Featured

Featured

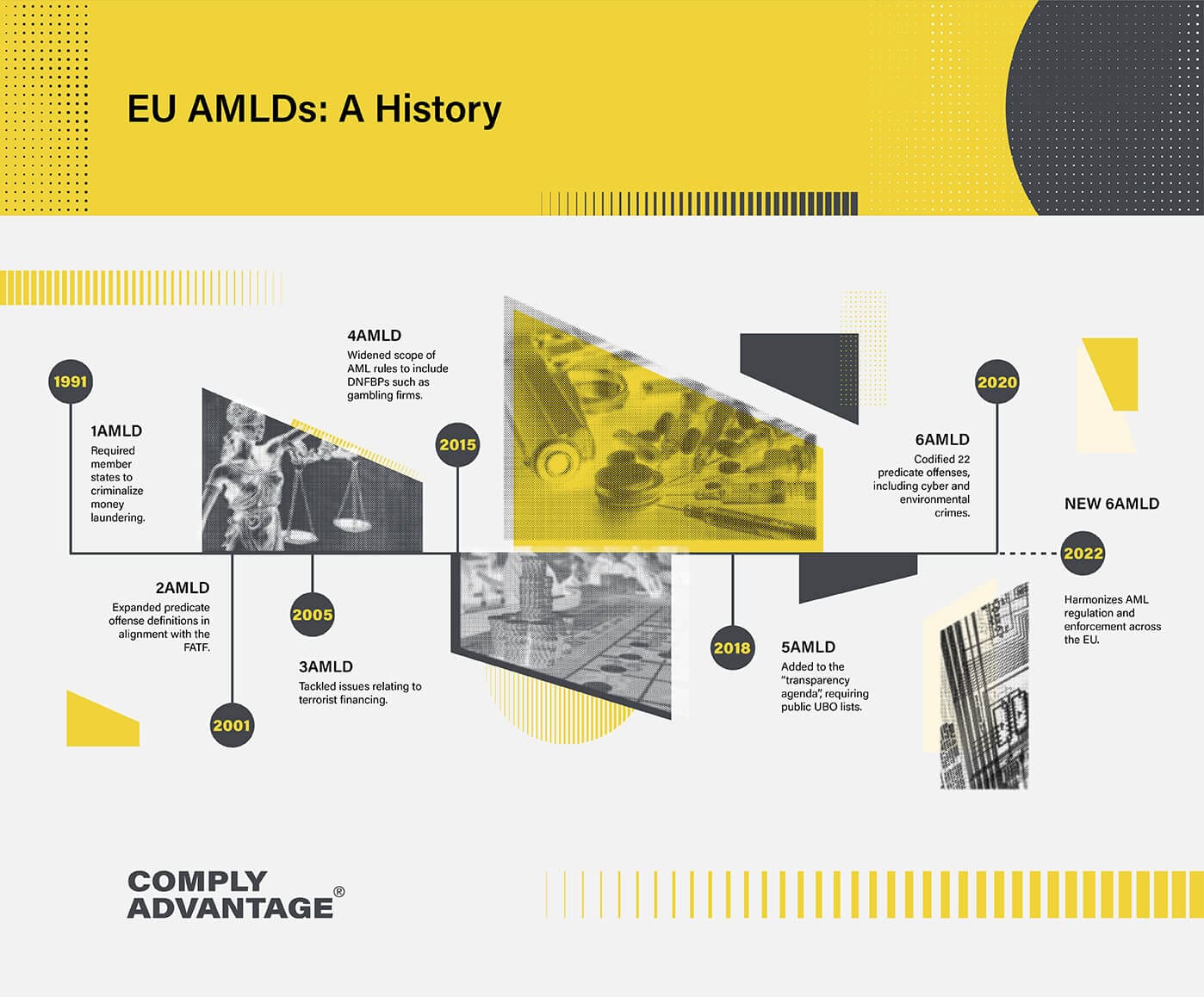

EU anti-money laundering directives are issued periodically by the European Parliament to be implemented by member states as part of domestic legislation.

European anti-money laundering directives (AMLD) are intended to prevent money laundering and terrorist financing and establish a consistent regulatory environment across the EU. This is accomplished by addressing emerging money laundering and terrorist financing typologies, and helping to close AML compliance gaps.

EU Regulatory Reform

On July 20 2021, the European Commission announced an “ambitious package of legislative proposals” intended to overhaul the EU’s AML/CFT framework. The package is designed to help member-states detect and address suspicious activity, and close compliance loopholes that criminals exploit to launder money.

