The EU’s new AML/CFT framework: A complete guide

Our comprehensive guide for firms contains advice and tips on the latest EU AML legislation, and how to make sure your business complies.

Download nowSince its formation, the European Union has developed a comprehensive anti-money laundering and countering the financing of terrorism (AML/CFT) framework. This allows member states to regulate businesses in their country to protect themselves against financial crime threats. The presence of EU-wide legislation also makes it more difficult for criminals to exploit regulatory gaps between individual jurisdictions.

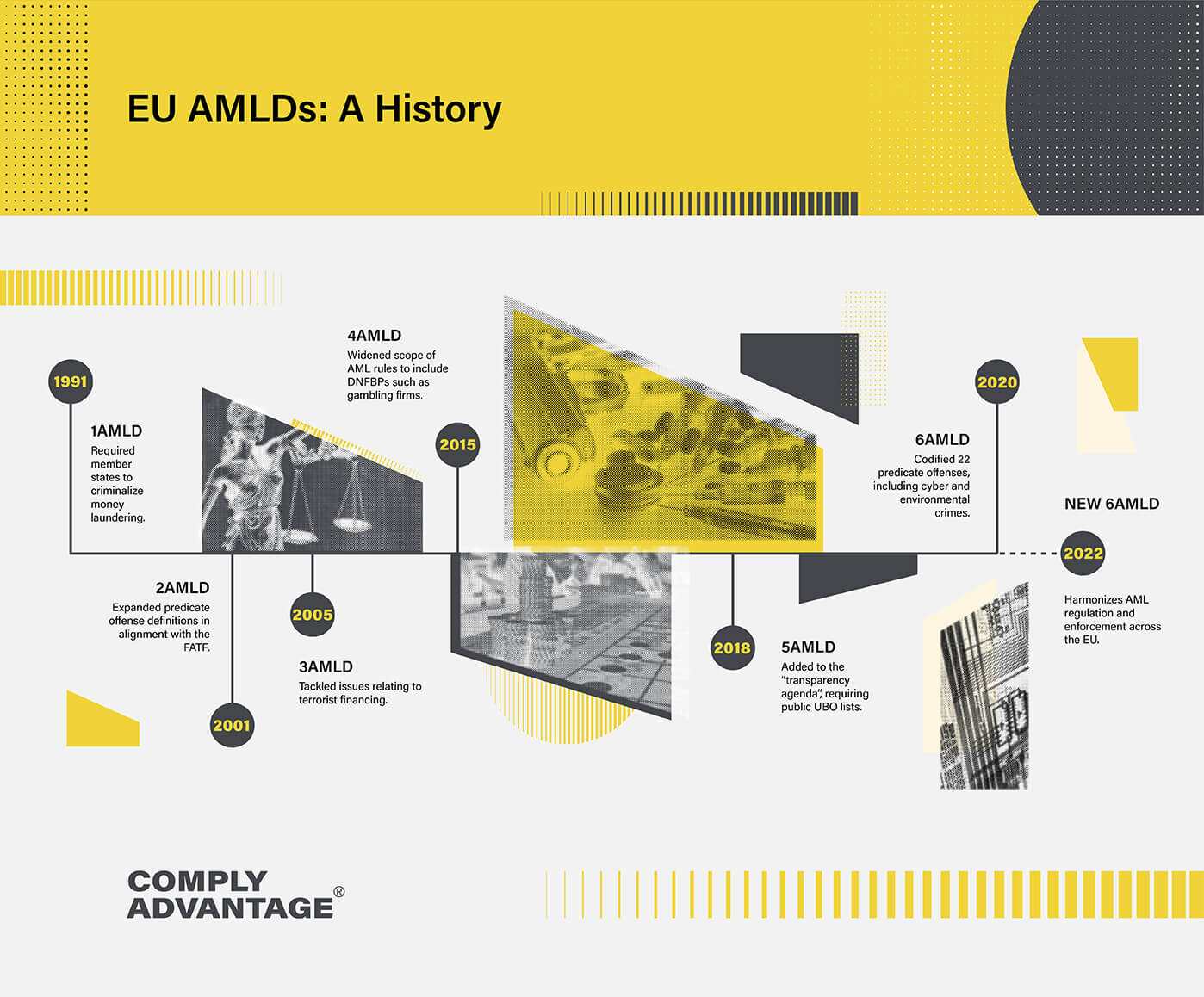

Since the early 1990s, the EU’s AML/CFT regime has been built around a series of Anti-Money Laundering Directives (AMLDs). AMLDs are periodically updated laws issued by the European Parliament detailing regulatory requirements for EU firms. However, since this body has no direct enforcement powers, implementation is the responsibility of member states, who must transpose the directives into their domestic legislation.

