An ultimate beneficial owner (UBO) is someone who ultimately owns or controls a company and benefits from its financial transactions. Because UBOs sometimes seek to remain anonymous, often through a complex chain of corporate infrastructure, they may not be immediately identifiable. Therefore, it’s crucial for FIs to understand the intricacies of beneficial ownership and apply appropriate measures to accurately identify UBOs, thus mitigating risks related to anonymity.

When financial institutions (FIs) onboard businesses and other entities as customers, they must have protocols in place to ensure they know exactly who they are beginning a business relationship with. This means identifying an account’s ultimate beneficial owner (UBO).

Why is it important to conduct UBO checks?

When criminals launder illegal funds, one way they try to avoid detection by firms’ anti-money laundering/countering the financing of terrorism (AML/CFT) measures is by concealing their identities. To do this, they often use proxies such as shell companies to transact on their behalf.

Although shell companies are not illegal outright, criminals often use them to disguise illegal funds and gain access to legitimate financial systems. By properly investigating ultimate beneficial ownership, firms can mitigate the AML/CFT risks posed by the misuse of shell companies and similar financial crime typologies. UBO checks are a common regulatory requirement, meaning failure to carry them out can carry financial or criminal consequences.

Ultimate beneficial ownership and AML regulations

AML regulations in various jurisdictions include definitions and requirements around beneficial ownership. While definitions of UBOs can vary, they typically involve a minimum ownership threshold of shares in a company. The Financial Action Task Force (FATF) guidance on UBOs, followed in many jurisdictions’ regulations, recommends this threshold not exceed 25 percent, meaning anyone who owns a percentage of an entity greater than this amount should be considered its UBO. Some further key points to understand in different countries are:

- US UBO regulations: Under the Anti-Money Laundering Act (AMLA), the US has a centralized beneficial ownership database. Companies must submit beneficial ownership information and documentation, including a UBO’s name, date of birth, address, and the unique identifying number of an acceptable identification document, to the Financial Crimes Enforcement Network (FinCEN).

- UK UBO regulations: Officially, UBOs are known in the UK as ‘persons with significant control’ (PSCs). Businesses must declare these on their PSC registers and submit them to Companies House, the body responsible for incorporating UK businesses.

- EU UBO regulations: The EU’s ‘new’ Sixth Anti-Money Laundering Directive (6AMLD) has broadened its definition of UBOs by allowing a lower ownership threshold of 15 percent for higher-risk companies. The directive also states that family ties can be considered when deciding who controls an entity. Trusts and similar legal arrangements are now required to register their UBOs in addition to businesses.

- Singapore UBO regulations: Singapore maintains the Register of Registrable Controllers as a centralized UBO database. All private companies, as well as private partnerships and non-profit organizations, must submit information on their UBOs for inclusion on this register.

How to conduct effective UBO checks

1. Collect identifying information

At the onboarding stage, FIs should ask prospective customers for essential information to establish their UBOs. This includes company names, registration numbers, addresses, and the names of individuals in senior management roles. This data should be backed up with appropriate documentation to verify it. Firms should research anyone – both natural and legal persons – with interest or shares in the company.