The package includes a ‘new’ Sixth Anti-Money Laundering Directive (6AMLD) which updates and replaces aspects of previous AMLD, and establishes a new anti-money laundering authority which will be responsible for AML/CFT supervision across the region. To help you get up to speed with the EU’s AML/CFT developments, we’re taking a closer look at the region’s regulatory landscape.

Recent EU Anti-Money Laundering Directives

When the EU issues an anti-money laundering directive, it also sets an implementation date by which appropriate AML/CFT legislation must be in place within member states. Since implementation periods can last several years, new money laundering and terrorism financing threats may emerge during that time. Accordingly, the EU issues new anti-money laundering directives regularly in order to reflect changes in criminal methodology and in AML/CFT best practices.

The most recent EU anti-money laundering directive is 6AMLD, replacing 5AMLD and 4AMLD before that. Every directive adds to or updates regulatory obligations on member-state governments. The details of the most recent anti-money laundering directives are as follows:

The Fourth Money Laundering Directive (4AMLD)

Implementation date: June 26 2017

The Fourth Anti-Money Laundering Directive broadly focused on aligning EU policy with AML/CFT guidelines from the Financial Action Task Force (FATF).

Wider regulatory scope: 4AMLD expanded the regulatory scope of AML/CFT legislation, imposing customer due diligence obligations (CDD) on many previously unregulated firms, including all gambling services, all credit and financial institutions and many designated non-financial businesses and professions (DNFBP). Similarly, 4AMLD expanded CDD obligations to certain types of transactions and financial products, including transactions outside of business relationships and, for the first time, some e-money products.

Beneficial ownership: 4AMLD introduced requirements for EU countries to record ultimate beneficial ownership (UBO) information in centralized registers and adjusted the definition of ultimate beneficial ownership to include senior management officials. Record-keeping requirements were also introduced for trustees of express trusts.

Expansion of the risk-based approach: 4AMLD significantly strengthened criteria for the risk-based approach to money laundering, requiring firms to factor geographic locations, products, services, types of transactions and delivery channels into their customer risk profiles.

Tax crimes: 4AMLD made tax crimes predicate offenses for money laundering and brought legal advice under the scope of AML/CFT reporting obligations.

Politically exposed persons: 4AMLD expanded the definition of a politically exposed person (PEP) to include domestic PEPs.

The Fifth Money Laundering Directive (5AMLD)

Implementation date: January 10 2020

5AMLD shares much of 4AMLD’s focus with provisions to strengthen and expand existing regulations and new regulatory measures for cryptocurrencies.

Cryptocurrency: 5AMLD introduced a legal definition of cryptocurrency and brought both cryptocurrencies and cryptocurrency exchanges under the scope of existing AML/CFT regulations. Under 5AMLD, providers of cryptocurrency services had to register with financial authorities, and financial intelligence units (FIU) were given powers to obtain the names and addresses of owners of cryptocurrency.

Prepaid cards: 5AMLD reduced the previous transaction limit on prepaid cards to €150, and to €50 for online transactions. Transactions from prepaid cards issued outside the EU were prohibited unless they were issued in a territory with EU-equivalent AML/CFT standards.

High value goods: Under 5AMLD, traders in high–value goods, such as artwork, became subject to AML/CFT reporting obligations and CDD measures when engaging in transactions of €10,000 or more. To help combat terror financing, historical, cultural and archaeological artifacts also fell under the high-value AML/CFT rules.

Beneficial ownership: Under 5AMLD, centralized UBO registers were made publicly accessible while a requirement for private UBO registers for bank accounts was introduced. EU member states were required to make their UBO lists inter-connected across countries and to strengthen their verification mechanisms.

High-risk countries: 5AMLD introduced a requirement for firms to perform mandatory enhanced due diligence (EDD) on customers from high-risk third countries in order to better manage AML/CFT deficiencies.

Politically exposed persons: 5AMLD introduced a requirement for member states to release publicly available functional PEP lists, while the EU also released its own EU-level PEP list. The functional lists contain domestic positions that are considered politically exposed but do not contain the names of the individuals filling them.

The Sixth Money Laundering Directive (6AMLD)

Implementation date: June 3 2021

6AMLD provides EU member states with clarification on emerging money laundering threats, defining the regulatory requirements introduced in 5AMLD in greater detail.

Harmonization: 6AMLD provides a harmonized definition of money laundering across all EU countries in order to close loopholes in domestic legislation. That harmonization includes an expanded list of 22 money laundering predicate offenses, including cybercrime, environmental crime, tax crime, and human trafficking and smuggling.

Additional offenses: 6AMLD adds “aiding and abetting” to the list of activities that are categorized as money laundering.

