Filter by topic

With human trafficking now estimated to be a global industry worth up to $498 billion, financial institutions (FIs) have a crucial role to play in dismantling the networks that exploit the vulnerable. Speaking as part of our CATALYST global event […]

5 minute read

The landscape of financial crime is shifting at an unprecedented rate. AI-enabled financial crime has seen a huge increase, estimated at 900% in some quarters. As criminals leverage automation and sophisticated social engineering to bypass traditional defenses, compliance functions can […]

7 minute read

Financial institutions (FIs) have strong regulatory and financial incentives to address the $1.6 to $3.6 trillion in illicit funds circulating through the financial system annually. However, there is also a strong ethical dimension to this fight – behind the vast sums […]

6 minute read

As artificial intelligence (AI) evolves from a speculative tool to a core component of regulatory technology (RegTech), financial institutions (FIs) face a fundamental question: are human compliance teams becoming expendable? At CATALYST 2025, a panel of experts from Mollie, Monzo […]

4 minute read

The global public sector loses trillions of dollars annually to a “scamdemic” – a massive scaling crisis of financial crime (FinCrime) and cybercrime. To navigate this crisis, industry leaders like Lord Chris Holmes of Richmond advocate for a shift away […]

4 minute read

If you work in anti-money laundering and countering the financing of terrorism (AML/CFT) compliance, you’re probably used to hearing about how the latest artificial intelligence (AI) tools will revolutionize your job. AI agents and agentic AI – two connected, but […]

6 minute read

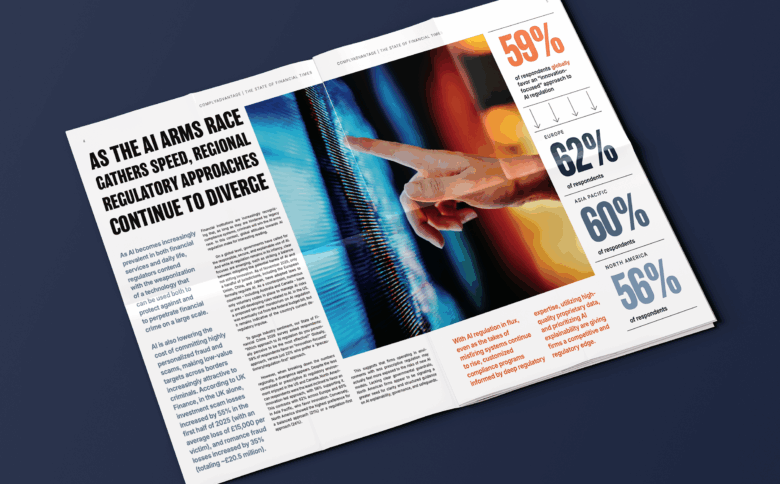

As AI becomes increasingly prevalent in both financial services and daily life, regulators contend with the weaponization of a technology that can be used both to protect against and to perpetrate financial crime on a large scale. AI is also […]

3 minute read

Excited conversations and ambitious statements about the transformative potential of AI are nothing new in compliance. This year, however, things are different. AI adoption has become the baseline for most compliance teams. In our latest global survey of 600 compliance […]

3 minute read