Organized crime groups (OCGs) are constantly evolving, using sophisticated methods to exploit global markets, weaken regulatory frameworks, and launder illicit proceeds. From environmental crime to cybercrime, these groups are diversifying their activities, making it harder for firms to detect and prevent illegal operations.

Given the growing scale and scope of organized crime, the topic featured as a core theme in our State of Financial Crime 2025 report, spotlighting its prevalence across various markets and the specific anti-money laundering (AML) tools firms are using to identify OCG-related threats.

This article explores some of the nuances of organized crime’s transformation as well as the new risks it presents and how you can effectively prepare to protect your organization.

How is organized crime changing?

Based on the findings and investigations of researchers and law enforcement agencies, OCGs continue to find new ways to make money, including:

1. The diversification of criminal activities

OCGs have significantly expanded their scope beyond traditional crimes like drug trafficking and extortion. These groups are now heavily involved in environmental crimes such as illegal logging, mining, and wildlife trafficking. These activities cause widespread environmental damage and introduce financial and reputational risks for businesses, particularly those with complex, global supply chains. For instance, illegal gold mining in South America is not only a source of substantial revenue for OCGs but also involves forced labor and contributes to severe environmental degradation, making it a regulatory and ethical concern for companies indirectly connected to these operations.

2. The rise of cybercrime and digital threats

The digital age has opened new avenues for OCGs to exploit, with cybercrime emerging as a major focus. OCGs are increasingly engaging in ransomware attacks, data breaches, and various forms of online financial fraud. They leverage advanced technologies, including the use of cryptocurrencies, to facilitate money laundering, making their activities harder to trace. Additionally, the use of drones for smuggling contraband demonstrates how these groups are adopting modern technologies to enhance their operations and evade law enforcement.

Webinar: Trump, GenAI, and the changing face of financial crime

Watch our expert-led webinar to explore the top trends and developments that will shape financial crime prevention in 2025 and beyond.

Watch on-demand3. Infiltration into legitimate industries

OCGs are also making inroads into legitimate industries, using these platforms to launder money and extend their influence under the guise of lawful business operations. Industries like agriculture and retail are particularly vulnerable. For example, in the avocado trade, some cartels in Latin America are exploiting this legitimate market to launder illicit gains. Similarly, the construction and real estate sectors have been targeted by OCGs as a means to integrate their criminal activities into the formal economy. This infiltration complicates the task for businesses trying to ensure their operations remain compliant and free from criminal exploitation.

How can I help my firm?

According to our survey of 600 senior compliance professionals, businesses are extremely aware of the risks of exposure to organized crime. 71 percent of organizations said they already undertake a detailed analysis of exposure to organized crime in their financial crime risk assessments, and 26 percent said they plan to undertake one in the next 12 months.

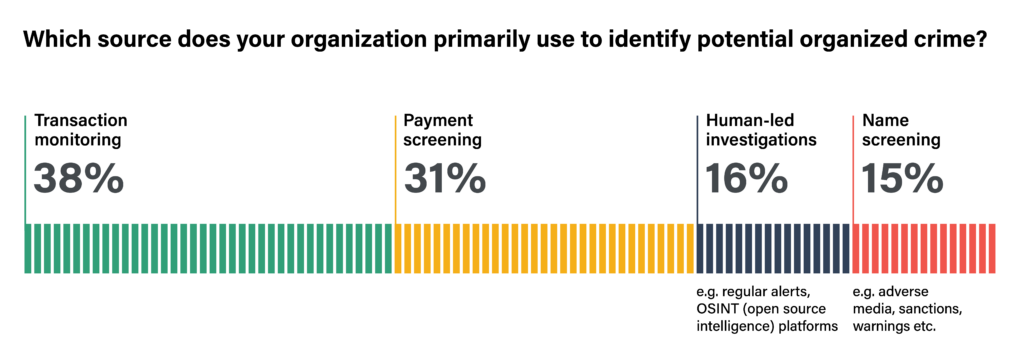

However, our survey also showed that firms’ detection of real-time exposure appears to rely on diverse methods, with 38 percent of respondents emphasizing transaction monitoring, 31 percent payment screening, 16 percent human-led investigations, and 15 percent name screening. This suggests that firms do not see any one platform as sufficient on its own and are using multi-pronged approaches as they seek to identify and mitigate the risks.

While multi-pronged approaches demonstrate a commitment to combating organized crime, our survey highlighted several key challenges that hinder firms’ effectiveness. To overcome these obstacles and improve their defenses, you should focus on the following:

1. Prioritize data integration and analytics capabilities

While many compliance teams recognize the need to break down data silos to combat organized crime, the reality often falls short. Our survey revealed that 45 percent of respondents cited siloed datasets as a significant hurdle, hindering their ability to connect the dots and identify suspicious activity. Given the increasing sophistication and complexity of organized crime groups, this presents a unique opportunity for compliance leaders: to leverage this threat as a catalyst, educating internal stakeholders on the critical need for data consolidation and investment in advanced analytics. By building a comprehensive risk profile through integrated data, you can not only improve detection but also proactively anticipate and mitigate emerging threats.

Technology will play a major role in helping generate insights about potential OCG exposure, especially by leveraging integrated platforms and comprehensive risk data sets.”

Iain Armstrong, Regulatory Affairs Practice Lead at ComplyAdvantage

2. Enhance third-party due diligence processes

Given the infiltration of OCGs into legitimate industries, your team must rigorously scrutinize its third-party relationships. Continuous monitoring of suppliers, contractors, and partners is crucial. Enhanced due diligence (EDD) should include assessing financial stability, ownership structures, and compliance history. Automating parts of the due diligence process can help firms manage these complex relationships more efficiently and accurately, reducing their exposure to potential criminal activity.

3. Develop a dynamic risk assessment framework

A static risk management approach is inadequate in the face of evolving organized crime tactics. Rather, your team should adopt a dynamic risk assessment framework that incorporates real-time data and predictive analytics. By regularly updating risk models and conducting scenario analysis, you can better anticipate and respond to threats.

Your team’s approach should go beyond tick-box compliance to thinking in detail about your company’s potential exposure to particular types of crime and crime typologies. Policies, procedures, and controls need to be agile, flexible, and open to recalibration.”

Iain Armstrong, Regulatory Affairs Practice Lead at ComplyAdvantage

4. Cultivate strategic partnerships and industry collaboration

Tackling organized crime requires a collaborative effort. Building strategic partnerships with industry peers, regulatory bodies, and law enforcement agencies can help you and your team stay ahead of criminal networks. Sharing information and best practices helps address the interconnected challenges of data quality, visibility, and integration identified in our report. In fact, in our survey, respondents were asked where the tightening of AML regulation would have the greatest impact on the fight against financial crime. The lead category was stronger public-private cooperation and data-sharing protocols (47 percent).

Participation in industry forums and information-sharing initiatives can help you remain informed about the latest trends and strategies, enhancing their collective ability to detect and combat organized crime.

Get a 360-degree view of financial crime risk with ComplyAdvantage Mesh

A cloud-based compliance platform, ComplyAdvantage Mesh combines industry-leading AML risk intelligence with actionable risk signals to screen customers and monitor their behavior in near real-time.

Get a demoOriginally published 21 January 2025, updated 21 January 2025

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2026 IVXS UK Limited (trading as ComplyAdvantage).