The First Anti-Money Laundering Directive (1AMLD) was issued in 1991, and therefore predates the transformation of the original ‘European Community’ into the EU in 1993. 1AMLD was passed at a critical time for AML, two years after the creation of the Financial Action Task Force (FATF), the global financial crime watchdog. It was arguably as much a rhetorical tool as a policy directive, encouraging member states to take AML seriously. Previously, AML had been the subject of only occasional inter-governmental action by European governments in the 1980s.

The FATF issued its first version of its Recommendations in April 1990, which significantly influenced 1AMLD. 1AMLD’s foundational measure required member states to criminalize money laundering. It also targeted banks as the primary ‘obligated entities’ in the private sector, requiring member states to ensure these firms implemented AML measures. These included know-your-customer (KYC) and customer due diligence (CDD) procedures, transaction monitoring, suspicious transaction reporting, and record-keeping requirements.

However, 1AMLD’s limits soon became clear: its focus on banks ignored the wide range of businesses used to integrate illicit funds with the legitimate financial system, and it did not address the various predicate crimes in money laundering. As a result, the Second Anti-Money Laundering Directive (2AMLD) was passed in 2001. Following the revision of the FATF’s Recommendations in 1996, it expanded and defined the range of predicate offenses and clarified reporting requirements. It also widened the scope of the directive to include ‘non-banking financial institutions’ (NBFIs), such as money services businesses, and ‘designated non-financial businesses and professions’ (DNFBPs), such as lawyers and accountants, often known as ‘gatekeepers’ to the financial system.

The Third Anti-Money Laundering Directive (3AMLD) came into effect in 2005 and was largely aimed at tackling the financing of terrorism. Some EU member states had already taken individual legislative actions in this area, such as the UK with the Terrorism Act 2000. In 2003, meanwhile, the FATF revised its Recommendations further to redefine its responsibilities as the international standard-setter for CFT and AML by creating nine ‘Special Recommendations’ on terrorist financing.

Aside from CFT, 3AMLD continued to expand AML obligations to new types of business, such as casinos, and saw the introduction of the risk-based approach to AML, allowing firms to vary their due diligence procedures depending on customer risk levels. Recognizing the need to motivate regulated firms, 3AMLD also introduced penalties for AML breaches. It did not, however, explicitly cover how these penalties were to be calculated, leaving this to domestic legislation. This would be something further versions of the AMLD would have to return to.

After more than a decade, 4AMLD was implemented in June 2017. It focused on aligning EU policy with the latest FATF guidelines and updating its measures in response to new financial crime typologies and AML opportunities created by technological development. Key updates included:

5AMLD, implemented in 2020, shared much of 4AMLD’s focus, with provisions to strengthen existing regulations. It also introduced new measures to address money laundering through cryptocurrencies. Some important areas of focus for 5AMLD were:

Implemented in 2021, 6AMLD, guided member states on emerging money laundering threats and clarified some aspects of 5AMLD. Some crucial elements of 6AMLD were:

Our comprehensive guide for firms contains advice and tips on the latest EU AML legislation, and how to make sure your business complies.

Download nowOn July 20, 2021, the European Commission announced a new ‘package’ to overhaul the EU’s AML/CFT framework. Part of this package was a new set of regulations that have come to be known as the ‘new’ 6AMLD – partly because the European Commission now regards the initial 6AMLD as a standalone piece of legislation. The new 6AMLD updated and replaced aspects of previous versions of AMLD, harmonizing AML regulation and enforcement across EU states. Highlights included:

In addition to 6AMLD, the EU’s AML/CFT package took the major step of creating a new EU-wide regulator responsible for AML/CFT supervision across the region: the Anti-Money Laundering Authority (AMLA). The latest version of the regulation confirming AMLA’s establishment, the Authority for Anti-Money Laundering and Countering the Financing of Terrorism and Amending Regulations, was agreed in December 2023. AMLA’s introduction reflects a changing global risk landscape, including the emergence of disruptive FinTech companies, new payment methods and virtual currencies, and increasingly sophisticated criminal methodologies. It was also a response to the involvement of major European FIs in money laundering-related scandals and the perceived shortcomings in the EU’s existing AML framework that had enabled this.

AMLA is expected to begin work in 2025, taking on supervisory activities by 2028. These will include:

The AMLDs are a substantial body of legislation, and EU firms often face the challenges of interpreting complex rules and taking practical, effective steps to fulfill them. To stay compliant and well-positioned for further regulatory updates, firms should ensure they have clear procedures in place to cover all of the following crucial steps:

ComplyAdvantage uses market-leading risk intelligence to provide firms with a comprehensive view of their AML/CFT threats, along with screening and monitoring enhanced by cutting-edge machine learning (ML). Firms subject to AMLD rely on ComplyAdvantage to ensure compliance with these solutions:

1000s of organizations like yours are already using ComplyAdvantage. Learn how to streamline compliance and mitigate risk with industry-leading solutions.

Get a demoOriginally published 02 April 2020, updated 07 November 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).