Environmental crime (sometimes known as ‘green crime’) involves exploiting natural resources and wildlife, with various associated criminal activities that include violence, theft, and trafficking. The Financial Action Task Force (FATF) estimates that environmental crime profits reach up to $281 billion every year; since this money is generated illegally, criminals use various money laundering strategies to transfer it through the legitimate financial system.

Given the growing threat environmental crime represents, firms must understand its connection to money laundering in the sectors and countries they serve, and ensure their anti-money laundering and countering the financing of terrorism (AML/CFT) programs are equipped to mitigate the risks they face.

What is environmental crime?

Environmental crime is any illegal activity that damages the environment, including the climate, forests, oceans, and wildlife. It is especially prevalent in countries where animals and natural resources are relatively plentiful and more easily exploited. Specific examples of environmental crime include:

- Deforestation.

- Illegal wildlife trafficking.

- Production of hazardous waste or ozone-depleting substances.

- Pollution of the atmosphere, oceans, rivers, or earth.

- Destruction of and trade in protected flora and fauna.

- Illegal, unreported, and unregulated fishing.

- Illegal logging.

The consequences of environmental crime are severe, both for the ecosystems and species it affects directly and for the communities and individuals it affects indirectly. For example, illicit loggers and developers guilty of deforestation destroy animal species’ habitats, displace indigenous residents, and exacerbate the effects of climate change. At the same time, the illegal ivory trade has been linked to terrorist violence.

How is money from environmental crime laundered?

Among the many common typologies of money laundering, certain methods are especially attractive to those seeking to process the profits of environmental crime. These include:

- Trade-based laundering (TBML): Criminals manipulate invoices and trade documents to overstate or understate the nature or value of goods. Illegal goods, such as protected plants and animals or hazardous waste, can be mixed with or disguised as legal ones, and the value of legal goods can be overstated to launder the profits of illegal environmental trade.

- Front companies: Illegally obtained funds can be invested in legitimate businesses as ‘front’ companies, often involved in environmental sectors such as renewable energy or waste management. By mixing illicit funds with legitimate transactions, especially in closely related industries, criminals can mask the origin of their money.

- Shell companies and offshore accounts: Criminals establish shell companies that appear to be legitimate businesses in sectors like forestry, mining, or waste management. These companies are often registered in offshore jurisdictions with lax regulations. They may use these entities to receive and transfer funds while obscuring true ownership and control of assets, making it difficult to trace the money back to its illegal source.

- Offsetting and carbon credit fraud: Criminals may engage in fraudulent offsetting schemes or carbon credit fraud. They create fake projects or overstate the environmental benefits of projects to generate carbon credits, which can be sold for profit and used to launder money.

1000s of organizations like yours are already in the know with ComplyAdvantage’s State of Financial Crime 2024 report. Download your copy now for industry-leading data and expert insights.

The financial crime trends you need to know about

Red flags for environmental crime money laundering

Firms should be familiar with events and behavior patterns that may indicate their customers’ involvement in environmental crime-related money laundering. Common money laundering red flags include unusually complex corporate structures, shell companies with obscure beneficial ownership, or unusual transaction patterns that seem inconsistent with a customer’s profile. When environmental crime is involved, these often present themselves in the following specific ways:

- Frequent transactions to offshore financial centers by customers operating in extractive industries such as logging or mining.

- Unexplained increases in financial activity in rural or isolated areas with ties to extractive industries.

- Unexplained changes to the revenue or cash flow of businesses operating in natural resource supply chains.

- Payments from companies in the extractive sector to entities seemingly unrelated to their business.

- Transactions between businesses selling or leasing equipment for mining or logging and customers not registered in those sectors.

- Customers licensed to work in the mining sector operating in or near conflict zones.

Environmental crime and AML regulations

The FATF’s most recent report on environmental crime and money laundering, published in 2021, acknowledges that many countries do not consider the specific risks of environmental crime when developing their AML frameworks and urges all member jurisdictions, even those without significant natural resource industries, to do so. Some governments or intergovernmental bodies have introduced legislation to address the links between environmental and financial crime.

