ComplyAdvantage Mesh

A 360-degree view of financial crime risk

A cloud-based compliance platform, ComplyAdvantage Mesh combines industry-leading AML risk intelligence with actionable risk signals to screen customers and monitor their behavior in near real time.

Get a Demo

Risk Solutions

Mesh efficiently powers risk detection across the customer lifecycle. It offers a range of modules that help build a holistic risk function.

Customer Screening

Screen new and existing customers against sanctions, PEPs, watchlists, adverse media, and enforcement data using advanced matching algorithms. Tailor your screening approach using the most flexible risk configurations.

Learn more

Company Screening

Implement an efficient workflow to streamline business onboarding. Benefit from multi-layered risk scoring across our dynamic real-time risk database.

Learn more

Ongoing Monitoring

Automate customer rescreening, as per your risk policy, with real-time data. Identify any changes to customers’ risk profiles based on evolving regulations, data, and risk signals.

Learn moreDifferentiated by insights

ComplyAdvantage’s proprietary risk database powers its Mesh platform, delivering depth, reliability, and actionability across many data sources.

Comprehensive coverage

Our market-leading insights go deeper than data. We identify relationships between hundreds of sanctions and watchlists, catalogs of global enforcement actions, expansive negative news archives, exclusive PEPs, and proprietary alerts that provide visibility into suspicious activity that would otherwise go undetected.

Vigorous accuracy standards

Curated by regulatory affairs experts and scaled with advanced machine learning, we offer highly accurate risk entity resolution. Flexible rules further optimize signals with your risk appetite.

Network link analysis

From ownership chains and transaction paths to political and social connections, our graph database technology powers more meaningful decisions by revealing the hidden risks in personal and corporate relationships.

Regime flexibility

Rules and parameters can be tailored to business jurisdictions and regulatory environments, including preferences for categories, sources, alerting thresholds, and other variables.

The powerful capabilities of Mesh

The platform centralizes exceptional capabilities usually duplicated across different segments of a financial crime program. It also helps build and seamlessly scale a truly integrated risk function that intelligently detects and enables prompt action in the most effective and efficient manner.

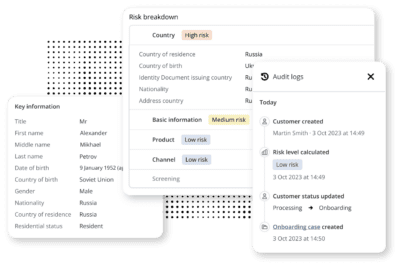

Case Management

Efficiently manage alert reviews and investigations within the platform. Collaborate across teams and maintain a full audit trail, capturing when and why decisions are made.

- Streamline tasks with crucial information on one screen.

- Prioritize the highest-risk cases first.

- Access a comprehensive audit trail.

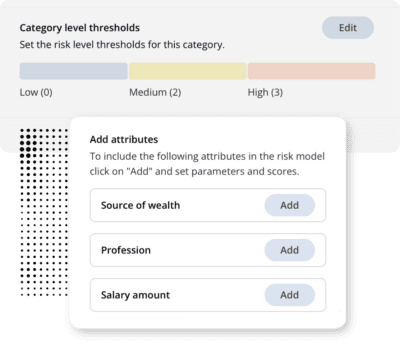

Risk Scoring

Develop a data-driven understanding of every person or company.

- Automated risk scoring across customer and events.

- Fully configurable and dynamically updated customer risk scores and levels.

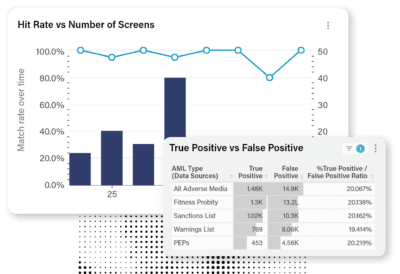

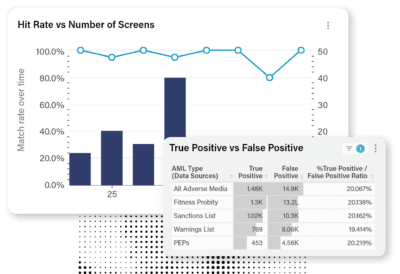

Insights

Gain visibility into key risk and performance metrics through interactive dashboards providing an overview of the compliance program’s effectiveness.

- Pre-configured business metric dashboards.

- Improve operational performance by monitoring customer and usage data in a single platform.

- Slice and download risk data by AML type, country, and customer risk level.

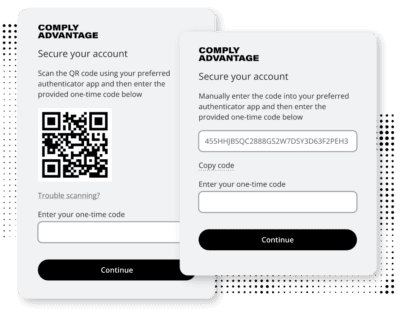

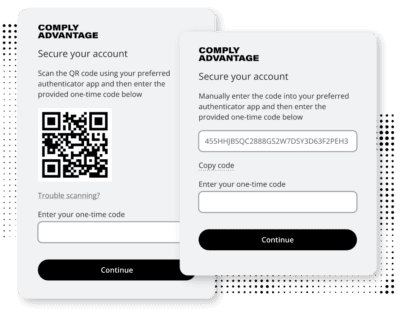

Security

ComplyAdvantage maintains comprehensive compliance certifications and attestations with bank-grade online security to ensure your data is managed and stored securely.

- SOC 2 Type II certified.

- ISO 27001 certification.

- GDPR aligned.

- Encryption at rest and in transit.

- Configurable role-based permissions.

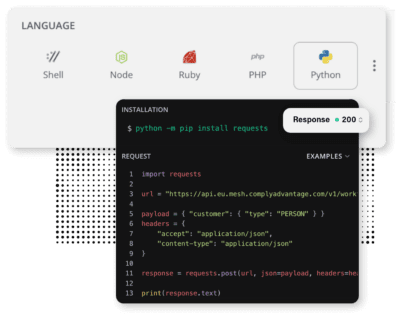

Integration

Designed to be integrated lightning-fast with flexibility.

- Leverage APIs alongside existing platforms and processes.

- Real-time API, batch, and SFTP options.

- Development experience team to assist with best practices.