With Donald Trump back in the White House and conflicts ongoing in Eastern Europe and the Middle East, financial institutions (FIs) can expect another consequential year for international sanctions, as explored in our State of Financial Crime 2025 report.

This article explores the trends you need to know about, including likely sanctions targets and areas where jurisdictions will work together. It also outlines how to minimize your firm’s sanctions risk exposure in 2025.

Key sanctions developments in 2025

1. US to ramp up pressure on China

2024 was a year of controlled tension between China and the West. The US, and allies like the EU and the UK, issued several sanctions and export controls on China, mostly in response to its development of advanced technology and its support for Russia and Iran. However, these were applied only gradually, and the US chose not to target Chinese banks facilitating Russian sanctions evasion.

In response, China played a “double game” by issuing export controls on dual-use goods with military applications. While these limited the supply of technology to the West, they also restricted exports to Russia, which could be read as a sign that China was willing to assuage US concerns over its relationship with Russia.

All this will likely change as Trump tries to correct what he sees as economic imbalances resulting from China’s trade practices. While he will turn to tariffs initially, precedent suggests a wave of sanctions will follow. The US will also take a harder line on Chinese financial support for Russia’s military efforts in Ukraine – partly to force Russia into an agreement but also to drive a wedge between the two countries.

Governments across the EU, UK, Canada, and other jurisdictions will follow the US’s lead; expect more designations of Chinese firms and secondary sanctions against smaller Chinese banks. In contrast, anticipated Chinese counter-measures to this firmer position will cause conflicts of interest in firms with both Eastern and Western interests.

2. Russia sanctions continue to create challenges

With no end to the war in Ukraine in sight, sanctions regimes against Russia will continue. So far, these have aimed to reduce Russian access to the international financial system, limit the supply of goods used in arms production, oil shipping, and logistics, and freeze the assets of Russian individuals.

However, they have encountered problems in their implementation, including loopholes that allowed targets to find workarounds, ineffective enforcement, and “shadow” markets for commodities like Russian oil. In 2025, making sanctions work better will be just as much of a priority as designating new entities.

Sanctions will continue, with new rounds to come from the EU, UK, and the US: President Trump has already threatened to increase sanctions on Russia if a peace deal is not reached. Having seen their enforcement criticized, governments and regulators will try to change the narrative in 2025. One of their priorities will be to reduce loopholes for evasion, including secondary sanctions on third countries and enforcement actions against individuals facilitating sanctions evasion.

Meanwhile, for as long as the war continues, Russia will continue to seek ways to evade sanctions using third countries and FinTech. If you work in the payment services or crypto-asset service sectors, you should pay special attention to the risks you face.

Webinar: Navigating global risks, AI, and key regulatory milestones in 2025

Join our expert panel as they unpack the results of our State of Financial Crime 2025 report.

Watch on demand3. Middle Eastern sanctions in flux

A host of US sanctions on Iran target its funding of groups such as Hamas and Hezbollah. Most of these funds derive from Iran’s “shadow” economy, where the profits of illicit oil sales are used to purchase sanctioned goods. 2024 saw Western attempts to tighten sanctions against Iran’s shadow trade and its ongoing efforts to procure commodities like advanced technology on the international market.

Further US sanctions on Iran and its proxy groups can be expected in 2025l. Whereas the US has also previously taken action against Israeli extremist settler groups, these measures have been rescinded since Trump’s return to office.

As of January 2025, ceasefires have been agreed between Israel and both Hamas and Hezbollah. The prospect of these turning into a more permanent peace, however, seems remote. Further conflict – a likely possibility with the new US administration willing to take a light-touch approach with Israel’s government – would lead to greater sanctions against Iran and its proxies by the US’s allies, regardless of its origins.

Since international payments are the lifeblood of the Iranian shadow economy, payment service providers (PSPs) should pay particular attention to sanctions updates. If you work for a PSP (whether fiat- or cryptocurrency-based) with exposure to trading intermediaries, logistics firms, small FIs, or charities in Middle Eastern or East Asian markets, you should review your risks.

4. North Korean loopholes to close

Relations between the West and North Korea remain difficult, thanks to the latter’s military support for Russia. An investigation by The Financial Times and the Royal United Services Institute, for example, suggested Russia was paying for munitions by supplying North Korea with oil over UNSC sanctions limits. 2024 designations responded to North Korea’s weapons proliferation program and illicit funding networks, including cryptocurrency thefts reportedly carried out by hackers working abroad as IT specialists. In 2025, we will likely see more of the same.

However, current sanctions regimes against North Korea are already extensive, and there are few remaining financial levers to pull. Further designations will probably target the Russian end of the arms-for-oil trade and the involvement of third-country entities: the next step for Western countries is to target clandestine North Korean networks in China, dovetailing with the new US administration’s hardline stance towards Beijing.

While dramatic changes are unlikely, countries with less extensive sanctions regimes will fill the gaps with designations matching longstanding US measures. Any new US designations will focus on firms and intermediaries used for evasion in China, Hong Kong, the UAE, and Southeast Asia.

How to ensure sanctions compliance in 2025

Faced with multiple developments across a fast-changing global sanctions landscape, advanced, reliable sanctions screening solutions remain paramount for FIs.