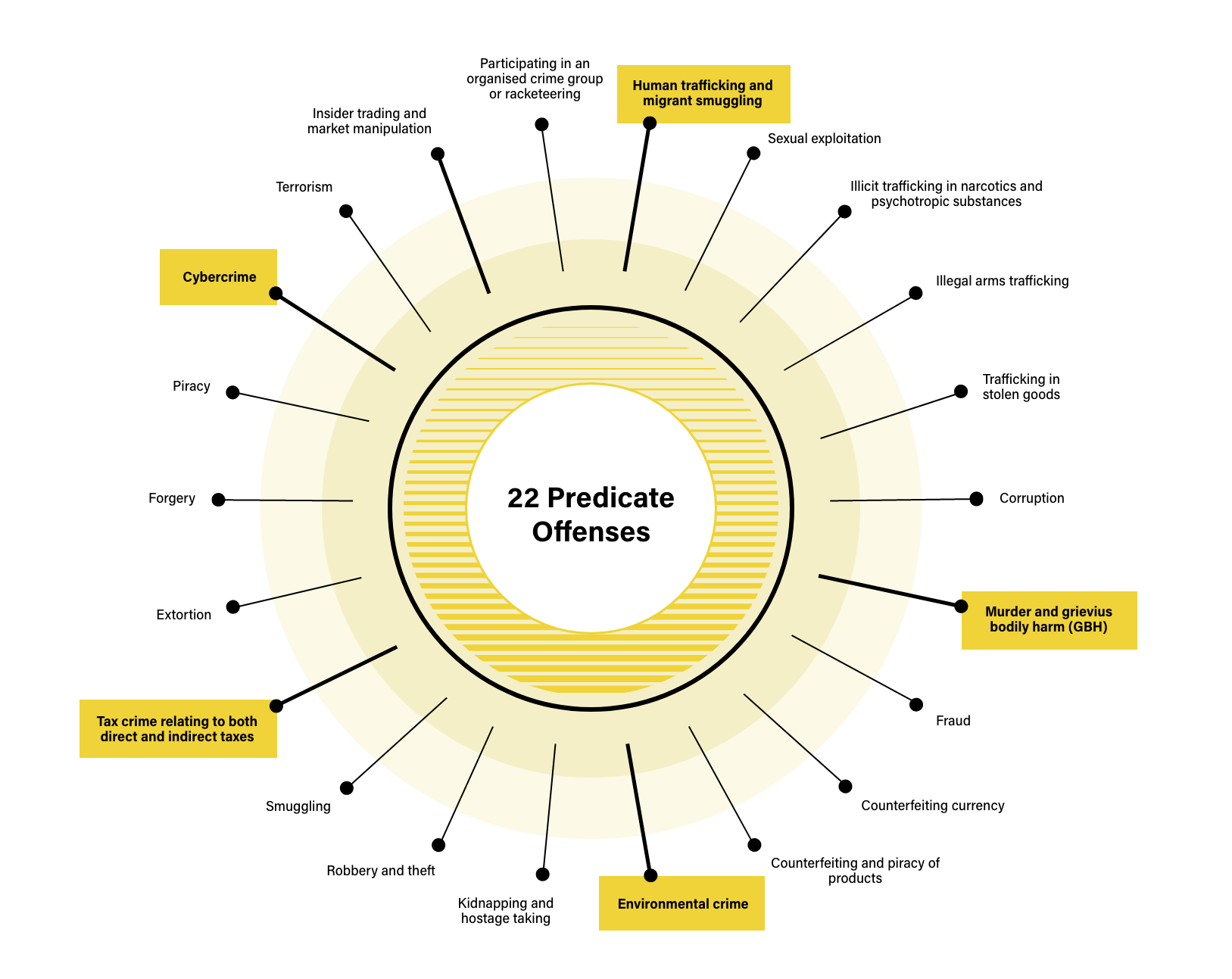

The EU’s ‘new’ Sixth Anti-Money Laundering Directive, or 6AMLD, lists 22 predicate offenses in money laundering – crimes that act as components in the more complex crime of money laundering, generating the funds that criminals then try to introduce into the legitimate financial system. 6AMLD also contains a list of environmental criminal offenses, which include:

- Destroying or trading protected flora and fauna.

- Illegal, unreported, and unregulated fishing.

- Illegal logging, which also involves the destruction of protected habitats.

- Releasing or transporting dangerous substances or pollutants, including radioactive, electronic, and hazardous waste.

- Producing of ozone-depleting substances.

- Ship-source pollution.

- Trading in or exploiting natural resources in the extractive industries, particularly in conflict zones and/or without appropriate permits or licenses.

In the United States, the Eliminate, Neutralize, and Disrupt (END) Wildlife Trafficking Act also categorizes wildlife trafficking as a money laundering predicate offense. In 2024, the Financial Crimes Enforcement Network (FinCEN) issued a reminder to financial institutions to remain alert to environmental crime risks.

To sidestep regulatory difficulties stemming from jurisdictional inconsistencies, the UK’s Proceeds of Crime Act (POCA) specifically covers conduct committed overseas by UK entities that would be punishable by more than 12 months imprisonment if committed in the UK. In 2024, the UK’s Environment Agency launched a new Economic Crime Unit to investigate money laundering cases in the waste management sector.

How to detect and prevent money laundering from environmental crime

To stay compliant with these regulations and enhance their ability to detect and prevent money laundering from environmental crime, firms should ensure their AML/CFT programs include specific measures and controls. These should always include:

- Risk assessments: Firms should undertake regular business-wide risk assessments to determine where they are most likely to encounter environmental crime money laundering risks – based on the locations they operate in, the clients they serve, and the products and services they offer. This should inform how they allocate compliance resources going forward (otherwise known as a risk-based approach). Location is a particularly relevant factor in assessing environmental crime risk levels since the distribution of natural resources across the globe, plus minimal or poorly enforced regulations in some areas, make certain countries high-risk.

- Customer due diligence (CDD): The FATF has highlighted the involvement of politically exposed persons (PEPs) in corporate structures linked to environmental crime and the fact that environmental crime is often linked to corruption. As part of their CDD processes, firms should use AML software with PEP screening capabilities alongside adverse media, sanctions, and enforcement data screening so they are aware of any red flags relating to their customers.

- Transaction monitoring: Firms should be aware of the finance flows associated with environmental crime, as highlighted among the red flags above, and update their transaction monitoring systems with new rules to identify these effectively. When firms suspect suspicious transaction patterns, they should report these to the relevant authorities using suspicious activity reports (SARs).

Protect your business from environmental crime

Learn how our solutions can help your business comply with AML environmental crime regulations.

Get a demoOriginally published 11 August 2020, updated 22 January 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2026 IVXS UK Limited (trading as ComplyAdvantage).