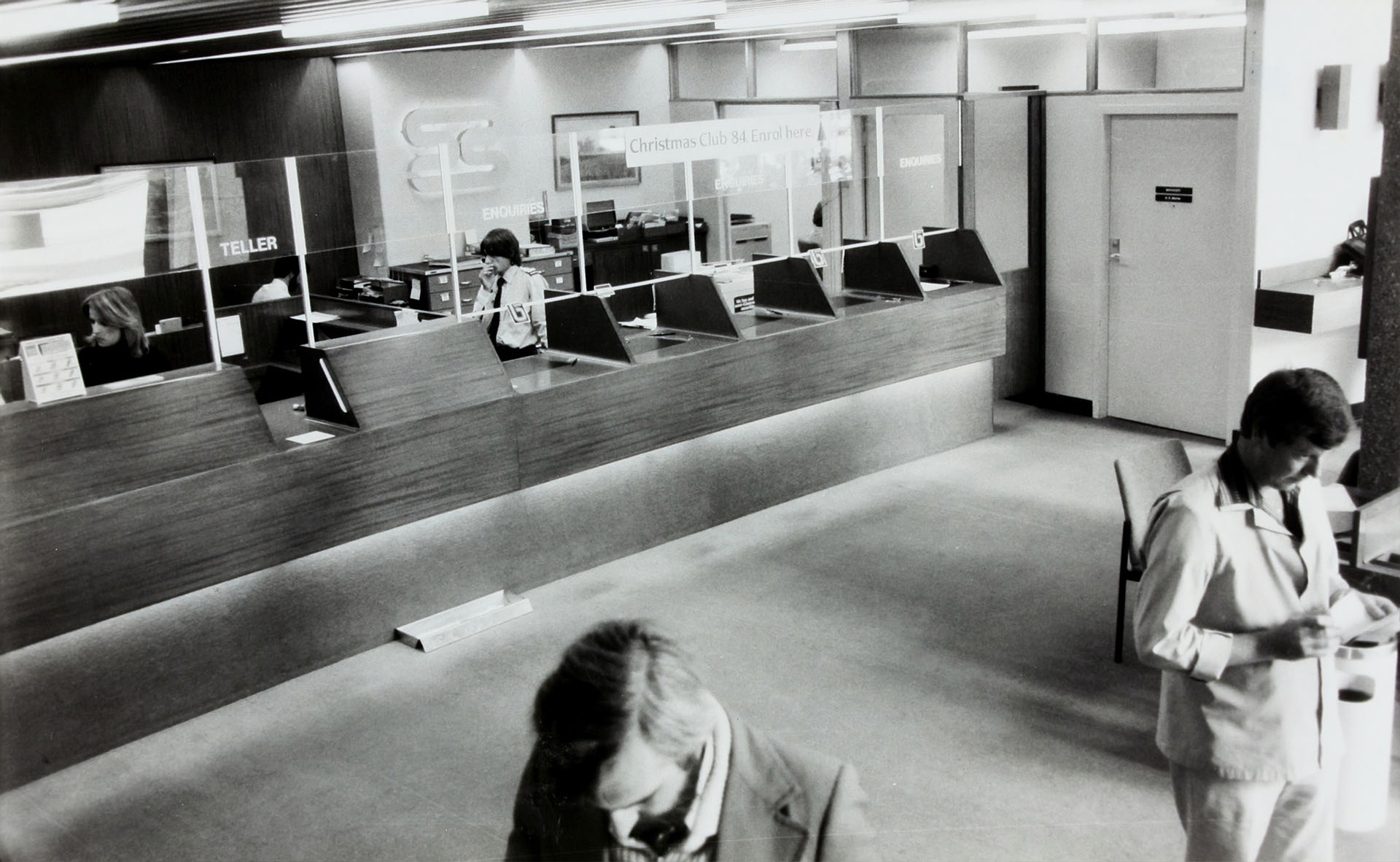

In a changing financial landscape, challenger banks are disrupting the space occupied by traditional banks and financial institutions by offering an array of innovative digital services delivered online. In the United States, recent uptake of challenger bank services has been […]