suggests regulatory oversight of the crypto sector will only increase going forward. In the event of stricter rules being implemented, following these principles will ensure you are well-placed to meet enhanced regulatory standards:

ComplyAdvantage helps global crypto firms identify and mitigate risks efficiently with proprietary data and industry-leading screening and monitoring solutions. We enable our customers to build trust with regulators and protect their reputation with consumers with features such as:

This article is part of a series on the state of global crypto regulations in 2025. Find out more by reading the other articles in the series:

Scale your business securely with efficient compliance software used by innovative virtual asset businesses around the world.

Get a demoOriginally published 06 July 2018, updated 30 June 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).