2. Confirm UBO status

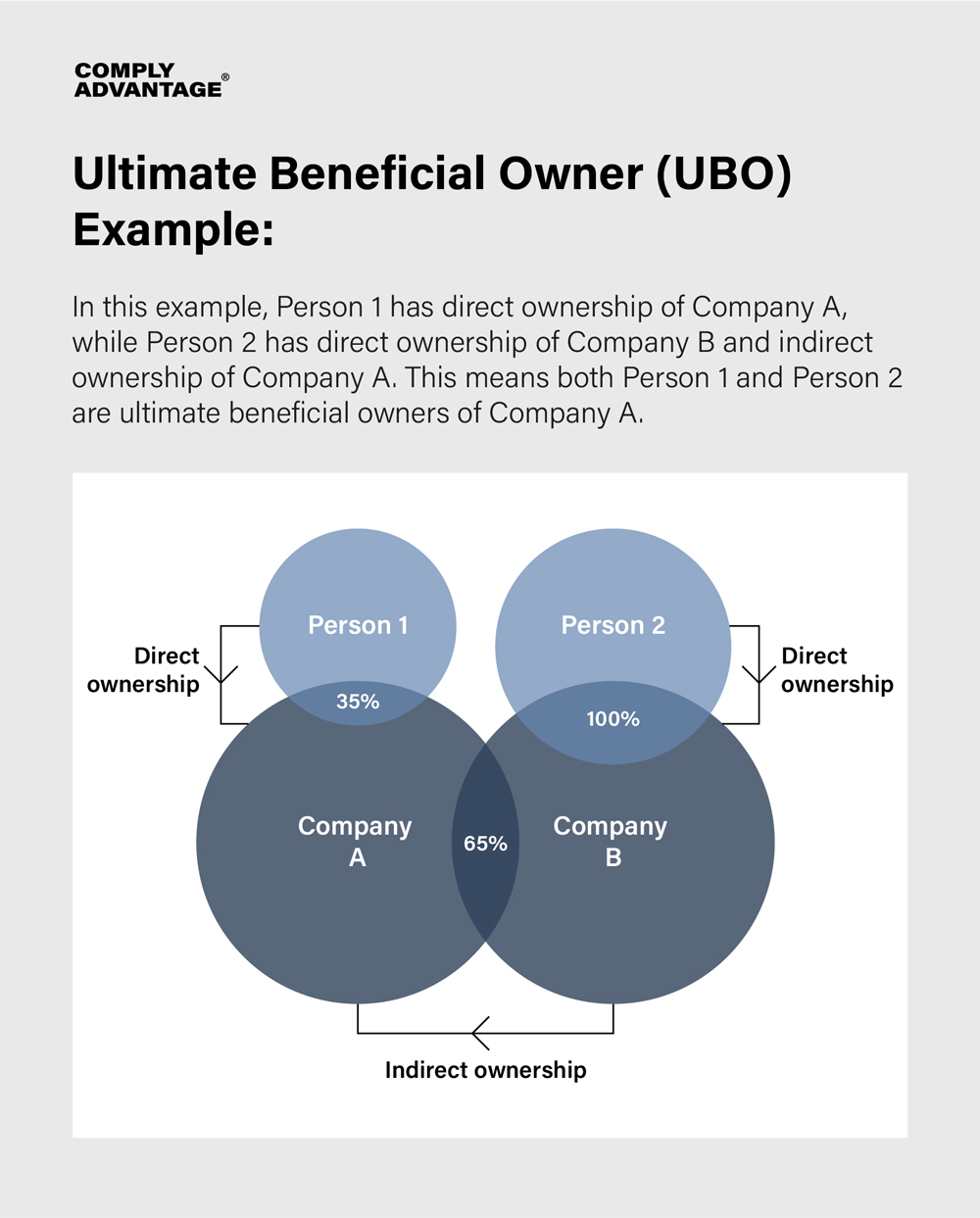

Using this information, FIs should determine who to define as a UBO. This will, as a first step, involve checking individuals against ownership thresholds. It is important to note that these thresholds apply both to direct ownership, where a UBO owns shares in a company themselves, and indirect ownership, where a UBO owns shares in an additional entity which controls the company in question. Firms should also bear in mind that an entity can have more than one UBO.

However, ownership thresholds are only one route towards establishing beneficial ownership. There are situations where it is possible for persons not meeting a threshold to exercise control over a company. The FATF gives several other examples of UBOs, including:

- Persons with the power to appoint the majority of senior management.

- Creditors able to control a company through the terms of a lending agreement.

- Anyone appointed to a position within a company that allows them to make major strategic decisions.

- Minority shareholders who retain control over a company through differential voting rights.

3. Conduct customer due diligence on UBOs

Once firms have identified an entity’s UBOs, they must carry out an appropriate level of customer due diligence (CDD) on them. In practice, this should involve:

- Politically exposed person (PEP) screening: PEPs can present an elevated AML risk due to their positions of power and influence, making them potentially more susceptible to corruption, bribery, and other forms of financial misconduct. Because of this, PEPs may seek to use shell companies to conceal their identities. Therefore, firms should screen customers to establish their PEP status and consider applying EDD measures to assess the associated risks.

- Sanctions screening: Individuals or entities subject to international sanctions may seek to use shell companies to evade these measures and access financial services. Accordingly, firms should screen high-risk customers against the relevant sanctions lists and implement robust monitoring systems to detect circumvention attempts.

- Adverse media screening: News stories may indicate that customers are involved in UBO-related money laundering offenses before official sources reveal this information. Firms should implement negative news screening to flag any stories involving their customers and align their adverse media categories with the FATF’s risk typologies to ensure potential money laundering risks are identified and managed in accordance with global standards.

In addition to implementing these onboarding measures, companies should also conduct continuous monitoring of transactions. This practice is crucial for identifying shell companies by detecting unusual transaction patterns or transactions involving high-risk countries.

A Guide to the Essentials of Anti-Money Laundering

Learn more about how to meet your compliance obligations, both at onboarding and beyond.

Download your copyBest practices for managing UBO risks

Some UBOs represent a higher risk of money laundering. This can be because of:

- A positive alert on any of the screening measures listed above.

- A UBO’s location is in a high-risk jurisdiction, such as a country on the FATF ‘grey’ or ‘black’ lists, especially if the entity they control is located elsewhere.

- The nature of the company’s business or the UBO’s occupation (businesses such as travel agencies, unregulated charities, and casinos should be assigned a higher risk level).