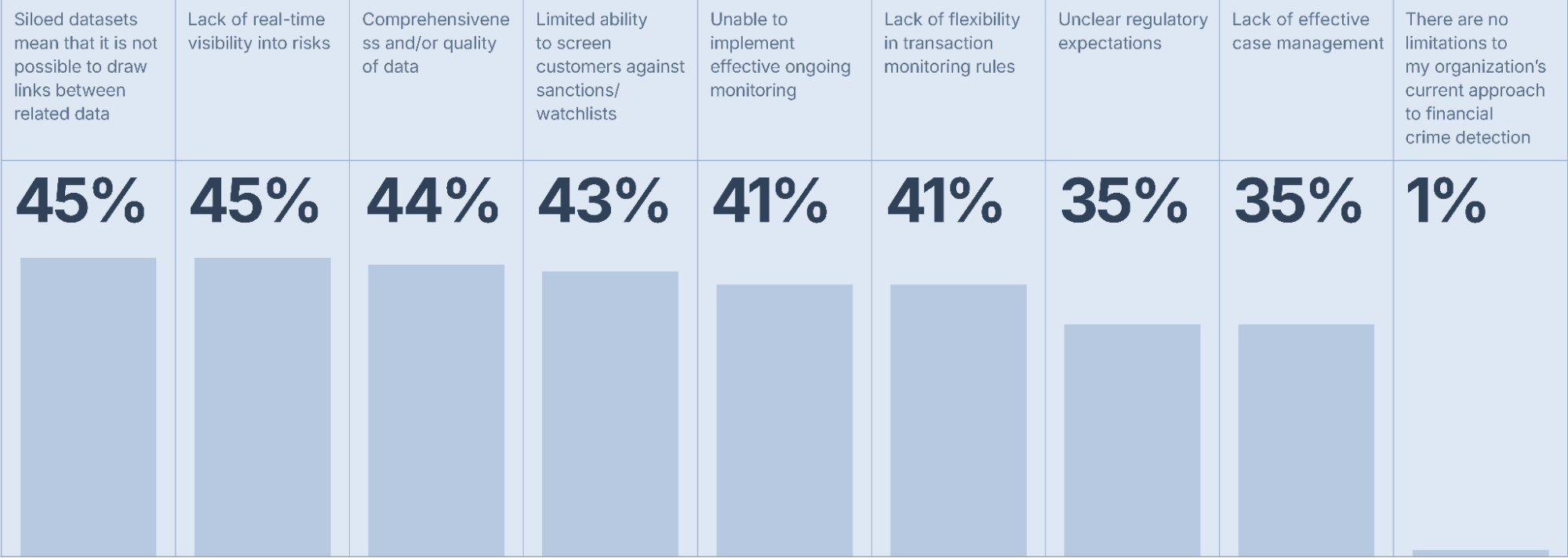

However, in our survey of compliance leaders for The State of Financial Crime 2025, 43 percent cited a limited ability to screen against sanctions lists as their biggest compliance problem.

What are the main limitations to your organization’s current approach to financial crime detection?

Organizations at the forefront of sanctions compliance are prioritizing:

1. Ensuring access to real-time data

Quickly changing designations mean real-time sanctions screening has become more important than ever. Delays in receiving accurate sanctions data mean you risk inadvertently trading with sanctioned entities and incurring regulatory enforcement. A solution that checks customers and supply chain partners against automatically refreshed data is the most efficient way to guard against this risk.

You should also ensure your due diligence processes can draw on other data, such as politically exposed person (PEP) or adverse media information, for the widest possible coverage.

“To insulate your firm from sanctions risks, you must have robust but flexible ongoing customer due diligence, drawing on the best risk information available. This means not only up-to-date sanctions and PEP lists but also adverse media information that can help identify high-risk counterparties not yet designated by governments.”

Andrew Davies, Global Head of Regulatory Affairs, ComplyAdvantage

2. Identifying third-country risks

The likelihood of governments and regulators attempting to crack down on Russian and North Korean sanctions evasion via secondary sanctions has put third-country risks into the spotlight. This means FIs need to factor these into their risk assessments and take appropriate steps to mitigate any threats.

“You should continue existing good practices on name and transaction screening. At the same time, you should pay attention to the risks of sanctions evasion through third countries, taking a proactive approach to identifying risks in your client base through due diligence reviews of high-risk clients.”

Iain Armstrong, Regulatory Affairs Practice Lead, ComplyAdvantage

High-risk clients include small or medium-sized import/export firms operating in locations with ties to sanctioned countries. In addition to conducting effective screening, your transaction monitoring should be appropriately calibrated to identify unusual commercial or financial behavior patterns based on evolving crime typologies.

3. Planning ahead for changes

To ensure your organization’s risk management frameworks are fit for purpose, you should be able to implement or adapt new policies as soon as new sanctions are enacted.

This means you should review any risks you might face from direct or correspondent relationships with entities likely to be sanctioned at some point and prepare responses for any future measures against them before they happen. US firms, for example, should have policies for designations of Chinese banks they have relationships with.

The key here is conducting comprehensive risk assessments and using agile platforms that can react quickly to global developments. When screening or monitoring transactions, use customized rulesets that can be flexibly applied to different customer segments based on your risk appetite and the sanctions challenges you are likely to face.

Protect your firm with real-time sanctions screening

Boost your risk intelligence and ensure compliance with updates to sanctions data completed in minutes.

Get a demoOriginally published 29 January 2025, updated 13 February 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2026 IVXS UK Limited (trading as ComplyAdvantage).