A Guide to AML/CFT for Singaporean FinTechs

Read our expert guide for Singaporean businesses, complete with practical tips and useful pointers on managing financial crime risks.

Download nowAs one of the world’s busiest and most innovative commercial hubs, Singapore is a natural destination for banks and financial services businesses. The country is home to more than 1300 financial technology (FinTech) firms, which attracted over US$4.1 billion in investment in 2022, and manages over US$4 trillion in assets under management (AUM). It has therefore established itself both as an innovation-friendly business center and as a premier global wealth management hub. It also maintains a strong regulatory framework around anti-money laundering and countering the financing of terrorism (AML/CFT).

Because of these factors, the country plays a significant role in the global fight against financial crime. Singapore’s AML/CFT regime is subject to constant evolution, with 2024 seeing a steady stream of new guidance and legislation coming into effect. This article walks firms through all the key laws, regulatory bodies, and actionable compliance tips they need to know about.

Singapore’s AML/CFT regime is contained within a body of legislation that began in the 1990s and is regularly updated in response to changing markets, institutions, and threats.

The CDSA was introduced in its original form in 1992 to combat drug-related money laundering before being amended in 1999 to expand its scope to other predicate crimes. The CDSA provides the basis for law enforcement to confiscate criminal proceeds and outlines financial institutions’ (FIs’) compliance requirements, such as:

Similarly to other global anti-terrorism legislation introduced in the early 2000s, the TSOFA specifically criminalized the collection or provision of funds for terrorist purposes and extended existing AML legislation to cover terrorist financing.

The MAS is Singapore’s financial regulator. Under the authority of the Financial Services and Markets Act, it publishes legally binding notices detailing specific AML/CFT measures all FIs must implement. These include:

Intended to regulate Singapore’s payments industry without stifling FinTech innovation, the PSA was introduced in 2020. It set out regulatory requirements for payment service providers (PSPs) and gave the MAS legal oversight of payment systems, including their AML/CFT obligations. Under the PSA, PSPs must:

The Anti-Money Laundering and Other Matters Act took effect in November 2024. It was introduced to achieve specific aims, including giving law enforcement agencies greater powers to prosecute financial crimes – clarifying Singapore’s processes for dealing with seized assets, and aligning casinos’ AML/CFT obligations with those recommended by the Financial Action Task Force (FATF).

The FSMA is an omnibus act for sector-wide financial regulation and migrates the existing supervision framework established by the MAS Act 1970. This includes Part 4 of the FSMA, which focuses on AML/CFT and mandates FIs to disclose information to the authorities as part of investigations.

In May 2023, this section was amended to create the legal framework for COSMIC (Collaborative Sharing of Money Laundering/Terrorist Financing Information and Cases), a centralized platform for FIs to share customer data for AML/CFT purposes. COSMIC launched in April 2024 with six participating banks and a focus on three specific risks: misuse of corporate structures, trade-based money laundering (TBML), and proliferation financing.

The various pieces of legislation that make up Singapore’s AML/CFT regime carry severe penalties for non-compliance, including both fines and imprisonment. Specific punishments include:

In 2024, an amendment to the CDSA specified two further penalties:

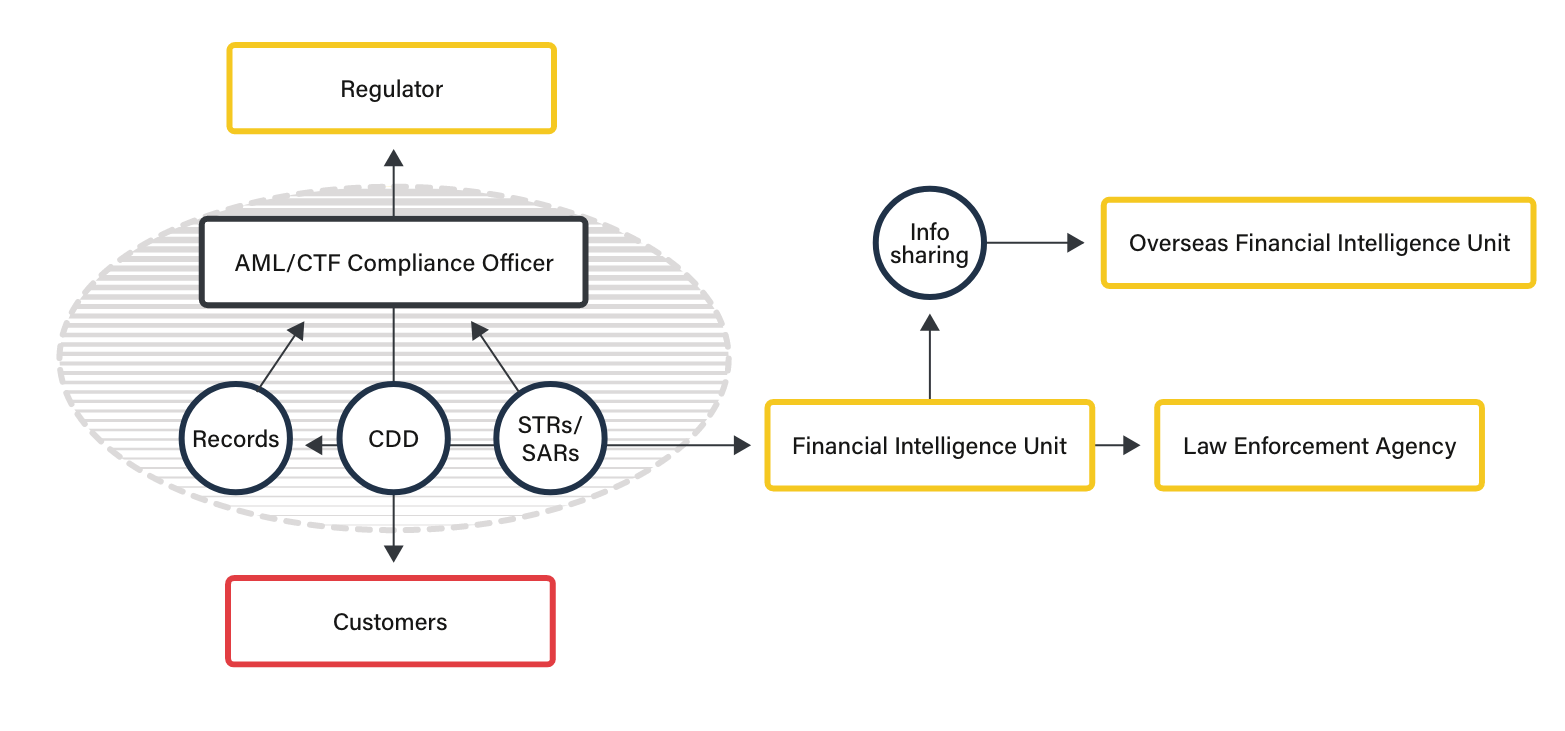

The responsibility for directing, monitoring, and enforcing the compliance of Singaporean firms is split between different organizations, each with different objectives and legal powers. AML compliance and enforcement involves a network of relationships between firms, their customers, regulators, and law enforcement bodies, as illustrated below:

The MAS supervises FIs’ AML/CFT measures to ensure they meet the required standards and educates them on emerging risks and industry best practices. In addition to its regulatory notices, the MAS directs Singapore’s overall financial policy direction and issues national strategy papers and risk assessments on combatting money laundering.

The CAD is the law enforcement agency responsible for financial crime investigations in Singapore. It is composed of several specialist divisions, each handling particular financial crime typologies. There are three Financial Investigation Divisions, dedicated to money laundering, terrorist financing, and specialized fraud investigations respectively.

The STRO sits within the CAD and is Singapore’s financial intelligence unit, meaning it receives STRs, CTRs, and CMRs from FIs. The STRO analyzes these reports for evidence of money laundering, terrorist financing, or other financial crimes, and disseminates intelligence to law enforcement agencies.

Read our expert guide for Singaporean businesses, complete with practical tips and useful pointers on managing financial crime risks.

Download nowSingaporean firms subject to AML regulation have a large body of legislation to consult, giving them a long list of technical compliance requirements. However, the journey from knowing the rules to understanding how to comply with them in practice can be a challenging one for firms. These are some crucial steps they should take:

ComplyAdvantage has a range of solutions built to make AML compliance as efficient as possible for firms. By using ComplyAdvantage to balance growth objectives with compliance requirements, businesses can:

ComplyAdvantage has helped 1000s of businesses with efficient AML compliance. Get a personalized demo and see how you can streamline your compliance with AI-powered software.

Get a demoOriginally published 12 November 2019, updated 11 December 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2025 IVXS UK Limited (trading as ComplyAdvantage).