- Live AML data generation

- Combined entity profiles

- Real-time screening

- Automated monitoring

- Multi-Language support

- Configurable matching algorithm

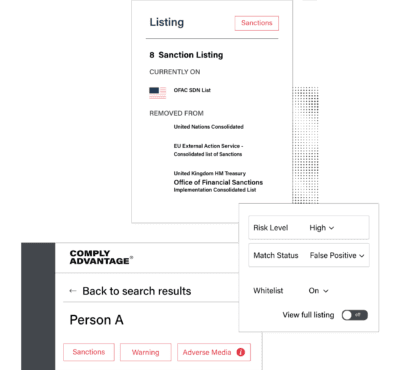

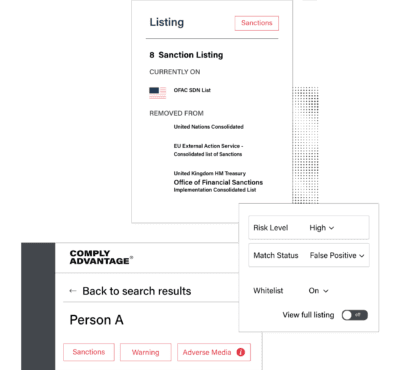

- Whitelisting

- REST API integration

- ISO27001 Level Security

Be the first to know about critical changes to your customer’s risk status with our PEP screening software.

Get a Demo

A proprietary real-time risk database of global Watchlists, PEPs, and Adverse Media.

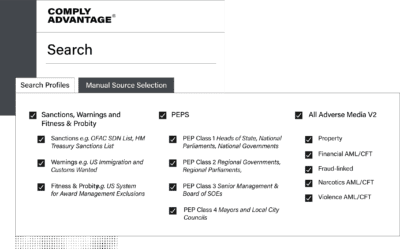

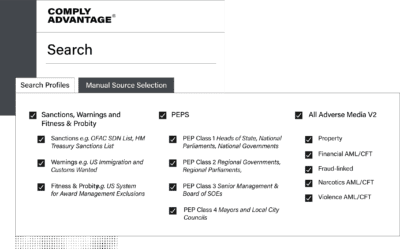

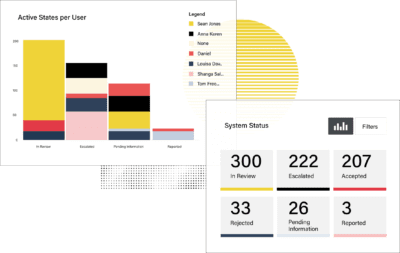

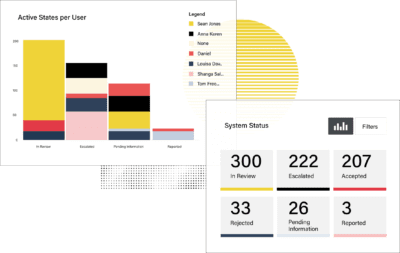

Apply different search settings to different groups of customers based on your business model

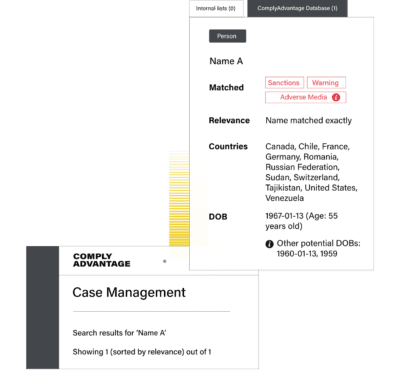

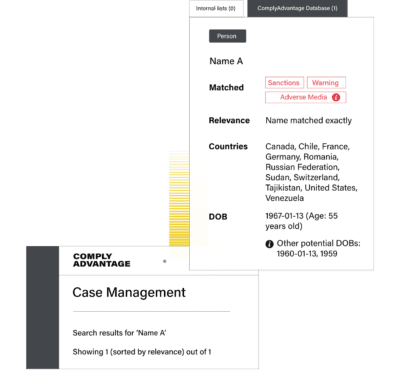

Screen against a database of entity and individual profiles, not endless articles

Integrate data feeds, case management systems and CRMs to match your workflow

A politically exposed person (PEP) is an individual who is or has been entrusted with a prominent function by a local, regional, national, or international governmental body. Given the global mobility of PEPs, the ComplyAdvantage database covers high-ranking government officials in every active jurisdiction. ComplyAdvantage provides a comprehensive and widely adopted source of structured intelligence on PEPs and heightened-risk individuals and organizations.

ComplyAdvantage aligns its PEP definition and categorization with the guidelines provided by the Financial Action Task Force (FATF). The FATF is an inter-governmental body established in 1989 by the Ministers of its member jurisdictions.

The FATF currently comprises 37 member jurisdictions and two regional organizations, representing most major financial centers in all parts of the globe. The objectives of the FATF are to set standards and promote effective implementation of legal, regulatory, and operational measures for combating money laundering, terrorist financing, and other related threats to the integrity of the international financial system.

Because of the risks associated with PEPs, the FATF Recommendations require the application of additional AML/CFT measures to business relationships with PEPs. These requirements are preventive (not criminal) in nature and should not be interpreted as meaning that all PEPs are involved in criminal activity or even necessarily pose a high risk of money laundering. Further legislation around the world, including the EU’s 4th money laundering directive, mandates enhanced due diligence (EDD) requirements when dealing with all politically exposed persons.

The ComplyAdvantage PEP Definition and ranking is based on the FATF version:

PEP CLASS 1

PEP CLASS 2

PEP CLASS 3

Senior management and board of directors of state-owned businesses and organizations.

PEP CLASS 4

Mayors and members of local government (sub-regional level).

Many regulations and best practice guidelines indicate that PEPs are not only entities that currently hold relevant positions but also entities that have stepped out of office. ComplyAdvantage takes a similar approach. Therefore, the ComplyAdvantage database also includes PEP entities that have previously held one of the above positions but do not currently hold one.

Additionally, family members and close associates of PEPs are considered PEPs and can be risk-ranked, as described in the FAQ below.

Yes. The FATF recommendations also apply to relatives and close associates of prominent entities, as these are also viewed as a potential source of risk – given their connections with the PEPs.

ComplyAdvantage considers the following categories of family members relevant from a PEP screening perspective (but not limited to):

If an entity belongs to any of the above categories, it will be ranked at the same level as the PEP it is associated with unless the family member in question is a PEP in his/her own right. In such cases, the political position held by the spouse will determine his or her classification.

We cover countries with an ISO 3166 country code.

We have a base coverage for all the countries listed there, but that doesn’t mean we have full coverage for all of them.

As our database needs to comply with many screening requirements across the world, as a general rule of thumb, we take the path of the most restrictive legislation. In this case, as some jurisdiction’s regulators require former PEPs to be screened, we will always flag a former office holder as a PEP irrespective of the time that person has exited office. This behavior is true for all the new sources of data that we currently add and maintain in our database.

However, even if we take this most restrictive approach, we label all former officeholders’ profiles with a “Remove date” that should serve as a proxy date for when the entity has exited office.

All PEP Profiles are checked for updates daily.

Yes, advance your customer screening with a powerful, flexible “fuzzy matching” search capability that allows you to optimize for the reduction of false positives in line with your risk-based approach. Our search algorithm accounts for all the major sources of mismatch in the name screening industry, such as name derivatives, phonetically similar names, spelling & typos, fuzzy matching, and different name forms.

Top 5 fraud trends in 2024 and how to mitigate them