Extension of criminal liability: Under 6AMLD, criminal liability for money laundering is extended to include legal persons (companies and partnerships) in situations where those persons have failed to prevent illegal activity.

Tougher punishment: 6AMLD increases the sentence for money laundering crimes to a minimum of 4 years imprisonment.

The ‘New’ Sixth Money Laundering Directive

As part of its package of legislative proposals, the EU will be introducing a money laundering directive, essentially a ‘new’ 6AMLD, which will set out ‘mechanisms to be put in place by the member states for the prevention of the use of the financial system for the purposes of money laundering or terrorist financing.’

The new 6AMLD will repeal aspects of previous directives, transfer requirements for countries, and introduce changes to better align the practices of domestic supervisors and FIUs. The EU intends for the legislation to add clarity and harmonization to AML/CFT practices, addressing rule inconsistencies and enhancing coordination and information sharing between authorities.

Key highlights of the new 6AMLD include:

- National Risk Assessments: EU member states must carry out National Risk Assessments (NRA) on a 4 year bais – and make the results available to obligated entities.

- FIU frameworks: Members states must develop a proposal for a domestic FIU joint-analysis framework in order to offer obligated entities greater clarity on how to submit suspicious activity reports (SAR)

- Regulatory supervisors: Member states must establish a public body with a duty of oversight over domestic self-regulatory bodies, while the EU will introduce a risk categorization tool to harmonize supervisory approaches. The EU has also introduced provisions for cross-border AML/CFT colleges to enhance cooperation between member states.

- Beneficial ownership: The new 6AMLD offers clarification on the kind of information that should be held in EU beneficial ownership registers.

- Asset registers: EU member states must create cross-border asset registers that contain information on bank accounts, safes, and real estate.

- Whistleblower protections: Member states must implement enhanced protections for whistleblowers, with a focus on strengthening personal data protection and judicial protection.

- Personal data: The new 6AMLD offers a clarification on the legal basis for processing personal data in the context of preventing financial crimes such as money lanudering and terrorism financing.

Recent EU AML Legislation

The European Commission goes beyond issuing anti-money laundering directives in its efforts to combat financial crime. As part of the legislative package that it set out in 2021, the EU announced the creation of a new EU anti-money laundering authority (AMLA) which would work to improve suspicious activity detection and to address the loopholes that criminals use to transform illegal funds.

The establishment of the EU AMLA reflects the changing global risk landscape, including the emergence of disruptive fintech start-ups, new payment methods, and virtual currencies – along with increasingly sophisticated criminal methodologies. The EU Commission’s focus, in both its recent proposals and its directives, is on creating a cohesive compliance environment across the bloc in order to bring all those risk variables into the fold. Accordingly, like recent AMLD measures, the EU AMLA is likely to focus on the importance of Know Your Customer (KYC) regulations within EU member states in order to prevent criminals from easily manipulating the financial system.

Download our guide to find out more about the EU’s coming AML/CFT frameworks.

Key Takeaways from EU Anti-Money Laundering Directive

The EU’s efforts to address money laundering and terrorism financing reflect the potential damage these crimes can cause, including their huge societal impacts and scores of victims. As enforcement actions by EU regulators become public, the consequences for firms involved in compliance violations can be significant – both in terms of financial penalties and reputational damage.

AML Governance:

Accordingly, firms operating in the financial industry should regard AMLD compliance requirements, and the EU’s recent AMLA proposal, as a wake-up call to protect both their customers and their business interests. Under EU AML/CFT legislation it is likely that demands for better governance and AML/CFT controls will originate from within financial institutions themselves as authorities exercise new powers to prosecute executive employees and subsequent reputational damage sees firms fall behind their competitors.

Investment Concerns:

EU AML/CFT compliance trends are also affected by investors, with the recent trends of environmental, social, and governance (ESG) risk factors, and European geopolitical friction serving to drive investors away from certain financial institutions. The EC has responded to investor concerns by moving to integrate environmental considerations (such as 6AMLD’s environmental crime designation) into financial regulation as a way to ensure that the EU remains in a position of global leadership.

Regulatory Cohesion:

The EC has stressed that each member state has a vital role to play in building an effective and cohesive investment environment in order to promote the safety of the EU as a financial market and to enhance the collective reputation of its businesses. In that environment, investors are unlikely to want to be exposed as supporting a global financial scandal, or have fines and penalties imposed against them as a result of regulatory breaches. Similarly, EU governments will likely seek to promote compliance as a way to avoid being added to lists of high-risk jurisdictions.

Originally published 02 April 2020, updated 20 December 2023

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).

EN

EN FR

FR