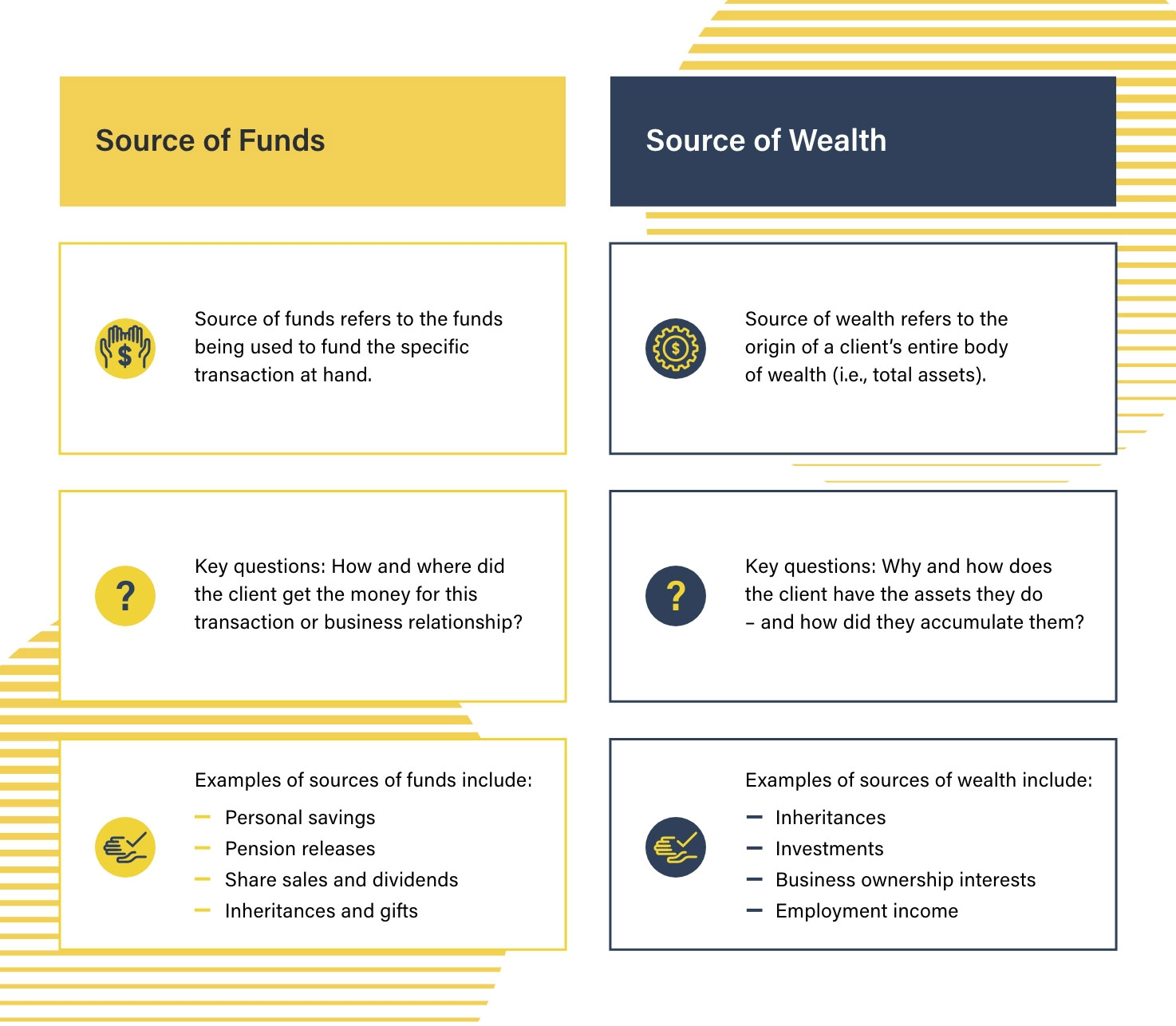

Firms should undertake further checks, known as enhanced due diligence (EDD), on higher-risk UBOs. An important part of EDD consists of source of funds (SOF) and source of wealth (SOW) checks: firms conduct these to understand how a company or its UBO has obtained its financial assets and investigate any inconsistencies. Firms can also ask for further details on the purpose of the UBO’s intended business relationship with them, or for more frequent reports on a company’s ownership as a condition of the relationship.

In cases where a UBO presents a clear risk of money laundering or terrorist financing, an FI should not onboard them or the entity they control and must report any suspicious activity to the relevant authorities.

Advanced AML solutions for UBO checks

ComplyAdvantage’s specialist AML solutions include intuitive features to help firms identify and mitigate UBO-related risks, including:

- Company screening and customer screening: Market-leading proprietary databases allow firms to screen efficiently for adverse media, PEP status, and sanctions or enforcement actions, allowing them to assess risk levels and take appropriate action.

- Transaction monitoring: Our transaction monitoring solution has an extensive rules library of AML/CFT typologies, complete customizability, and scalability to billions of transactions, helping FIs to detect suspicious transaction patterns easily.

- Ongoing monitoring: By continually monitoring information relating to customers and companies, firms can quickly capture and act on any changes in their risk profiles.

Manage UBO risks with enhanced company screening

Mesh Company Screening allows businesses to protect themselves from financial crime risks with market-leading software and risk intelligence.

Get a demoOriginally published 04 April 2015, updated 08 November 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2026 IVXS UK Limited (trading as ComplyAdvantage).