The State of Financial Crime 2023

Stay on top of environmental crime trends and novel criminal techniques to protect your business in 2023.

Download nowThe US Department of Homeland Security is establishing a new wildlife trafficking unit to disrupt the flow of wildlife commodities that are illegally traded to help fund terrorist organizations. Following the 2023 Homeland Security Appropriations Bill, $7.5 million was allocated to build and support the unit as it sets out to coordinate with the government and the private sector to:

According to the Conservation Strategy Fund, illegal wildlife trafficking ranks as the world’s fourth-largest internationally-organized crime, generating an estimated $7 to $28 billion in criminal gains annually.

In an interview with National Geographic, senior adviser for the new investigations unit Elliott Harbin said a primary focus of the new unit will be “undercover operations”. Additionally, the team – consisting of 14 investigators and analysts – will work to unravel key aspects of criminal networks, including the methods used to launder illicit funds and the nexus between wildlife trafficking and other financial crimes, such as drug trafficking.

In January 2023, the US Treasury Department also agreed to form a task force with South Africa’s National Treasury to “follow the money” and step up efforts to halt wildlife trafficking. Three focus areas of the task force include:

Environmental crime is growing at an annual rate three times faster than the world’s GDP. According to the Financial Action Task Force (FATF), inconsistent regulatory standards and legal environments worldwide have contributed to the “low-risk, high-reward” perception of environmental crime among criminals.

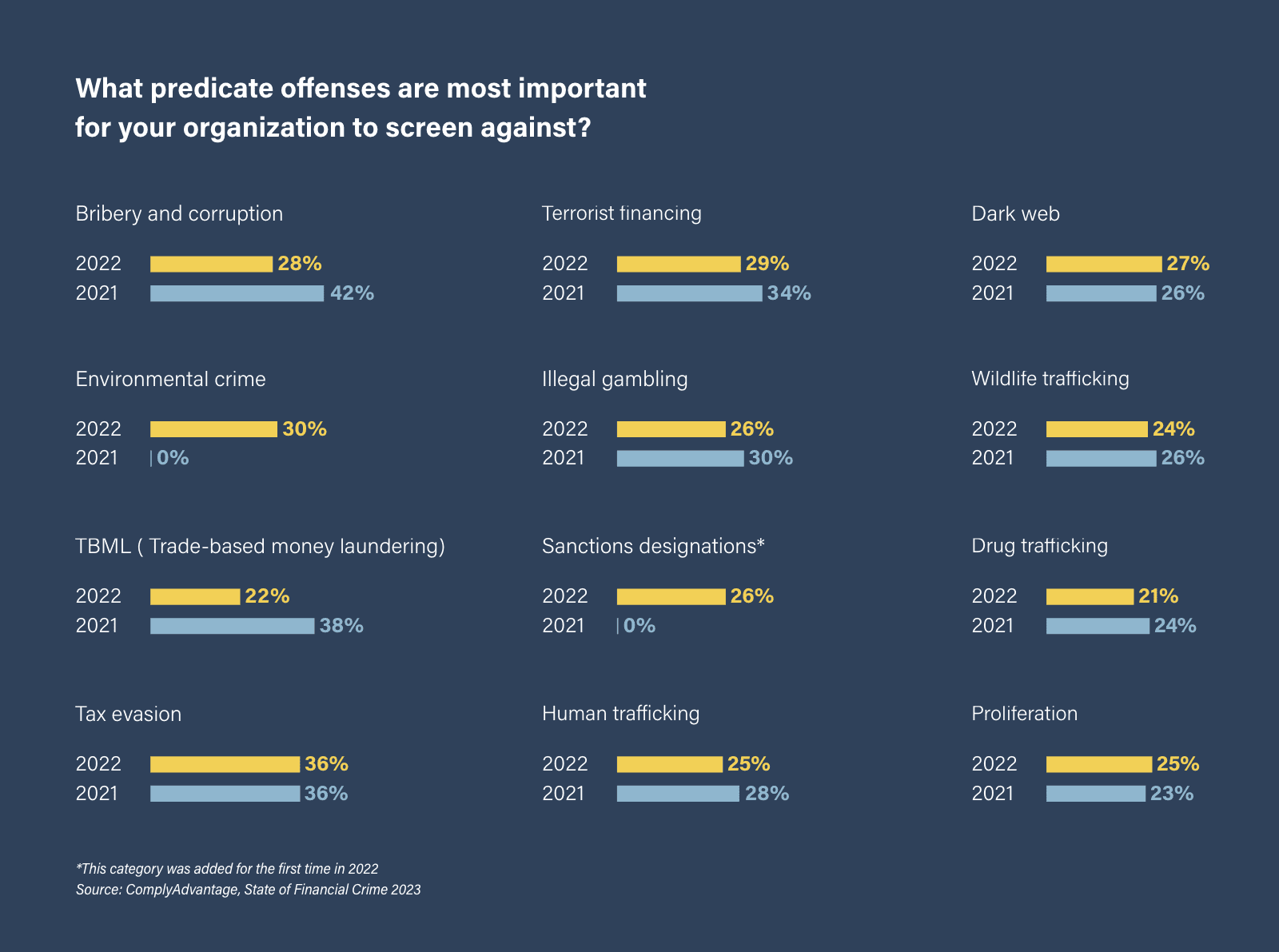

Concern around environmental crime has likewise increased, as highlighted in our 2023 global compliance report. In our survey, we asked 200 C-suite and senior compliance decision-makers across North America which predicate offenses were most important to their organizations. More than one in four selected environmental crime, making it one of the top selected offenses. This is despite its inclusion in our survey for the first time in 2022. Environmental crime was also the second highest typology of concern for firms when submitting suspicious activity reports (SARs), behind only tax evasion.

To spot customers that are involved in environmental crime and are attempting to launder the proceeds of that illegal activity, compliance staff should be familiar with certain red flag behaviors. These include:

In a webinar exploring financial crime trends in 2023, ComplyAdvantage Regulatory Affairs Practice Lead Alia Mahmud commented on the importance for firms to undertake effective “horizon scanning” to enhance their controls to detect environmental crimes. Horizon scanning should include keeping abreast of new and upcoming regulatory changes to ensure internal policies and procedures comply with legislation and adequately reflect the risk landscape. Furthermore, firms should closely examine their governance structures, ensuring those at the top are making the right decisions to stay up to date with regulatory changes.

Additionally, firms should look to monitor for adverse media at the onboarding stage and on an ongoing basis throughout the business relationship. However, collecting and analyzing adverse media is often time-consuming as it requires managing large amounts of AML data. To manage that requirement, compliance teams should seek to implement an adverse media solution with categorization capabilities. By categorizing adverse media, firms can screen for environmental crime predicate offenses much more efficiently, prioritizing high-risk customers, better remediating red flags, and ensuring SARs are submitted to the relevant authorities as quickly as possible.

Stay on top of environmental crime trends and novel criminal techniques to protect your business in 2023.

Download nowOriginally published 01 June 2023, updated 05 June 2023

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).