Scalable AML Screening and Monitoring Solutions for Payment Companies

Onboard clients quickly and efficiently to improve client experience

“Unlike other vendors in this space, ComplyAdvantage really listened and wanted to make sure the proposed solution was exactly right for us. Not only are all compliance concerns ably addressed, it has vastly improved the customer experience. Customers are onboarded and funds cleared in minutes, with customer satisfaction and feedback much improved.

Scalable AML Screening and Monitoring Solutions for Payment Companies

Onboard clients quickly and efficiently to improve client experience

Speak to an AML specialist about your compliance needs

Real-time screening for faster client onboarding

- Screen your clients with confidence against real-time Sanction lists, Watchlists, PEPs and Adverse Media insights.

- Reduce the time it takes to onboard by leveraging a customizable matching technology according to your risk appetite.

- Enhance your due-diligence process and deep-dive into your clients, merchants and financial counterparties risk profiles

- Use Adverse Media as part of the screening process to reduce reputational and regulatory risk as well as minimising false positives.

Use a 2-way API to be the first to know about critical changes in risk

- Automated Ongoing monitoring will trigger alerts in real-time when changes in status are made.

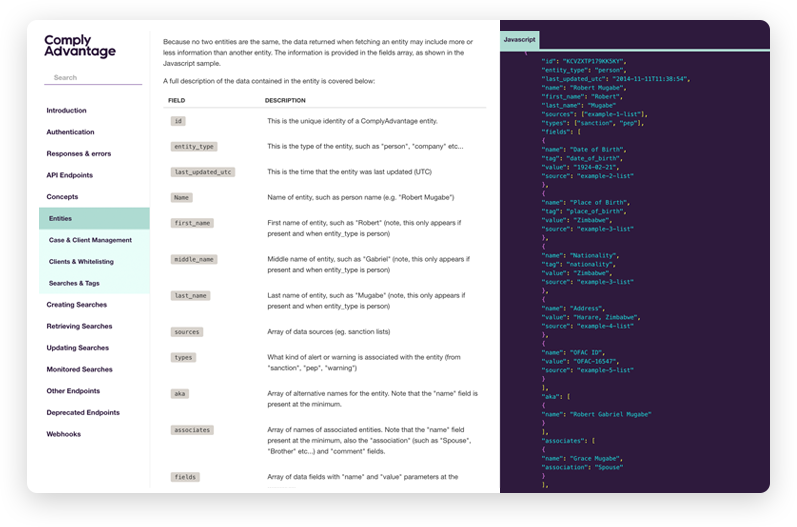

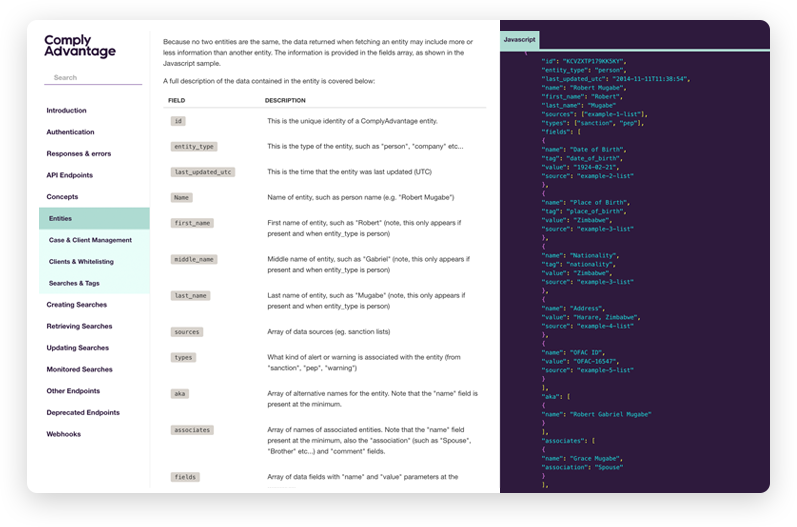

- Integrate AML checks seamlessly into your onboarding and monitoring workflow via a highly functional RESTful API.